- Taiwan

- /

- Semiconductors

- /

- TWSE:8110

We Wouldn't Rely On Walton Advanced Engineering's (TPE:8110) Statutory Earnings As A Guide

Broadly speaking, profitable businesses are less risky than unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. This article will consider whether Walton Advanced Engineering's (TPE:8110) statutory profits are a good guide to its underlying earnings.

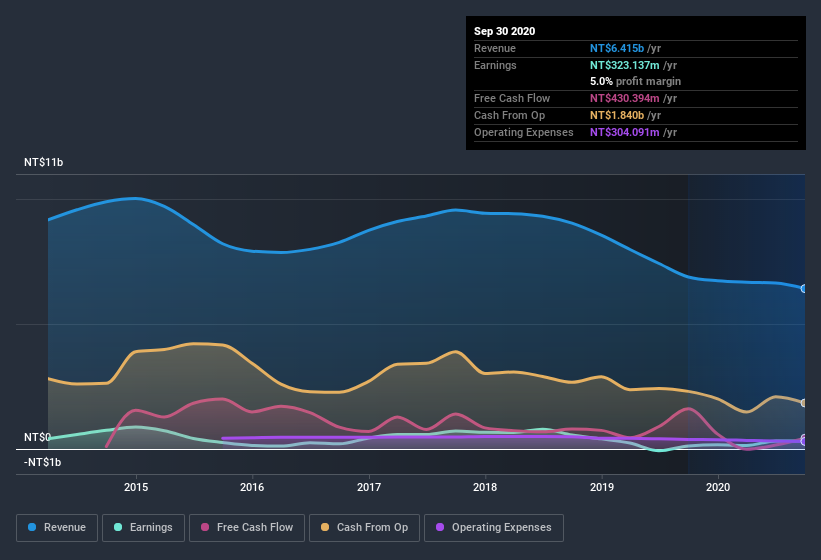

While Walton Advanced Engineering was able to generate revenue of NT$6.42b in the last twelve months, we think its profit result of NT$323.1m was more important. The chart below shows that both revenue and profit have declined over the last three years.

Check out our latest analysis for Walton Advanced Engineering

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. As a reuslt, we think it's important to consider how unusual items and the recent tax benefit have influenced Walton Advanced Engineering's statutory profit. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Walton Advanced Engineering.

The Impact Of Unusual Items On Profit

For anyone who wants to understand Walton Advanced Engineering's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from NT$105m worth of unusual items. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. We can see that Walton Advanced Engineering's positive unusual items were quite significant relative to its profit in the year to September 2020. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that Walton Advanced Engineering received a tax benefit which contributed NT$34m to the bottom line. This is meaningful because companies usually pay tax rather than receive tax benefits. We're sure the company was pleased with its tax benefit. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Walton Advanced Engineering's Profit Performance

In the last year Walton Advanced Engineering received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. And on top of that, it also saw an unusual item boost its profit, suggesting that next year might see a lower profit number, if these events are not repeated. For all the reasons mentioned above, we think that, at a glance, Walton Advanced Engineering's statutory profits could be considered to be low quality, because they are likely to give investors an overly positive impression of the company. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Our analysis shows 2 warning signs for Walton Advanced Engineering (1 doesn't sit too well with us!) and we strongly recommend you look at these before investing.

Our examination of Walton Advanced Engineering has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Walton Advanced Engineering or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Walton Advanced Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:8110

Walton Advanced Engineering

Provides semiconductor packaging and testing services in Taiwan and China.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion