- Taiwan

- /

- Semiconductors

- /

- TWSE:2329

Market Cool On Orient Semiconductor Electronics, Limited's (TWSE:2329) Earnings Pushing Shares 27% Lower

The Orient Semiconductor Electronics, Limited (TWSE:2329) share price has fared very poorly over the last month, falling by a substantial 27%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 14% in that time.

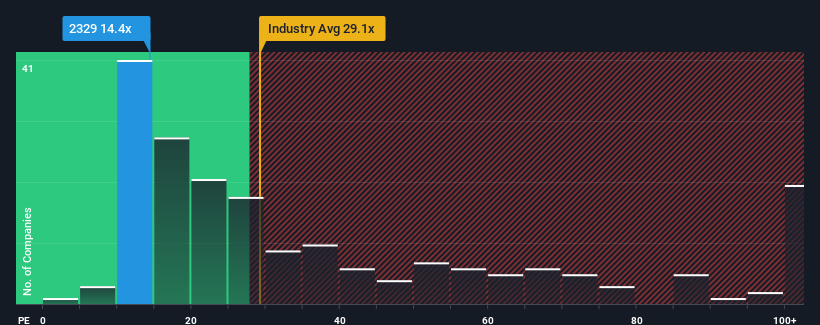

Following the heavy fall in price, Orient Semiconductor Electronics may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 14.4x, since almost half of all companies in Taiwan have P/E ratios greater than 23x and even P/E's higher than 40x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been quite advantageous for Orient Semiconductor Electronics as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Orient Semiconductor Electronics

How Is Orient Semiconductor Electronics' Growth Trending?

Orient Semiconductor Electronics' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 58% last year. Pleasingly, EPS has also lifted 225% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 23% shows it's noticeably more attractive on an annualised basis.

In light of this, it's peculiar that Orient Semiconductor Electronics' P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Orient Semiconductor Electronics' P/E?

Orient Semiconductor Electronics' recently weak share price has pulled its P/E below most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Orient Semiconductor Electronics revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Before you take the next step, you should know about the 1 warning sign for Orient Semiconductor Electronics that we have uncovered.

If you're unsure about the strength of Orient Semiconductor Electronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2329

Orient Semiconductor Electronics

Manufactures, combines, process, and exports various types of integrated circuits, semiconductor components, computer motherboards, electronic inventory, and computer and communication circuit boards.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives