As global markets navigate a busy earnings season and fluctuating economic indicators, small-cap stocks have shown resilience compared to their larger counterparts, with the Russell 2000 posting modest gains amid broader market declines. In this environment of mixed signals from labor markets and manufacturing activity, identifying high-growth tech stocks that can thrive requires careful consideration of their potential for innovation and adaptability in the face of economic uncertainties.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Hangzhou Electronic Soul Network Technology (SHSE:603258)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hangzhou Electronic Soul Network Technology Co., Ltd. develops and publishes online and mobile games in Asia, with a market cap of CN¥5.08 billion.

Operations: Electronic Soul focuses on developing and publishing online and mobile games in Asia. The company's revenue is primarily derived from its gaming operations, leveraging a diverse portfolio of titles to capture market interest.

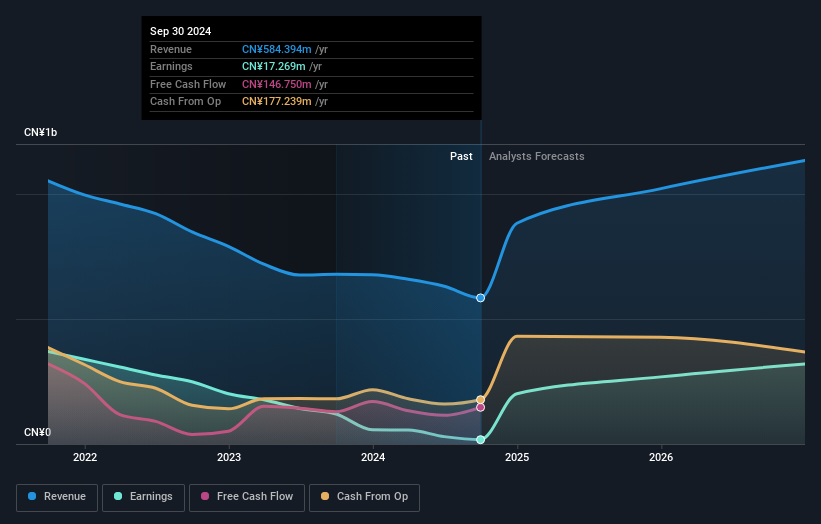

Hangzhou Electronic Soul Network Technology, navigating through a challenging landscape with a 22.7% projected annual revenue growth, outpaces the broader Chinese market's 14% increase. Despite recent earnings contraction by 85.6%, contrasting sharply with the industry's milder 16.1% decline, the firm is poised for a robust recovery with anticipated earnings growth of 54.7%. This resurgence is supported by strategic share repurchases totaling CNY 13.81 million this year and substantial R&D investment aimed at fostering innovation and maintaining competitive edge in the tech sector.

Beijing CTJ Information Technology (SZSE:301153)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing CTJ Information Technology Co., Ltd. operates within the software and information technology service industry, with a market capitalization of CN¥10.67 billion.

Operations: The company generates revenue primarily from its software and information technology services, totaling CN¥920.11 million.

