- China

- /

- Semiconductors

- /

- SHSE:688206

3 Growth Companies With Insider Ownership Up To 26%

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data, global markets showed mixed performances, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating. Amidst this volatility, growth stocks lagged behind value shares as cautious earnings reports from tech giants influenced investor sentiment. In such an environment, companies with high insider ownership can be particularly appealing to investors seeking alignment of interests between management and shareholders. This article explores three growth companies where insiders hold up to 26% ownership, potentially indicating confidence in their long-term prospects despite current market challenges.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's explore several standout options from the results in the screener.

Kalpataru Projects International (NSEI:KPIL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kalpataru Projects International Limited offers engineering, procurement, and construction services across various sectors such as power transmission and distribution, buildings and factories, water, railways, oil and gas, and urban infrastructure both in India and internationally with a market cap of ₹199.79 billion.

Operations: The company generates revenue primarily through its Engineering, Procurement and Construction (EPC) segment, which accounts for ₹199.13 billion, alongside contributions from Development Projects totaling ₹2.71 billion.

Insider Ownership: 12.9%

Kalpataru Projects International is experiencing significant earnings growth, forecasted at 28.34% annually, surpassing the Indian market's average. Despite trading below its estimated fair value, challenges arise with tax disputes and penalties in multiple jurisdictions, including a recent INR 640.7 million demand by Indian authorities and a penalty of INR 13.9 million in Mauritania. While revenue growth is strong at 13.4% annually, interest payments are not well covered by earnings, indicating potential financial strain.

- Navigate through the intricacies of Kalpataru Projects International with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Kalpataru Projects International's share price might be too pessimistic.

Primarius Technologies (SHSE:688206)

Simply Wall St Growth Rating: ★★★★★☆

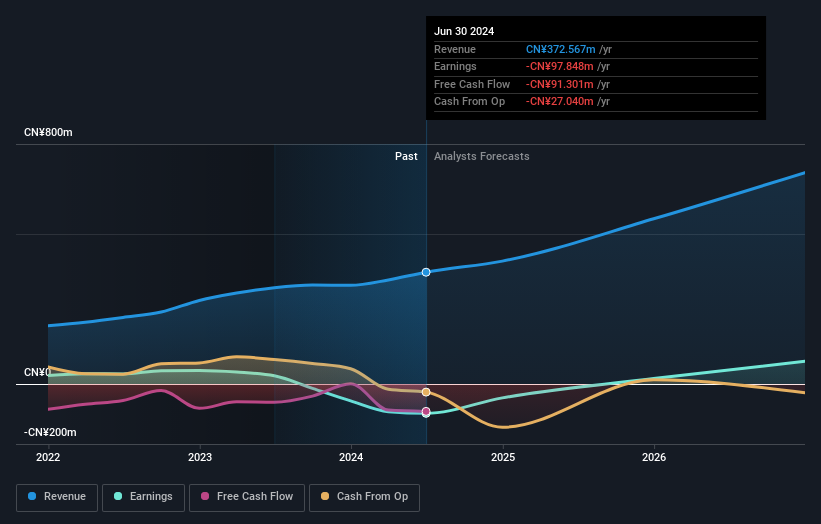

Overview: Primarius Technologies Co., Ltd. is a Chinese company that researches, designs, and develops EDA tools, with a market cap of CN¥9.23 billion.

Operations: Primarius Technologies Co., Ltd. generates its revenue primarily from the research, design, and development of EDA tools in China.

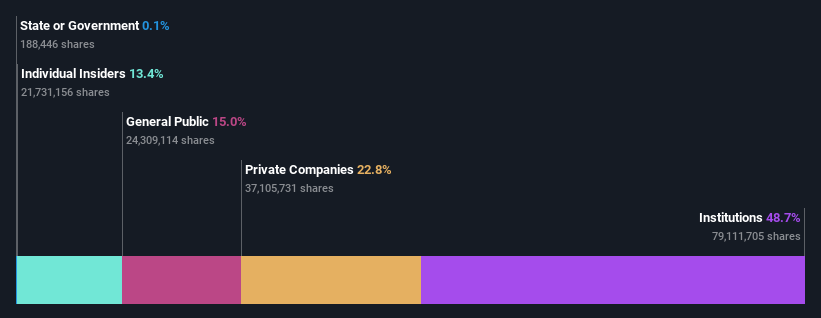

Insider Ownership: 16.2%

Primarius Technologies is poised for substantial growth, with revenue expected to rise by 27.5% annually, outpacing the Chinese market's average. Despite this, the company faces challenges with a net loss of CNY 57.16 million for the nine months ending September 2024 and a low forecasted return on equity of 0.8%. The firm has completed a share buyback program worth CNY 17.02 million, indicating confidence in its long-term prospects despite recent volatility.

- Click to explore a detailed breakdown of our findings in Primarius Technologies' earnings growth report.

- Our expertly prepared valuation report Primarius Technologies implies its share price may be too high.

Shenzhen Bluetrum Technology (SHSE:688332)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Bluetrum Technology Co., Ltd. is involved in the research, development, design, and sale of wireless audio SOC chips with a market cap of CN¥9.68 billion.

Operations: Shenzhen Bluetrum Technology Co., Ltd. generates revenue from its core activities in the research, development, and sale of wireless audio SOC chips.

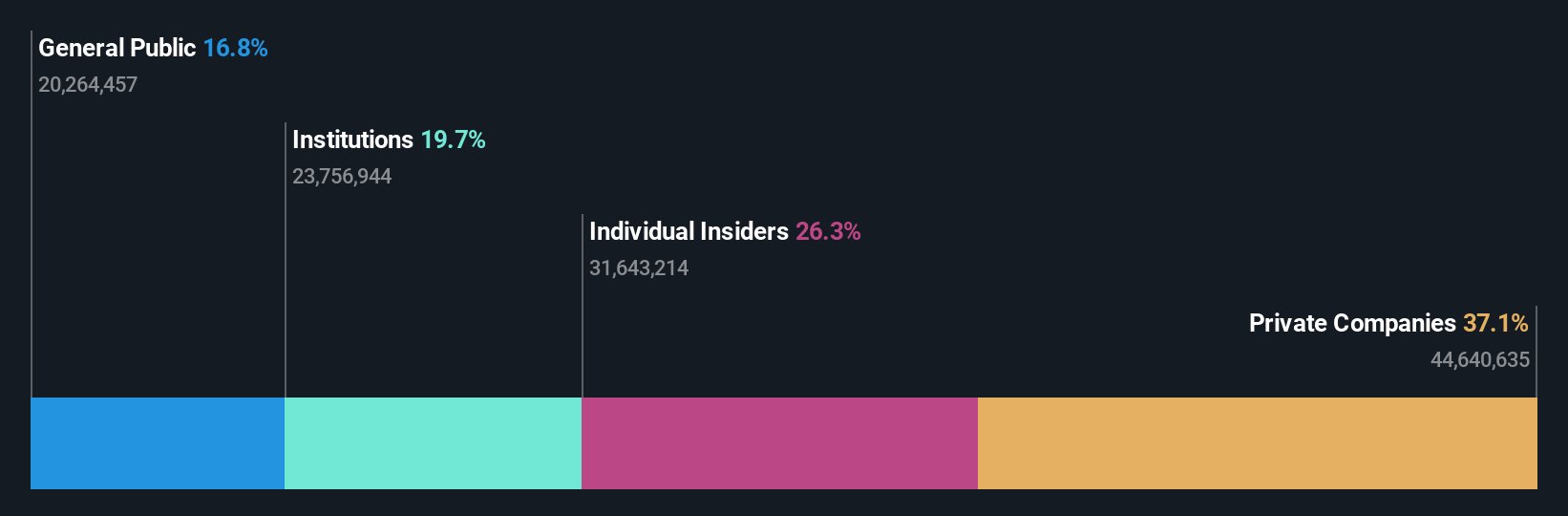

Insider Ownership: 26.3%

Shenzhen Bluetrum Technology shows potential for growth, with revenue projected to increase by 25% annually, surpassing the Chinese market's average. Recent earnings highlight a rise in sales to CNY 1.25 billion for the first nine months of 2024, alongside net income growth. Despite high volatility and a low future return on equity forecast, its current valuation appears favorable relative to peers in the semiconductor industry.

- Take a closer look at Shenzhen Bluetrum Technology's potential here in our earnings growth report.

- Our valuation report unveils the possibility Shenzhen Bluetrum Technology's shares may be trading at a discount.

Where To Now?

- Dive into all 1527 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688206

Primarius Technologies

Researches, designs, and develops EDA tools in China.

Flawless balance sheet with high growth potential.