- China

- /

- Commercial Services

- /

- SZSE:300847

Discovering HG Technologies And 2 Other Small Caps with Strong Potential

Reviewed by Simply Wall St

In a week where global markets have shown mixed performance, small-cap stocks have demonstrated resilience, holding up better than their large-cap counterparts amid busy earnings reports and economic uncertainty. This backdrop creates an intriguing environment for identifying promising small-cap companies like HG Technologies that may offer strong potential due to their unique market positions or innovative approaches.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 7.05% | 14.29% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al Wathba National Insurance Company PJSC | 14.56% | 13.48% | 31.31% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.07% | 35.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

HG Technologies (SZSE:300847)

Simply Wall St Value Rating: ★★★★★★

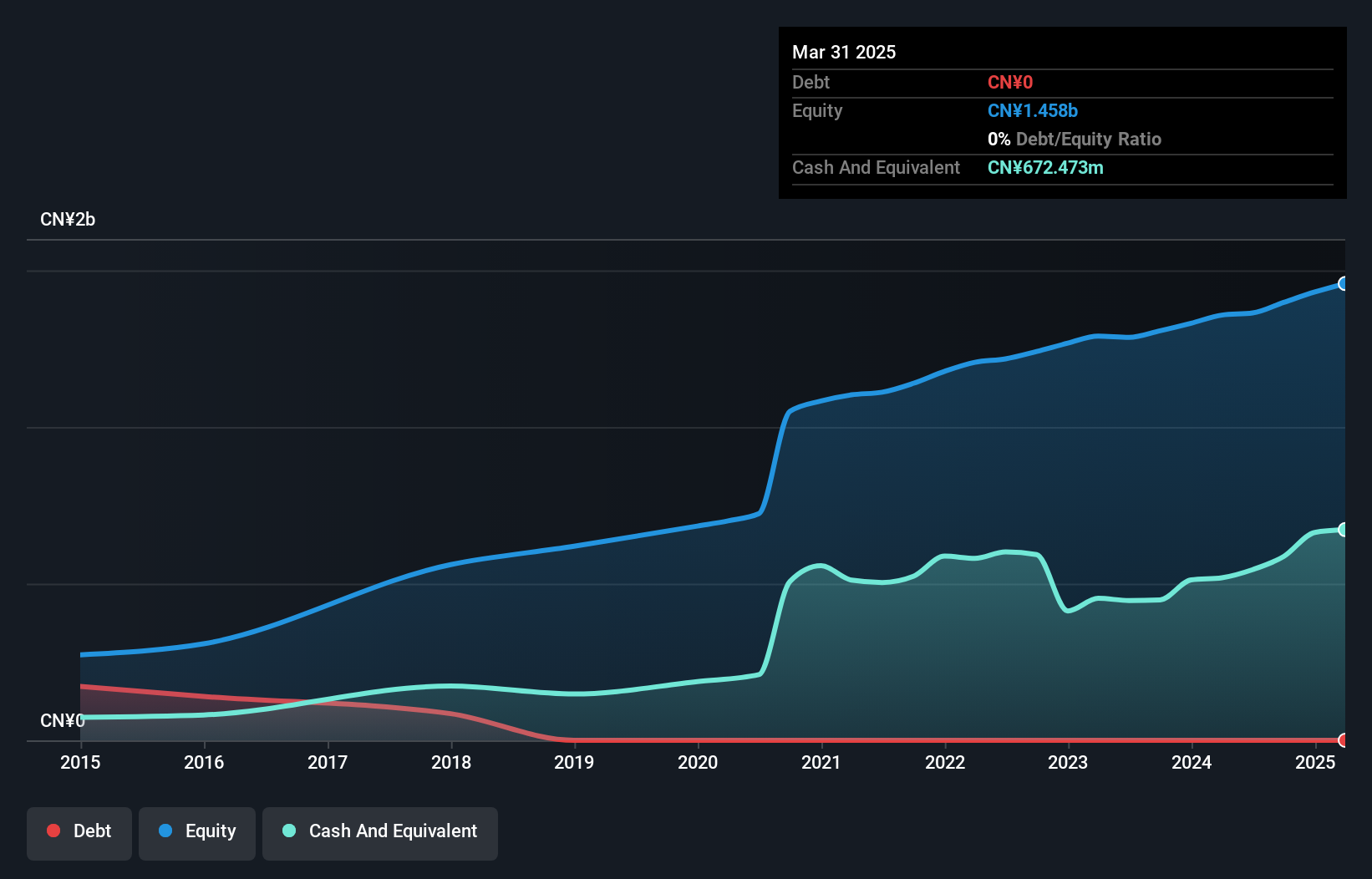

Overview: HG Technologies Co., Ltd. focuses on the R&D, production, and sale of electrostatic imaging consumables and equipment for printing and copying, with a market cap of CN¥5.83 billion.

Operations: HG Technologies derives its revenue primarily from the sale of electrostatic imaging consumables and equipment. The company's financial performance is highlighted by a net profit margin of 15.6%.

HG Technologies, a promising player in its industry, has shown robust financial performance with earnings growth of 20.8% over the past year, outpacing the Commercial Services industry's 0.9%. The company is debt-free and reported revenue of CNY 871.09 million for the nine months ending September 2024, up from CNY 761.17 million a year earlier. Net income also increased to CNY 95.11 million from CNY 72.43 million last year, reflecting high-quality earnings and profitability without debt concerns impacting interest coverage. Despite recent share price volatility, HG Technologies' financials suggest potential for continued growth and stability in its sector.

- Click here and access our complete health analysis report to understand the dynamics of HG Technologies.

Assess HG Technologies' past performance with our detailed historical performance reports.

ITE Tech (TWSE:3014)

Simply Wall St Value Rating: ★★★★★★

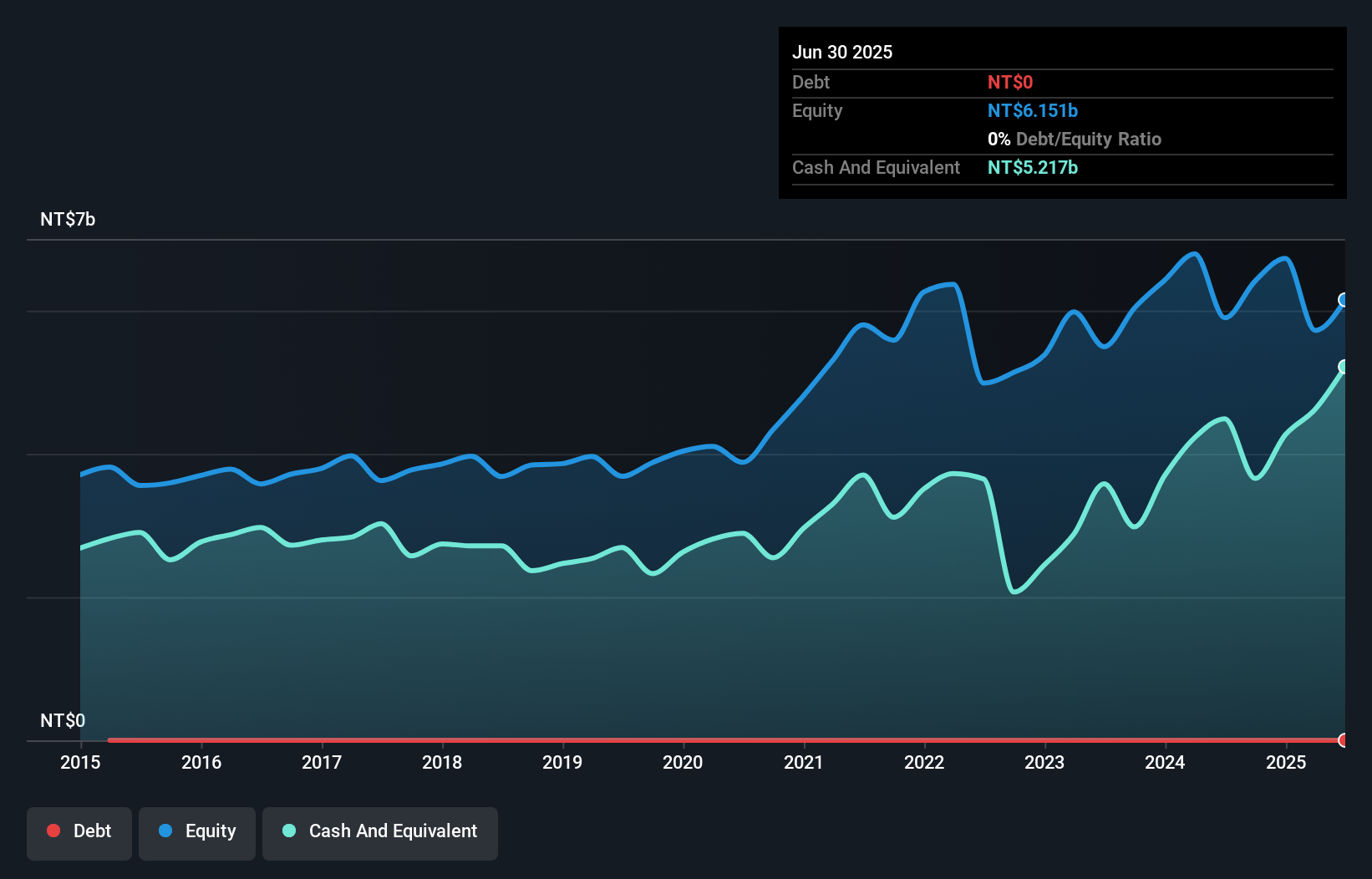

Overview: ITE Tech Inc, with a market cap of NT$22.75 billion, is a fabless IC design company that offers I/O, keyboard, and embedded controller technology products both in Taiwan and globally.

Operations: ITE Tech generates revenue primarily from its I/O, keyboard, and embedded controller technology products. The company has a market cap of NT$22.75 billion.

ITE Tech, a nimble player in the semiconductor space, stands out with its earnings growth of 11.9%, surpassing the industry average of 0.1%. The company boasts a debt-free balance sheet for over five years, which alleviates concerns about interest coverage. Recent financials reveal third-quarter sales at TWD 1.86 billion and net income reaching TWD 495.84 million, both showing improvement from last year’s figures. However, shareholder dilution has occurred recently despite its attractive price-to-earnings ratio of 15.3x being below the TW market average of 21.4x, suggesting potential value for investors seeking opportunities in this sector.

- Click to explore a detailed breakdown of our findings in ITE Tech's health report.

Examine ITE Tech's past performance report to understand how it has performed in the past.

AP Memory Technology (TWSE:6531)

Simply Wall St Value Rating: ★★★★★★

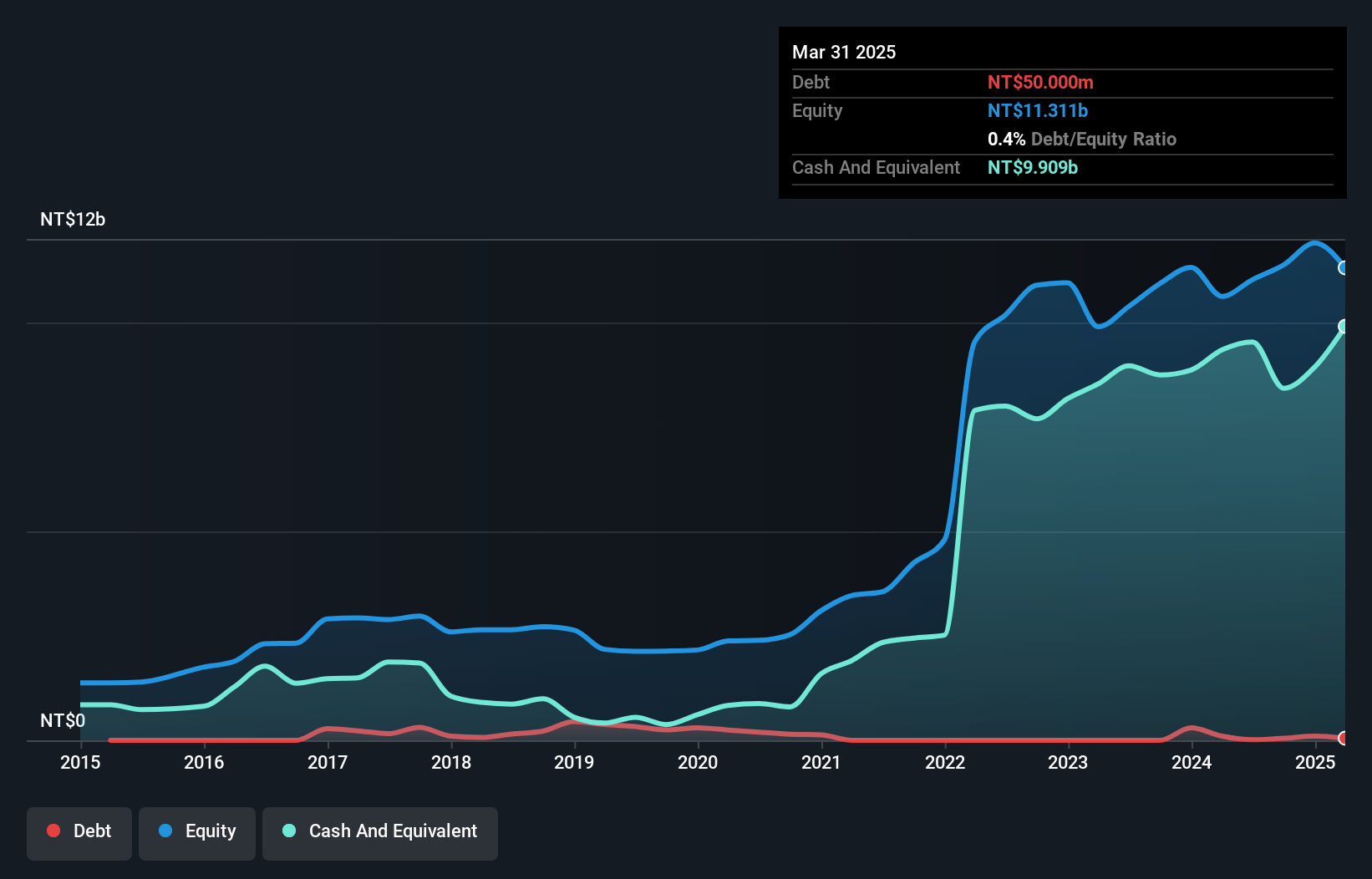

Overview: AP Memory Technology Corporation specializes in the design, development, licensing, manufacturing, and sale of customized memory-related integrated circuit chip products globally and has a market capitalization of approximately NT$50.20 billion.

Operations: AP Memory Technology generates revenue primarily from its IoT Division, contributing NT$3.84 billion, and the AI Division, adding NT$254.81 million.

AP Memory Technology, a niche player in the semiconductor industry, showcases robust financial health with earnings growing 25.3% last year, outpacing the industry's modest 0.1%. Despite a notable NT$328.9 million one-off gain affecting recent results, their debt-to-equity ratio impressively decreased from 15.5% to 0.1% over five years, indicating strong fiscal management. Recent quarterly sales reached TWD 1,274 million compared to TWD 1,240 million previously; however, net income dipped to TWD 337 million from TWD 530 million due to lower earnings per share of TWD 2.08 versus last year's TWD 3.27 amidst executive board changes and strategic adjustments.

- Get an in-depth perspective on AP Memory Technology's performance by reading our health report here.

Key Takeaways

- Discover the full array of 4718 Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HG Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300847

HG Technologies

Engages in the research and development, production, and sale of electrostatic imaging consumables and imaging equipment for printing and copying.

Flawless balance sheet with solid track record.