For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Ampoc Far-East (TWSE:2493). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Ampoc Far-East with the means to add long-term value to shareholders.

Check out our latest analysis for Ampoc Far-East

How Fast Is Ampoc Far-East Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. It certainly is nice to see that Ampoc Far-East has managed to grow EPS by 34% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

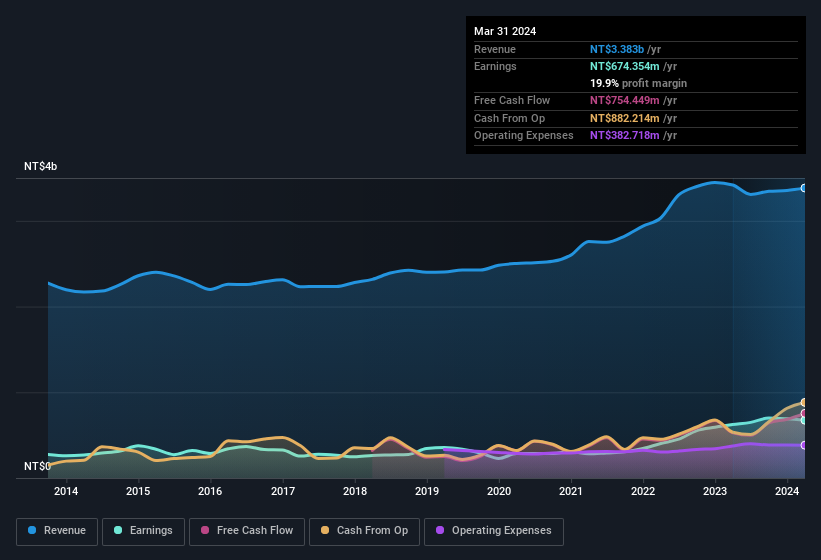

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Ampoc Far-East reported flat revenue and EBIT margins over the last year. That's not a major concern but nor does it point to the long term growth we like to see.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Ampoc Far-East isn't a huge company, given its market capitalisation of NT$9.6b. That makes it extra important to check on its balance sheet strength.

Are Ampoc Far-East Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Shareholders will be pleased by the fact that insiders own Ampoc Far-East shares worth a considerable sum. Given insiders own a significant chunk of shares, currently valued at NT$2.0b, they have plenty of motivation to push the business to succeed. Amounting to 21% of the outstanding shares, indicating that insiders are also significantly impacted by the decisions they make on the behalf of the business.

Is Ampoc Far-East Worth Keeping An Eye On?

You can't deny that Ampoc Far-East has grown its earnings per share at a very impressive rate. That's attractive. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. We should say that we've discovered 1 warning sign for Ampoc Far-East that you should be aware of before investing here.

Although Ampoc Far-East certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Taiwanese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2493

Ampoc Far-East

Researches, manufactures, and sells equipment and materials for the electrical industry in Taiwan, China, and Hong Kong.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026