- Taiwan

- /

- Semiconductors

- /

- TWSE:5269

ASMedia Technology Inc. (TWSE:5269) Looks Just Right With A 28% Price Jump

Despite an already strong run, ASMedia Technology Inc. (TWSE:5269) shares have been powering on, with a gain of 28% in the last thirty days. The annual gain comes to 149% following the latest surge, making investors sit up and take notice.

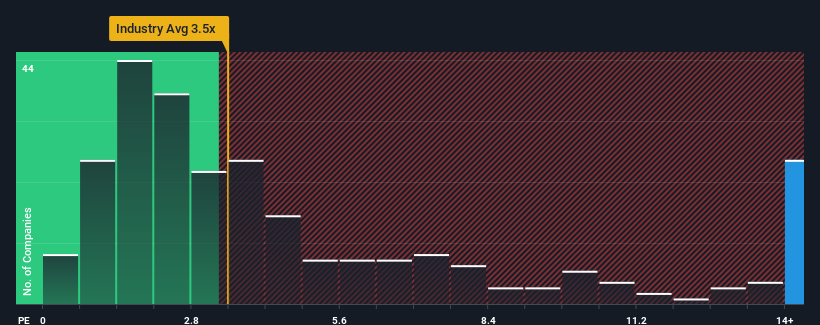

Following the firm bounce in price, when almost half of the companies in Taiwan's Semiconductor industry have price-to-sales ratios (or "P/S") below 3.5x, you may consider ASMedia Technology as a stock not worth researching with its 28.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for ASMedia Technology

What Does ASMedia Technology's P/S Mean For Shareholders?

ASMedia Technology certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. It seems that many are expecting the company to continue defying the broader industry adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think ASMedia Technology's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

ASMedia Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.3%. Still, lamentably revenue has fallen 4.8% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 38% over the next year. That's shaping up to be materially higher than the 22% growth forecast for the broader industry.

In light of this, it's understandable that ASMedia Technology's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does ASMedia Technology's P/S Mean For Investors?

ASMedia Technology's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that ASMedia Technology maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Semiconductor industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - ASMedia Technology has 2 warning signs we think you should be aware of.

If you're unsure about the strength of ASMedia Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:5269

ASMedia Technology

Engages in the design, development, and sale of high-speed switch, PCIe bridge, and USB controller integrated circuits in the Americas, Mainland China, Southeast Asia, Northeast Asia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success