- Taiwan

- /

- Semiconductors

- /

- TWSE:2408

There's Reason For Concern Over Nanya Technology Corporation's (TWSE:2408) Massive 29% Price Jump

Despite an already strong run, Nanya Technology Corporation (TWSE:2408) shares have been powering on, with a gain of 29% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 32% over that time.

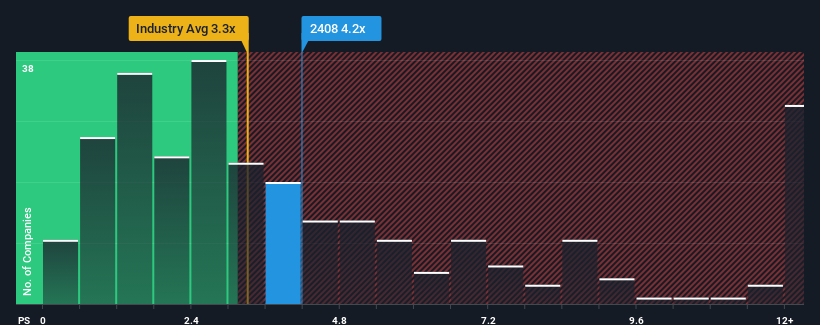

After such a large jump in price, given close to half the companies operating in Taiwan's Semiconductor industry have price-to-sales ratios (or "P/S") below 3.3x, you may consider Nanya Technology as a stock to potentially avoid with its 4.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Nanya Technology

What Does Nanya Technology's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Nanya Technology has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Nanya Technology's future stacks up against the industry? In that case, our free report is a great place to start.How Is Nanya Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Nanya Technology would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. Still, lamentably revenue has fallen 60% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 13% per annum as estimated by the nine analysts watching the company. That's shaping up to be materially lower than the 21% each year growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Nanya Technology's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Nanya Technology's P/S?

Nanya Technology shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Nanya Technology, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you take the next step, you should know about the 1 warning sign for Nanya Technology that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Nanya Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2408

Nanya Technology

Research, develops, manufactures, and sells semiconductor products in Taiwan, Japan, Malaysia, China, the United States, Thailand, Germany, Singapore, Poland and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives