- Taiwan

- /

- Semiconductors

- /

- TWSE:4956

Revenues Not Telling The Story For Epileds Technologies, Inc. (TWSE:4956) After Shares Rise 48%

The Epileds Technologies, Inc. (TWSE:4956) share price has done very well over the last month, posting an excellent gain of 48%. The annual gain comes to 207% following the latest surge, making investors sit up and take notice.

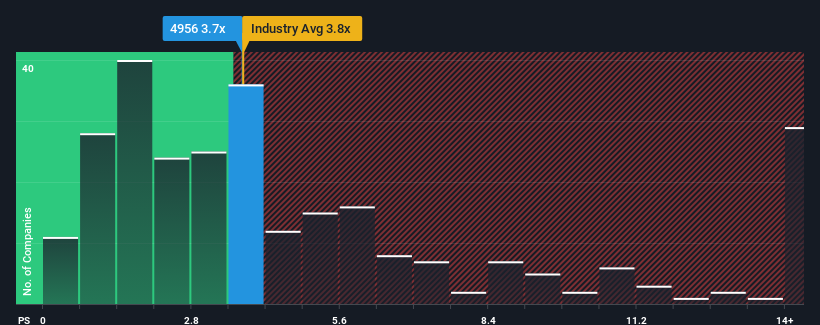

In spite of the firm bounce in price, there still wouldn't be many who think Epileds Technologies' price-to-sales (or "P/S") ratio of 3.7x is worth a mention when the median P/S in Taiwan's Semiconductor industry is similar at about 3.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Epileds Technologies

What Does Epileds Technologies' P/S Mean For Shareholders?

For example, consider that Epileds Technologies' financial performance has been pretty ordinary lately as revenue growth is non-existent. Perhaps the market believes the recent run-of-the-mill revenue performance isn't enough to outperform the industry, which has kept the P/S muted. Those who are bullish on Epileds Technologies will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Epileds Technologies' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Epileds Technologies' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 30% drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 26% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's somewhat alarming that Epileds Technologies' P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Final Word

Its shares have lifted substantially and now Epileds Technologies' P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We find it unexpected that Epileds Technologies trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Plus, you should also learn about these 2 warning signs we've spotted with Epileds Technologies.

If these risks are making you reconsider your opinion on Epileds Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Epileds Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:4956

Epileds Technologies

Researches and develops, designs, manufactures, and sells blue, green, red, and white light LED wafers and chips in Taiwan and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives