In a week marked by fluctuating indices and mixed economic signals, global markets have seen significant movements, with the technology-heavy Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating. Amidst this backdrop of volatility, dividend stocks offering yields up to 5.3% can be particularly appealing for investors seeking stable income streams in uncertain times. These stocks are often valued for their ability to provide consistent returns through dividends, which can be especially attractive when market conditions are unpredictable.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Globeride (TSE:7990) | 4.11% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.09% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.45% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.88% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.86% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.82% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.53% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.35% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 2012 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

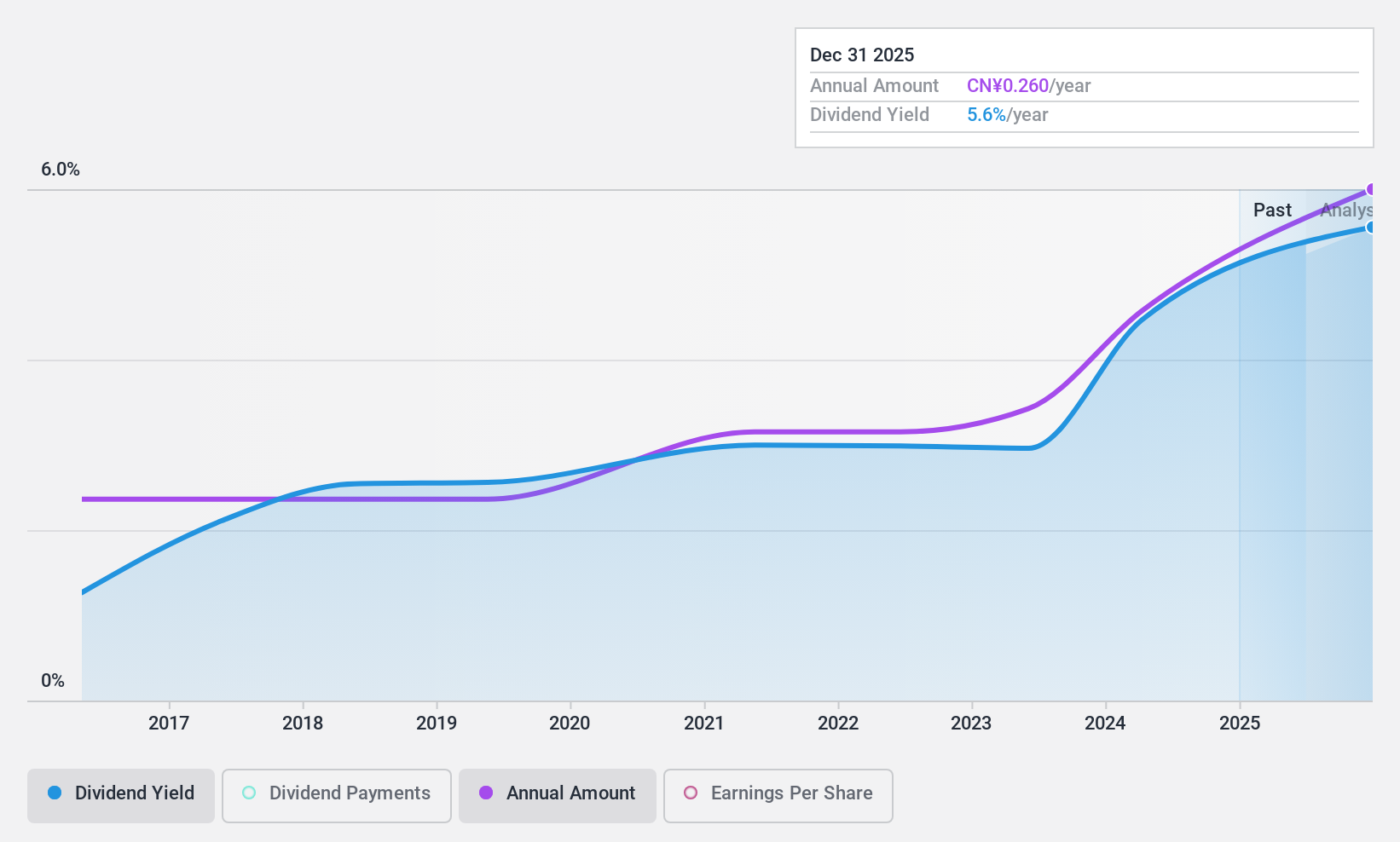

Zhejiang Giuseppe Garment (SZSE:002687)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zhejiang Giuseppe Garment Co., Ltd, with a market cap of CN¥2.18 billion, produces and sells business wear, men's wear, and casual wear under the George White brands in China.

Operations: The company's revenue segments include business wear, men's wear, and casual wear under the George White brands in China.

Dividend Yield: 4.1%

Zhejiang Giuseppe Garment's dividend payments have been volatile over the past decade, though they are currently covered by both earnings and cash flows with a payout ratio of 74.7% and a cash payout ratio of 55%. Despite recent declines in sales and net income, the company's dividend yield remains in the top 25% of payers in the Chinese market. Additionally, its price-to-earnings ratio suggests it is trading at good value compared to peers.

- Unlock comprehensive insights into our analysis of Zhejiang Giuseppe Garment stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Zhejiang Giuseppe Garment shares in the market.

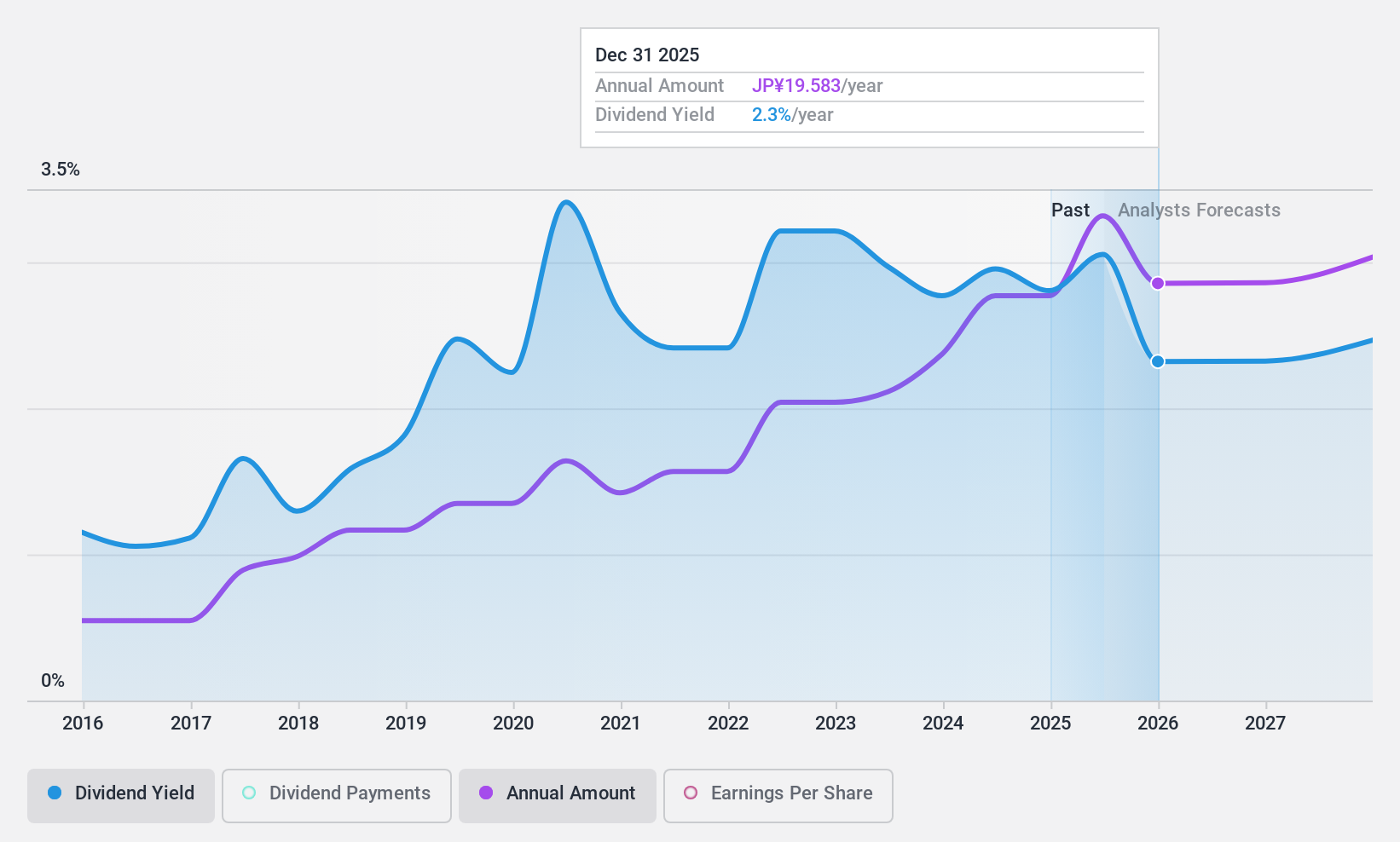

Kokuyo (TSE:7984)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kokuyo Co., Ltd. operates in Japan, focusing on the manufacturing, purchasing, and selling of stationery and office furniture products, with a market cap of ¥277.51 billion.

Operations: Kokuyo Co., Ltd.'s revenue segments include the Lifestyle Area - Stationery Business at ¥83.56 billion, Work Style Area - Furniture Business at ¥155.51 billion, Lifestyle Area - Interior Retail Business at ¥20.99 billion, and Work Style Area - Business Supply Distribution Business at ¥98.99 billion.

Dividend Yield: 2.8%

Kokuyo's dividend payments, although increasing over the past decade, have been unreliable and volatile. The dividends are well-covered by earnings with a payout ratio of 39.8% and cash flows at an 88% cash payout ratio. Despite trading at 40.3% below estimated fair value, its dividend yield is relatively low compared to top payers in Japan. Earnings have grown significantly over five years but large one-off items impact financial results.

- Get an in-depth perspective on Kokuyo's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Kokuyo is trading behind its estimated value.

ITE Tech (TWSE:3014)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ITE Tech. Inc is a fabless IC design company that offers I/O, keyboard, and embedded controller technology products both in Taiwan and internationally, with a market cap of NT$22.75 billion.

Operations: ITE Tech. Inc's revenue segments include I/O technology products, keyboard solutions, and embedded controllers.

Dividend Yield: 5.3%

ITE Tech's dividends have been inconsistent over the past decade, showing significant volatility. Despite a competitive yield of 5.32%, the dividend is not fully supported by free cash flows, with a high cash payout ratio of 106.9%. The payout ratio stands at 79%, indicating coverage by earnings but highlighting sustainability concerns. Recent earnings growth of 11.9% and a favorable price-to-earnings ratio suggest potential value, though executive changes could influence future stability.

- Click here and access our complete dividend analysis report to understand the dynamics of ITE Tech.

- Our comprehensive valuation report raises the possibility that ITE Tech is priced higher than what may be justified by its financials.

Next Steps

- Investigate our full lineup of 2012 Top Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Giuseppe Garment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002687

Zhejiang Giuseppe Garment

Produces and sells business wear, men's wear, and casual wear under the George White brands in China.

Flawless balance sheet low.

Market Insights

Community Narratives