- Taiwan

- /

- Semiconductors

- /

- TWSE:2449

3 Asian Stocks Estimated To Be Up To 48.5% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate the complexities of new U.S. tariffs and mixed economic signals, Asian markets have shown resilience, with China's stimulus hopes buoying investor sentiment. In this environment, identifying undervalued stocks becomes crucial for investors seeking opportunities amidst uncertainty, as these stocks may offer potential value when their intrinsic worth is not fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiyo Yuden (TSE:6976) | ¥2553.00 | ¥5091.29 | 49.9% |

| SILICON2 (KOSDAQ:A257720) | ₩52900.00 | ₩104284.28 | 49.3% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥52.83 | CN¥104.19 | 49.3% |

| Medy-Tox (KOSDAQ:A086900) | ₩162400.00 | ₩322233.66 | 49.6% |

| Mandom (TSE:4917) | ¥1442.00 | ¥2835.83 | 49.2% |

| Lucky Harvest (SZSE:002965) | CN¥35.03 | CN¥69.40 | 49.5% |

| Hugel (KOSDAQ:A145020) | ₩355000.00 | ₩698441.84 | 49.2% |

| HL Holdings (KOSE:A060980) | ₩41650.00 | ₩82439.98 | 49.5% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.82 | NZ$1.62 | 49.5% |

| ALUX (KOSDAQ:A475580) | ₩11490.00 | ₩22641.19 | 49.3% |

Underneath we present a selection of stocks filtered out by our screen.

Wanguo Gold Group (SEHK:3939)

Overview: Wanguo Gold Group Limited is an investment holding company involved in mining, ore processing, and the sale of concentrate products in the People's Republic of China and Solomon Islands, with a market cap of HK$33.38 billion.

Operations: The company's revenue is derived from the Yifeng Project, contributing CN¥687.63 million, and the Solomon Project, which accounts for CN¥1.19 billion.

Estimated Discount To Fair Value: 48.5%

Wanguo Gold Group is trading at HK$30.8, significantly below its estimated fair value of HK$59.82, indicating potential undervaluation based on cash flows. Despite a volatile share price and past shareholder dilution, the company's earnings are forecast to grow significantly at 33.8% annually, outpacing the Hong Kong market's growth rate. Recent board changes and dividend declarations highlight active corporate governance and shareholder returns, with a special dividend of 7.5 RMB cents per share announced in June 2025.

- Insights from our recent growth report point to a promising forecast for Wanguo Gold Group's business outlook.

- Click to explore a detailed breakdown of our findings in Wanguo Gold Group's balance sheet health report.

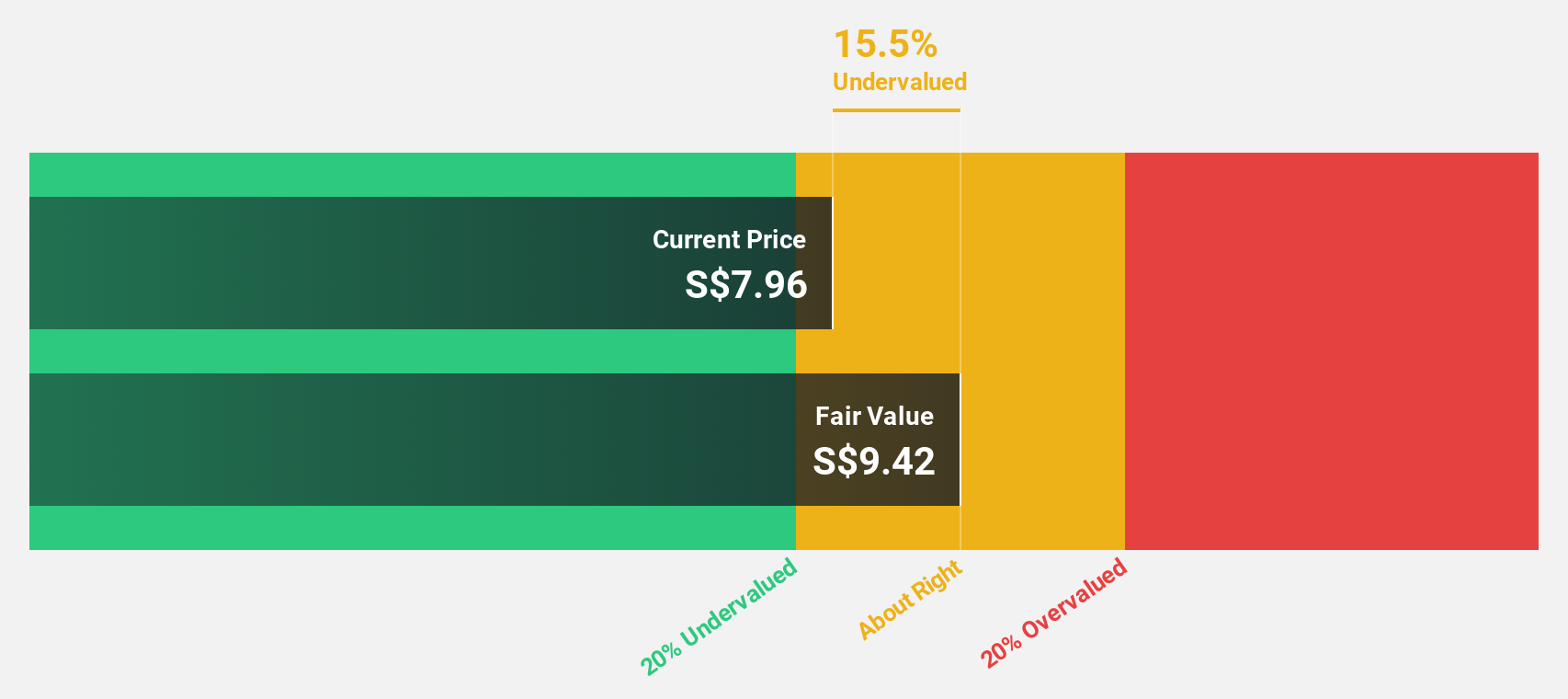

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global technology, defence, and engineering company with a market cap of SGD26.04 billion.

Operations: The company generates revenue from three primary segments: Commercial Aerospace (SGD4.44 billion), Urban Solutions & Satcom (SGD2.01 billion), and Defence & Public Security (SGD4.97 billion).

Estimated Discount To Fair Value: 13.8%

Singapore Technologies Engineering is trading at S$8.34, below its estimated fair value of S$9.68, suggesting potential undervaluation based on cash flows. Revenue and earnings are projected to grow faster than the Singapore market, despite a high debt level. Recent contract wins totaling $4.4 billion across various segments bolster future growth prospects but may not materially impact current financial metrics immediately due to their long-term nature and execution timelines.

- Our growth report here indicates Singapore Technologies Engineering may be poised for an improving outlook.

- Dive into the specifics of Singapore Technologies Engineering here with our thorough financial health report.

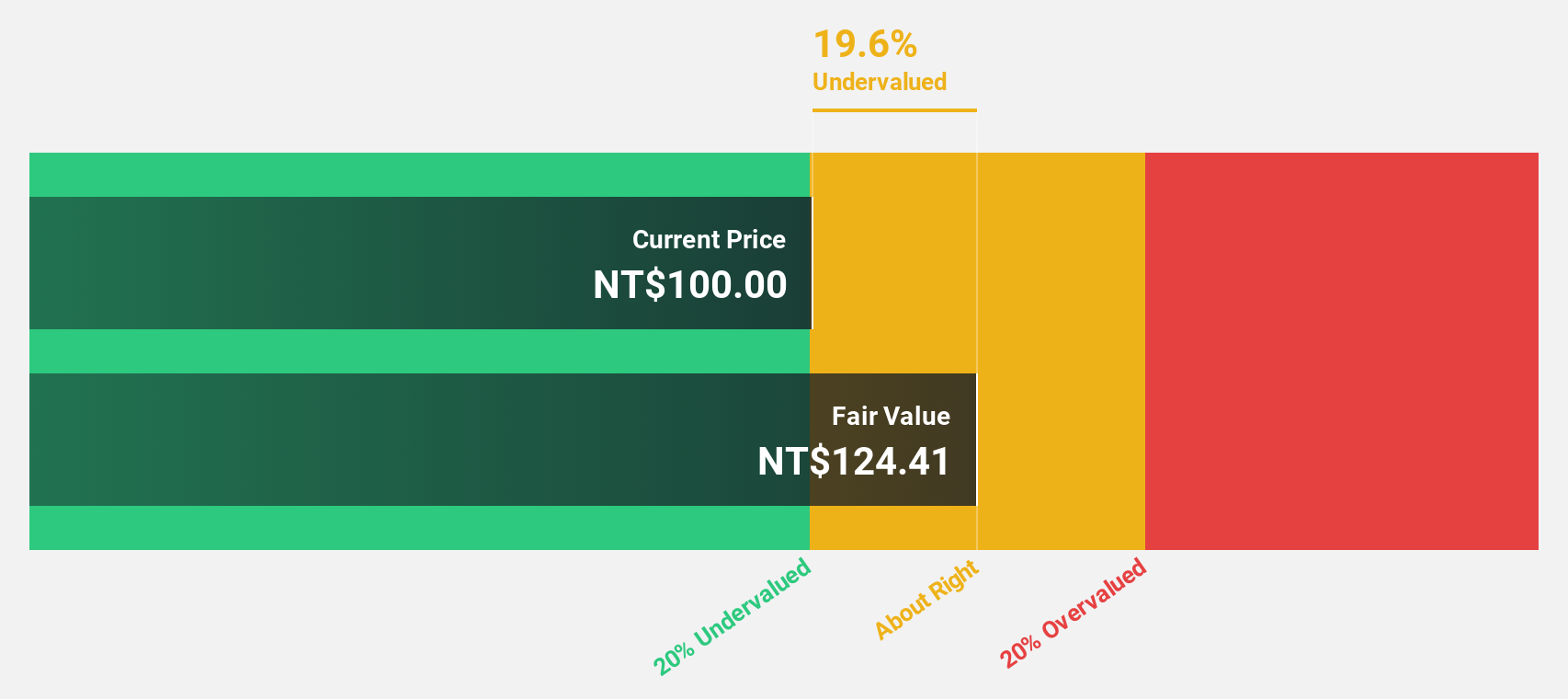

King Yuan Electronics (TWSE:2449)

Overview: King Yuan Electronics Co., Ltd. provides design, manufacturing, selling, testing, and assembly services for integrated circuits across Taiwan, Asia, North America, and internationally with a market cap of NT$133.89 billion.

Operations: The company's revenue from Contract Electronics Manufacturing Services is NT$28.19 billion.

Estimated Discount To Fair Value: 20.1%

King Yuan Electronics, trading at NT$109.5, is valued below its estimated fair value of NT$137.05, highlighting potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 25% annually over the next three years, outpacing Taiwan's market growth rate. Recent earnings results show substantial improvement with net income rising to TWD 4.29 billion from TWD 1.37 billion year-on-year, supporting robust cash flow generation despite a dividend not fully covered by earnings or free cash flows.

- The growth report we've compiled suggests that King Yuan Electronics' future prospects could be on the up.

- Get an in-depth perspective on King Yuan Electronics' balance sheet by reading our health report here.

Seize The Opportunity

- Explore the 262 names from our Undervalued Asian Stocks Based On Cash Flows screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if King Yuan Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2449

King Yuan Electronics

Engages in the designing, manufacturing, selling, testing, and assembly service of integrated circuits in Taiwan, Asia, North America, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives