Guangdong Fenghua Advanced Technology (Holding) And 2 More Stocks Trading At Estimated Discounts

Reviewed by Simply Wall St

In a week marked by a flurry of earnings reports and economic data, global markets experienced mixed performances, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating. Amidst this volatility, investors are increasingly seeking opportunities in undervalued stocks that may offer potential value despite broader market uncertainties. Identifying such stocks often involves looking for companies with strong fundamentals that have been overlooked or mispriced by the market, particularly during periods of economic fluctuation or cautious investor sentiment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Avant Group (TSE:3836) | ¥1971.00 | ¥3936.15 | 49.9% |

| Nordic Waterproofing Holding (OM:NWG) | SEK175.60 | SEK349.53 | 49.8% |

| Elica (BIT:ELC) | €1.725 | €3.44 | 49.8% |

| On the Beach Group (LSE:OTB) | £1.534 | £3.07 | 50% |

| Cosmax (KOSE:A192820) | ₩157400.00 | ₩314256.00 | 49.9% |

| KeePer Technical Laboratory (TSE:6036) | ¥3920.00 | ¥7817.96 | 49.9% |

| SciDev (ASX:SDV) | A$0.615 | A$1.23 | 49.8% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2709.00 | ¥5400.10 | 49.8% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.36 | €16.67 | 49.8% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥63.90 | CN¥127.25 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636)

Overview: Guangdong Fenghua Advanced Technology (Holding) Co., Ltd. operates in the electronic components industry and has a market cap of CN¥19.15 billion.

Operations: The company generates revenue of CN¥4.55 billion from its Electronic Components & Parts segment.

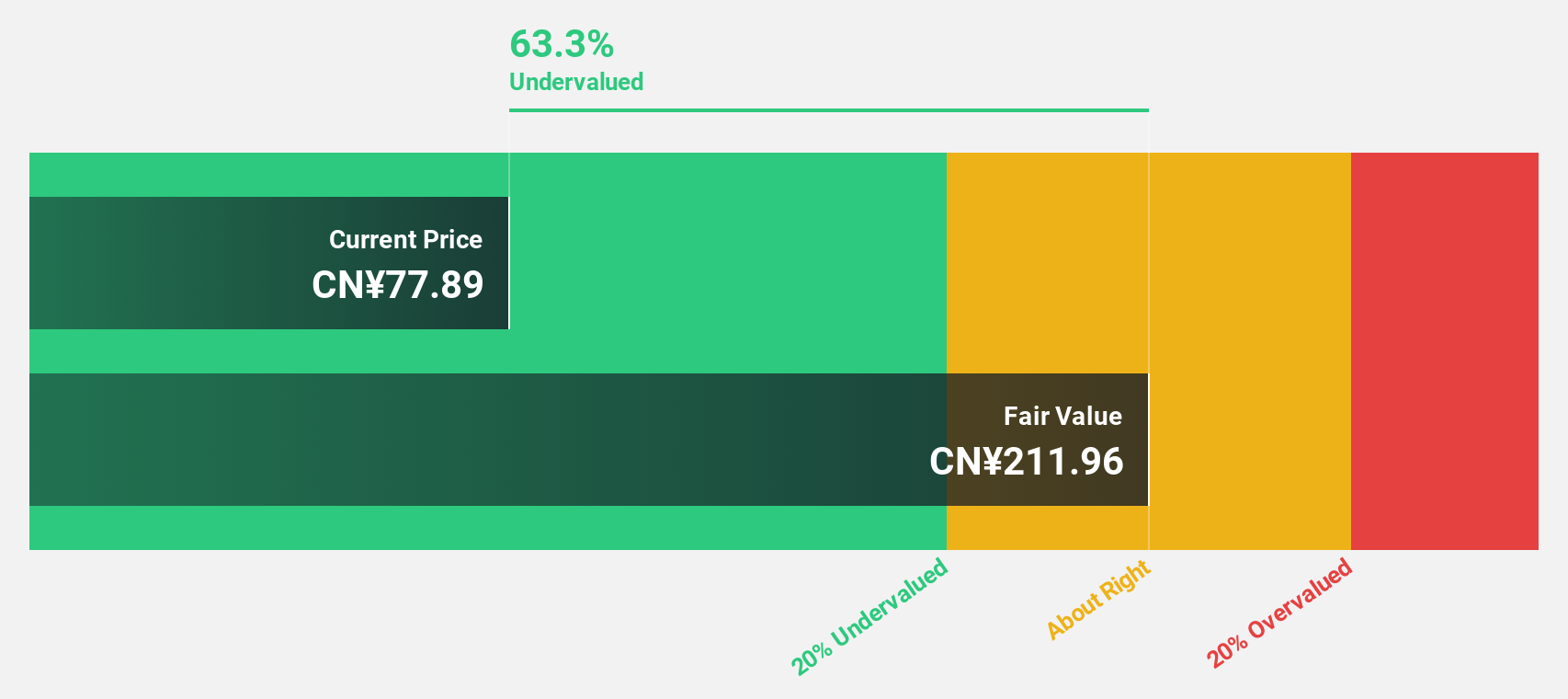

Estimated Discount To Fair Value: 49%

Guangdong Fenghua Advanced Technology (Holding) appears undervalued, trading at CN¥16.5, significantly below its estimated fair value of CN¥32.38. The company reported strong earnings growth of 160.1% over the past year, with net income rising to CNY 265.5 million for the nine months ended September 2024 from CNY 111.47 million a year ago. Forecasts suggest annual earnings growth of 38.1%, outpacing the Chinese market's average growth rate of 26.1%.

