- Taiwan

- /

- Semiconductors

- /

- TWSE:3592

Raydium Semiconductor Corporation's (TWSE:3592) 25% Jump Shows Its Popularity With Investors

Raydium Semiconductor Corporation (TWSE:3592) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Looking further back, the 16% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

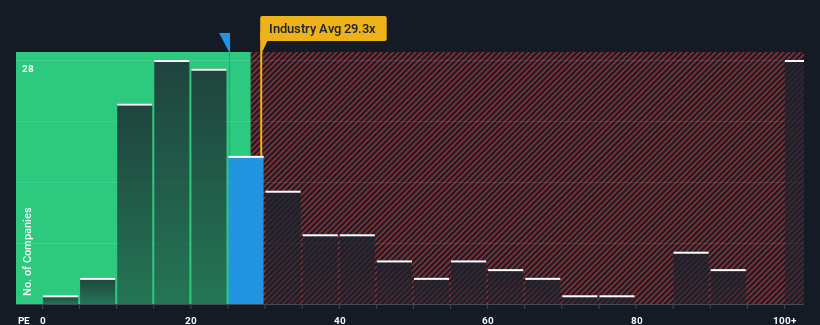

After such a large jump in price, given around half the companies in Taiwan have price-to-earnings ratios (or "P/E's") below 22x, you may consider Raydium Semiconductor as a stock to potentially avoid with its 25.1x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Raydium Semiconductor has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for Raydium Semiconductor

How Is Raydium Semiconductor's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Raydium Semiconductor's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 63%. Still, the latest three year period has seen an excellent 45% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 56% as estimated by the five analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 23%, which is noticeably less attractive.

In light of this, it's understandable that Raydium Semiconductor's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Raydium Semiconductor's P/E?

Raydium Semiconductor's P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Raydium Semiconductor's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Raydium Semiconductor you should be aware of, and 1 of them is a bit unpleasant.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3592

Raydium Semiconductor

Engages in the design, development, and sale of display drivers, sequential control, and power management integrated circuit (IC) products in China, Hong Kong, Taiwan, and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success