In a week marked by busy earnings reports and economic data, global markets experienced notable volatility, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating. Despite this turbulence, small-cap stocks showed resilience compared to their larger counterparts, underscoring the dynamic nature of high-growth sectors amidst cautious earnings from tech giants. In such an environment, identifying promising stocks often involves focusing on companies with robust growth potential that can navigate macroeconomic uncertainties effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Shanghai Baosight SoftwareLtd (SHSE:600845)

Simply Wall St Growth Rating: ★★★★★☆

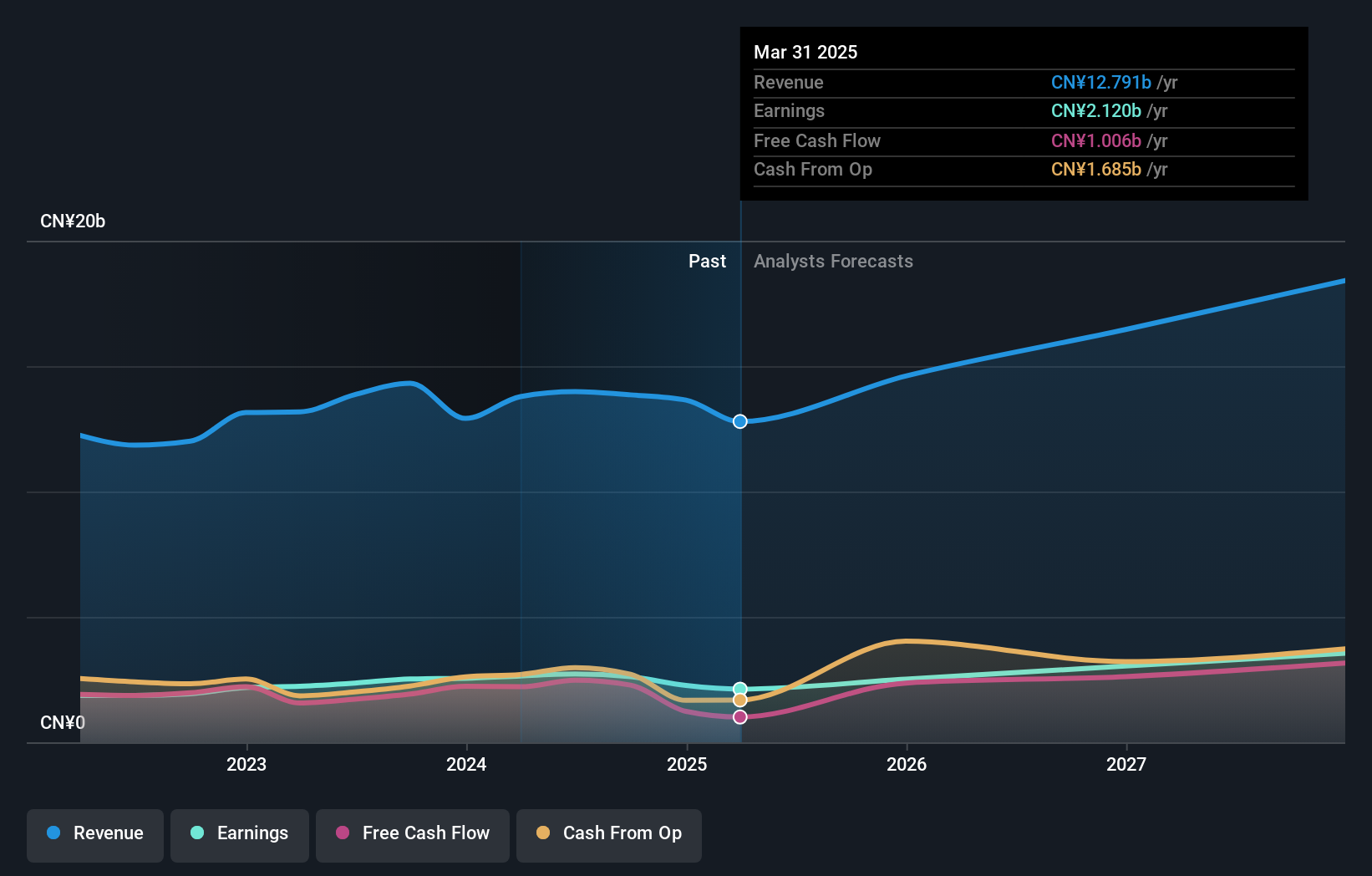

Overview: Shanghai Baosight Software Co., Ltd. offers industrial solutions in China with a market capitalization of CN¥67.65 billion.

Operations: Baosight Software specializes in delivering industrial solutions across China. The company generates revenue primarily through its software and system integration services, with a focus on the manufacturing sector. Its business model capitalizes on technological advancements to enhance operational efficiencies for clients, contributing to its financial performance.

Shanghai Baosight Software Co., Ltd. has demonstrated a robust trajectory in its financial performance, with a notable 21.1% annual revenue growth outpacing the Chinese market average of 14%. This growth is complemented by an earnings increase of 3.4% over the past year, surpassing the software industry's decline of 11.2%. The company's commitment to innovation is reflected in its R&D expenses, which have consistently aligned with strategic expansions and technological advancements, ensuring it remains competitive within the tech sector. Moreover, recent earnings results for the nine months ending September 2024 show revenues up at CNY 9.76 billion from CNY 8.82 billion year-over-year, alongside a net income rise to CNY 1.93 billion, signaling strong operational execution and market adaptability.

Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636)

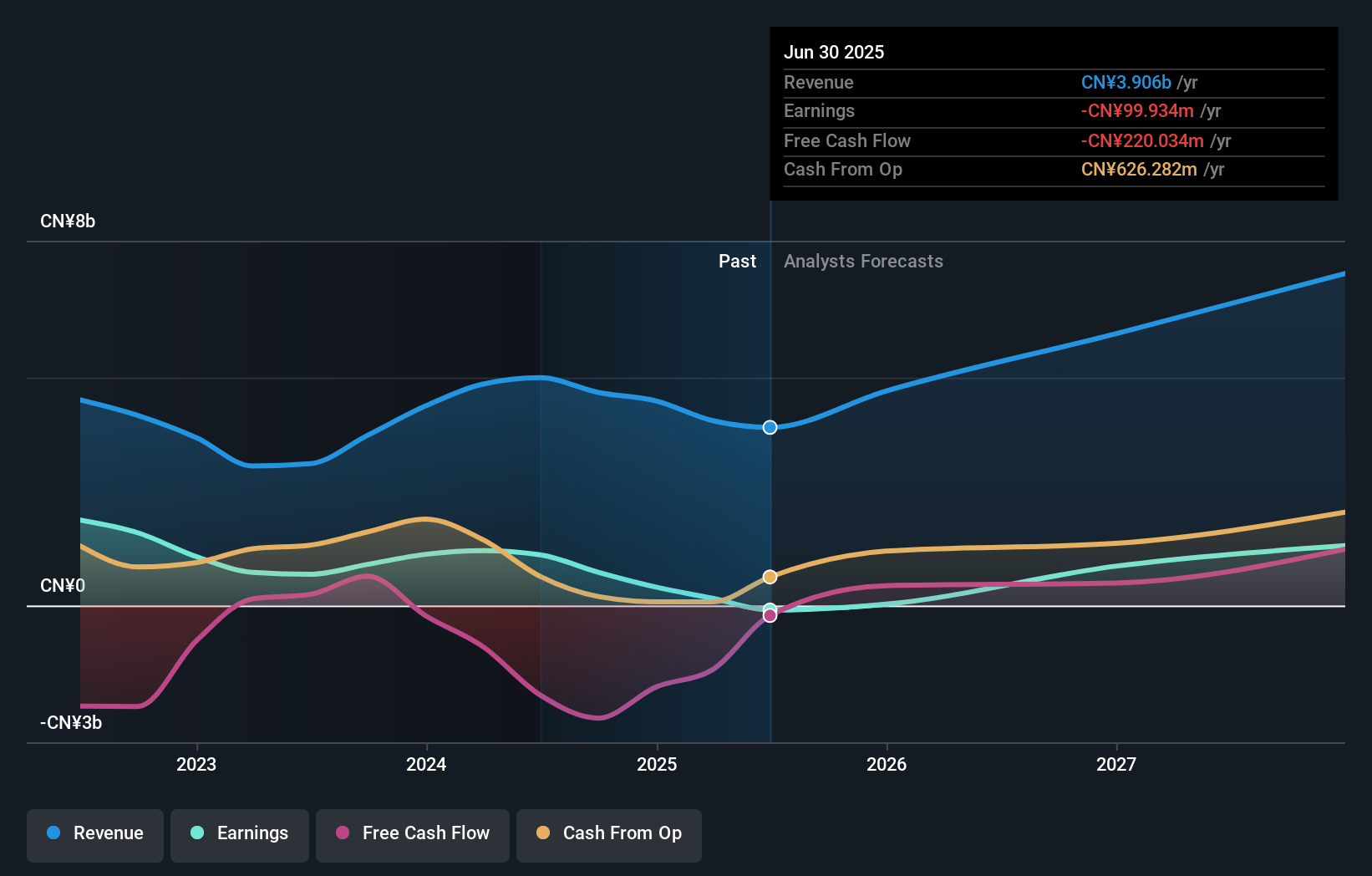

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangdong Fenghua Advanced Technology (Holding) Co., Ltd. operates in the electronic components and parts industry with a market cap of approximately CN¥19.15 billion.

Operations: The company generates revenue primarily from its electronic components and parts segment, amounting to CN¥4.55 billion.

Guangdong Fenghua Advanced Technology has shown a remarkable growth trajectory, with its revenue jumping from CNY 3.24 billion to CNY 3.57 billion over the last nine months, an increase of approximately 10.2%. This surge is supported by a significant boost in net income from CNY 111.47 million to CNY 265.5 million, reflecting strong operational efficiency and market responsiveness. The firm's commitment to innovation is evident in its R&D investments, which are crucial for sustaining its rapid growth rate of 38.1% per year in earnings, outpacing the broader Chinese market's expansion rate of 26.1%. With such robust financial health and strategic focus on technological advancements, Guangdong Fenghua is well-positioned to maintain its upward trajectory in the highly competitive tech sector.

Maxscend Microelectronics (SZSE:300782)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Maxscend Microelectronics Company Limited focuses on the research, development, production, and sale of radio frequency integrated circuits in China, with a market cap of CN¥53.46 billion.

Operations: The company specializes in radio frequency integrated circuits, operating within the Chinese market. It generates revenue through the production and sale of these circuits, focusing on innovation and development to enhance its product offerings.

Maxscend Microelectronics has demonstrated resilience with a reported revenue increase to CNY 3.37 billion, up from CNY 3.07 billion year-over-year, despite a dip in net income to CNY 425.42 million from CNY 818.95 million previously. This performance is underscored by an R&D commitment that aligns with its strategic focus on maintaining competitive edge in the tech sector, where innovation drives market success. The company's earnings are expected to grow by an impressive 30.8% annually, outpacing the broader Chinese market's growth rate of 26.1%, showcasing its potential amidst challenging dynamics and reinforcing its role in shaping future tech advancements.

Seize The Opportunity

- Explore the 1288 names from our High Growth Tech and AI Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600845

Undervalued with high growth potential and pays a dividend.