- Our earnings growth report unveils the potential for significant increases in Guangdong Fenghua Advanced Technology (Holding)'s future results.

- Get an in-depth perspective on Guangdong Fenghua Advanced Technology (Holding)'s balance sheet by reading our health report here.

Anhui Jinhe IndustrialLtd (SZSE:002597)

Overview: Anhui Jinhe Industrial Co., Ltd. operates in the chemicals industry in China with a market capitalization of CN¥13.10 billion.

Operations: The company generates revenue from its operations in the chemicals sector within China.

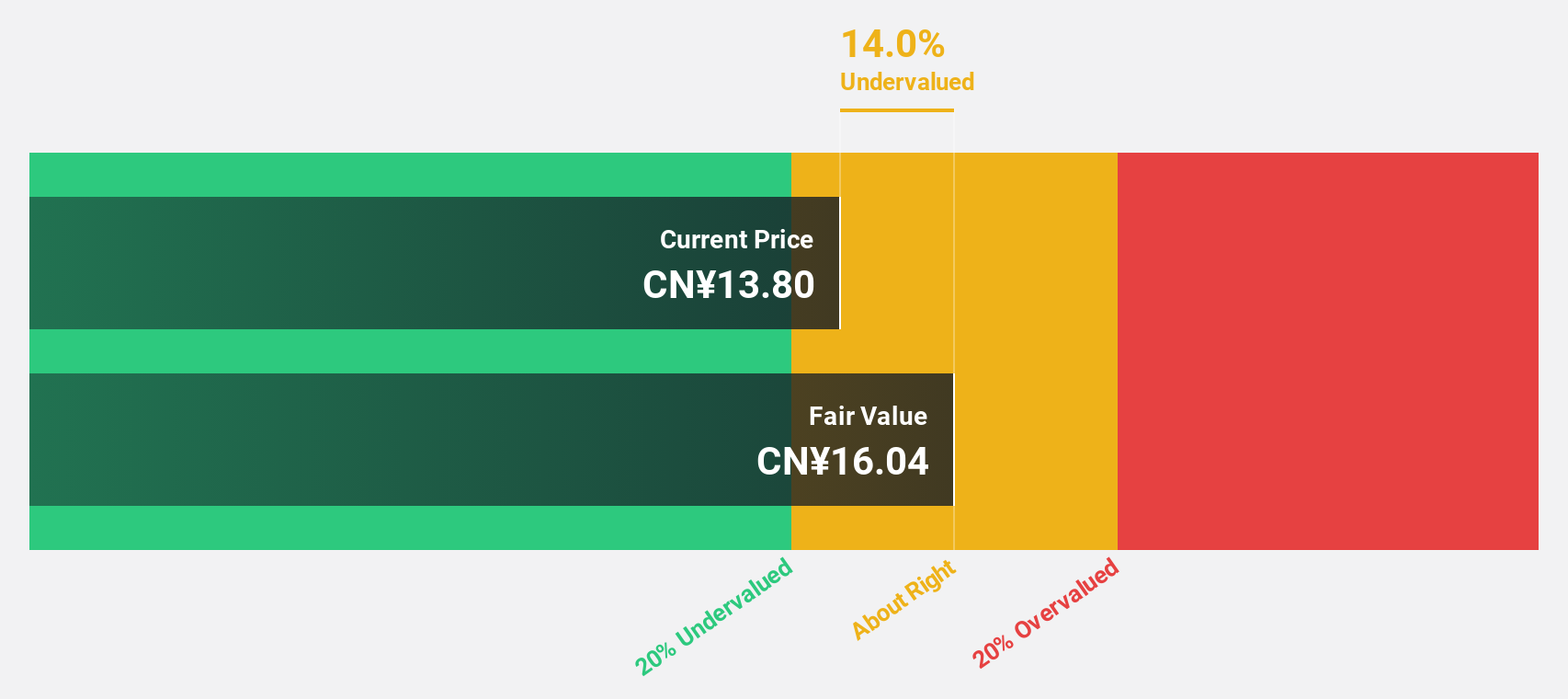

Estimated Discount To Fair Value: 24.6%

Anhui Jinhe Industrial Ltd. is trading at CN¥25.2, below its estimated fair value of CN¥33.42, highlighting potential undervaluation based on cash flows. Despite a decline in profit margins from 15.9% to 10.5% and lower net income for the nine months ended September 2024, earnings are forecast to grow significantly at 34.5% annually, exceeding the Chinese market average of 26.1%. However, its dividend yield of 0.79% isn't well-covered by free cash flows.

