- Taiwan

- /

- Semiconductors

- /

- TWSE:3711

Asian Market Insights: 3 Stocks Possibly Trading Below Estimated Value

Reviewed by Simply Wall St

As Asian markets navigate a complex landscape of economic data and investor sentiment, opportunities may arise for discerning investors to identify stocks potentially trading below their estimated value. In this environment, understanding the fundamentals that contribute to a stock's valuation becomes crucial, as these elements can help uncover investment opportunities even amidst broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Takara Bio (TSE:4974) | ¥871.00 | ¥1701.61 | 48.8% |

| Taiwan Union Technology (TPEX:6274) | NT$440.00 | NT$867.34 | 49.3% |

| Samyang Foods (KOSE:A003230) | ₩1445000.00 | ₩2799114.46 | 48.4% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.18 | CN¥26.01 | 49.3% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥10.26 | CN¥20.12 | 49% |

| JINS HOLDINGS (TSE:3046) | ¥6130.00 | ¥12257.56 | 50% |

| China Ruyi Holdings (SEHK:136) | HK$2.44 | HK$4.82 | 49.3% |

| China Beststudy Education Group (SEHK:3978) | HK$4.78 | HK$9.28 | 48.5% |

| Beijing Roborock Technology (SHSE:688169) | CN¥152.18 | CN¥300.79 | 49.4% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.03 | CN¥56.05 | 50% |

Let's uncover some gems from our specialized screener.

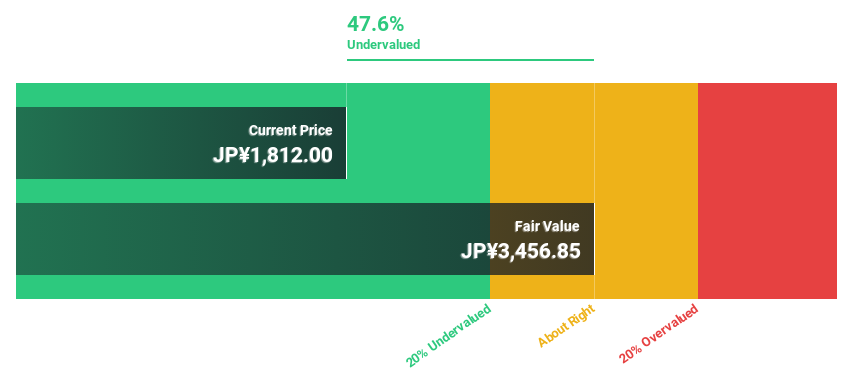

Renesas Electronics (TSE:6723)

Overview: Renesas Electronics Corporation is a global semiconductor company involved in the research, development, design, manufacture, sale, and servicing of semiconductors across Japan, China, Asia, Europe, North America and other international markets with a market cap of ¥3.36 trillion.

Operations: The company's revenue is primarily derived from its Automotive segment, which generated ¥625.17 billion, and its Industrial/Infrastructure/IoT segment, contributing ¥626.54 billion.

Estimated Discount To Fair Value: 24.7%

Renesas Electronics appears undervalued based on cash flow analysis, trading at ¥1851.5, significantly below the estimated fair value of ¥2458.41. Despite a volatile share price recently and low forecasted return on equity, the company is expected to become profitable within three years with revenue growth outpacing the Japanese market average. Recent leadership changes aim to enhance global sales and AI opportunities, while innovative product developments in DDR5 RCDs and microcontrollers highlight its strategic focus on high-performance computing solutions.

- Our expertly prepared growth report on Renesas Electronics implies its future financial outlook may be stronger than recent results.

- Take a closer look at Renesas Electronics' balance sheet health here in our report.

King Yuan Electronics (TWSE:2449)

Overview: King Yuan Electronics Co., Ltd. is involved in the design, manufacturing, selling, testing, and assembly of integrated circuits with a market cap of NT$280 billion.

Operations: The company generates revenue of NT$32.26 billion from its Contract Electronics Manufacturing Services segment.

Estimated Discount To Fair Value: 38%

King Yuan Electronics is trading at NT$229, significantly below its estimated fair value of NT$369.4, highlighting its undervaluation based on cash flows. Despite recent earnings volatility, with third-quarter net income slightly down year-on-year to TWD 2,302.16 million, the company shows strong growth potential. Revenue is forecast to grow 28.6% annually, outpacing the Taiwan market average of 14.3%, and earnings are expected to rise significantly over the next three years.

- Our earnings growth report unveils the potential for significant increases in King Yuan Electronics' future results.

- Get an in-depth perspective on King Yuan Electronics' balance sheet by reading our health report here.

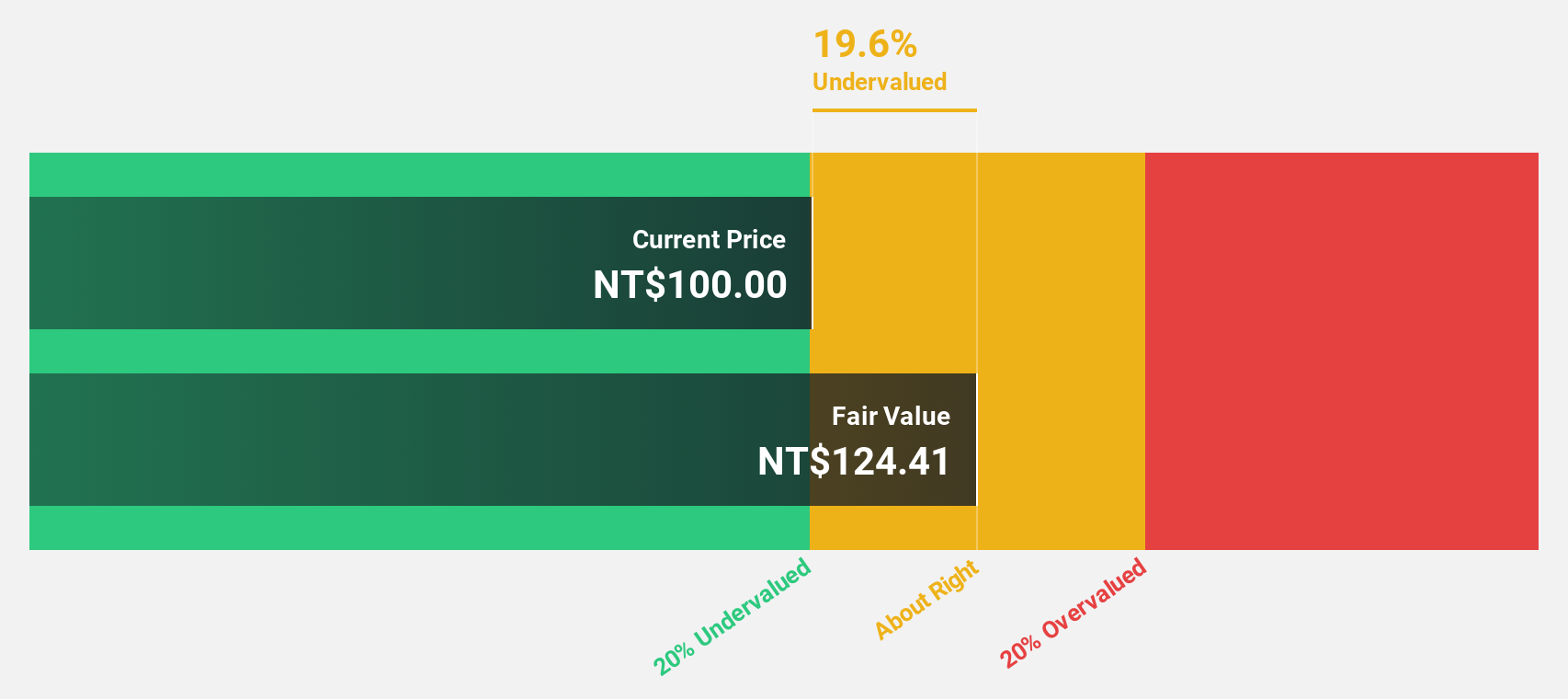

ASE Technology Holding (TWSE:3711)

Overview: ASE Technology Holding Co., Ltd. offers semiconductor manufacturing services globally, including in the United States, Taiwan, and Europe, with a market cap of NT$1 trillion.

Operations: The company's revenue is primarily derived from Packaging services at NT$297.82 billion, Electronic Manufacturing Services (EMS) contributing NT$297.91 billion, and Testing services generating NT$67.29 billion.

Estimated Discount To Fair Value: 48%

ASE Technology Holding is trading at NT$229.5, considerably below its fair value estimate of NT$441.71, signifying undervaluation based on cash flows. The company reported solid third-quarter results with increased revenue and net income year-on-year, despite a volatile share price recently. Earnings are projected to grow significantly at 29% annually, although the dividend yield of 2.31% lacks coverage by free cash flows. The acquisition in Penang could enhance operational capabilities and future growth prospects.

- The growth report we've compiled suggests that ASE Technology Holding's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of ASE Technology Holding stock in this financial health report.

Seize The Opportunity

- Access the full spectrum of 271 Undervalued Asian Stocks Based On Cash Flows by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3711

ASE Technology Holding

Provides semiconductor manufacturing services in the United States, Taiwan, rest of Asia, Europe, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026