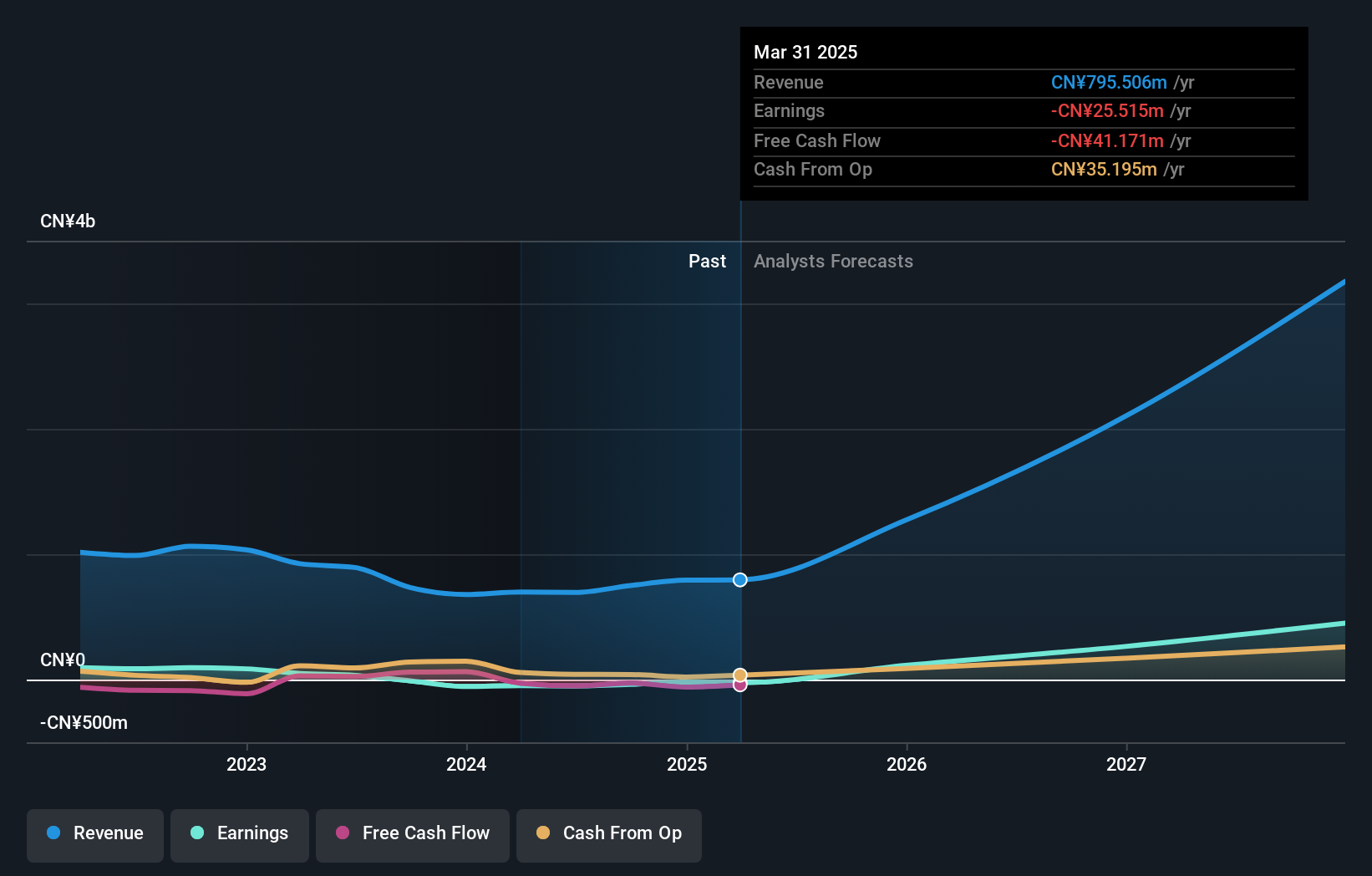

Beijing CTJ Information Technology, amidst a challenging financial backdrop with a sharp revenue drop to CNY 493.5 million from last year's CNY 781.21 million, still forecasts a promising future with an expected annual revenue growth of 31.9%. Despite recent net income plummeting to CNY 6.78 million from CNY 187.82 million, the company is poised for recovery with projected earnings growth at an impressive rate of 51.4% per annum. This optimism is bolstered by their commitment to innovation as evidenced by significant R&D expenditures which form a strategic part of their budget, aligning with industry trends towards enhanced technological capabilities and services expansion.

J.Pond Precision Technology (SZSE:301326)

Simply Wall St Growth Rating: ★★★★★☆

Overview: J.Pond Precision Technology Co., Ltd. specializes in the manufacturing and sale of precision functional and structural parts, with a market capitalization of CN¥4.75 billion.

Operations: J.Pond Precision Technology generates revenue primarily through the sale of precision functional and structural parts. The company's market capitalization stands at CN¥4.75 billion, reflecting its scale in the industry.

J.Pond Precision Technology has demonstrated a significant turnaround, evidenced by its latest nine-month sales increasing to CNY 593.68 million from CNY 521.74 million the previous year, and shifting from a net loss to a net income of CNY 0.756 million. This resurgence is underpinned by robust R&D investments which are critical in driving future innovations and maintaining competitive edge in the tech sector. The company's proactive approach includes repurchasing shares worth CNY 10.99 million, reflecting confidence in its financial health and strategic direction. With revenue expected to surge at an annual rate of 42.2%—outpacing the Chinese market's growth—and earnings projected to grow by an impressive 115.8%, J.Pond is positioning itself as a dynamic player within the high-growth tech landscape.

Seize The Opportunity

- Investigate our full lineup of 1288 High Growth Tech and AI Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing CTJ Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301153

Beijing CTJ Information Technology

Beijing CTJ Information Technology Co., Ltd.

Flawless balance sheet with high growth potential.