- Our expertly prepared growth report on Anhui Jinhe IndustrialLtd implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Anhui Jinhe IndustrialLtd stock in this financial health report.

YanKer shop FoodLtd (SZSE:002847)

Overview: YanKer shop Food Co., Ltd engages in the research, development, production, and sale of leisure food products both in China and internationally, with a market cap of CN¥14.66 billion.

Operations: The company generates revenue primarily from the production and sale of snack food, amounting to CN¥4.97 billion.

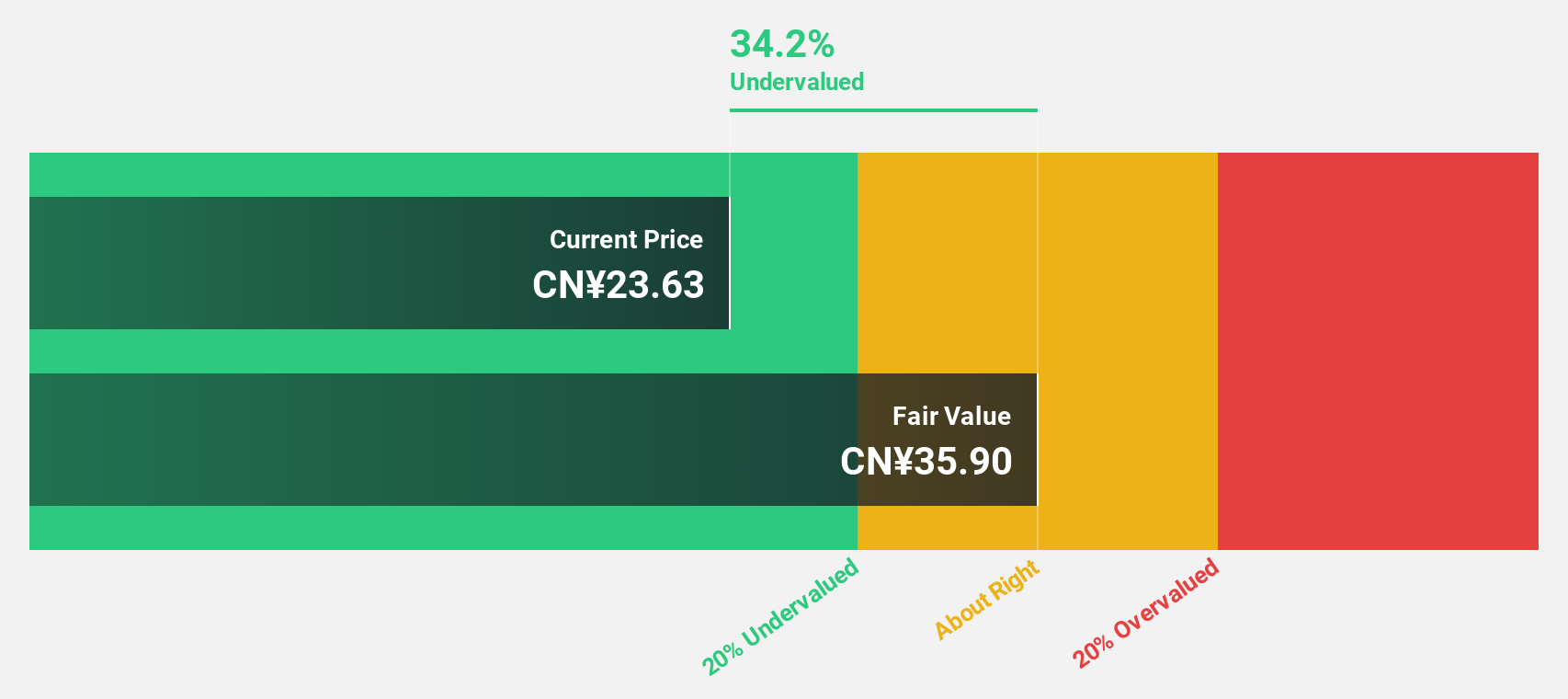

Estimated Discount To Fair Value: 36.5%

YanKer shop Food Ltd. is currently trading at CN¥55.71, significantly below its estimated fair value of CN¥87.66, suggesting potential undervaluation based on cash flows. The company reported strong earnings growth for the nine months ended September 2024, with net income rising to CNY 493.03 million from CNY 395.87 million a year earlier. However, it has an unstable dividend track record and earnings are forecast to grow slower than the market average at 22.3% annually.

- Insights from our recent growth report point to a promising forecast for YanKer shop FoodLtd's business outlook.

- Delve into the full analysis health report here for a deeper understanding of YanKer shop FoodLtd.

Summing It All Up

- Get an in-depth perspective on all 956 Undervalued Stocks Based On Cash Flows by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002597

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives