- Taiwan

- /

- Semiconductors

- /

- TWSE:2449

Earnings Not Telling The Story For King Yuan Electronics Co., Ltd. (TWSE:2449) After Shares Rise 28%

King Yuan Electronics Co., Ltd. (TWSE:2449) shareholders have had their patience rewarded with a 28% share price jump in the last month. The annual gain comes to 121% following the latest surge, making investors sit up and take notice.

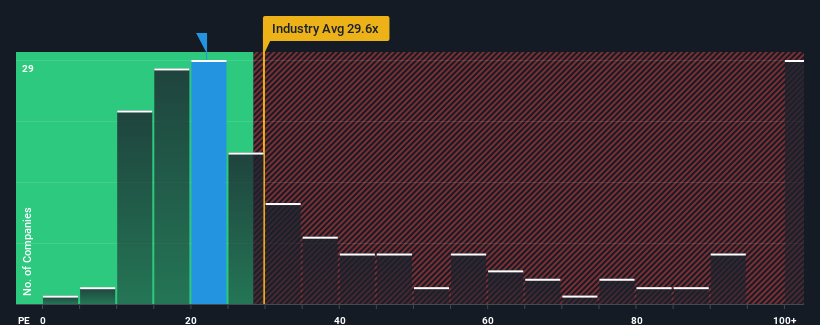

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about King Yuan Electronics' P/E ratio of 22x, since the median price-to-earnings (or "P/E") ratio in Taiwan is also close to 22x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

King Yuan Electronics' negative earnings growth of late has neither been better nor worse than most other companies. The P/E is probably moderate because investors think the company's earnings trend will continue to follow the rest of the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's earnings continue tracking the market.

View our latest analysis for King Yuan Electronics

How Is King Yuan Electronics' Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like King Yuan Electronics' to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 61% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 18% over the next year. That's shaping up to be materially lower than the 22% growth forecast for the broader market.

In light of this, it's curious that King Yuan Electronics' P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From King Yuan Electronics' P/E?

Its shares have lifted substantially and now King Yuan Electronics' P/E is also back up to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that King Yuan Electronics currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for King Yuan Electronics that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if King Yuan Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2449

King Yuan Electronics

Engages in the designing, manufacturing, selling, testing, and assembly service of integrated circuits in Taiwan, Asia, North America, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives