- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6278

We Think Taiwan Surface Mounting Technology (TPE:6278) Can Stay On Top Of Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Taiwan Surface Mounting Technology Corp. (TPE:6278) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Taiwan Surface Mounting Technology

How Much Debt Does Taiwan Surface Mounting Technology Carry?

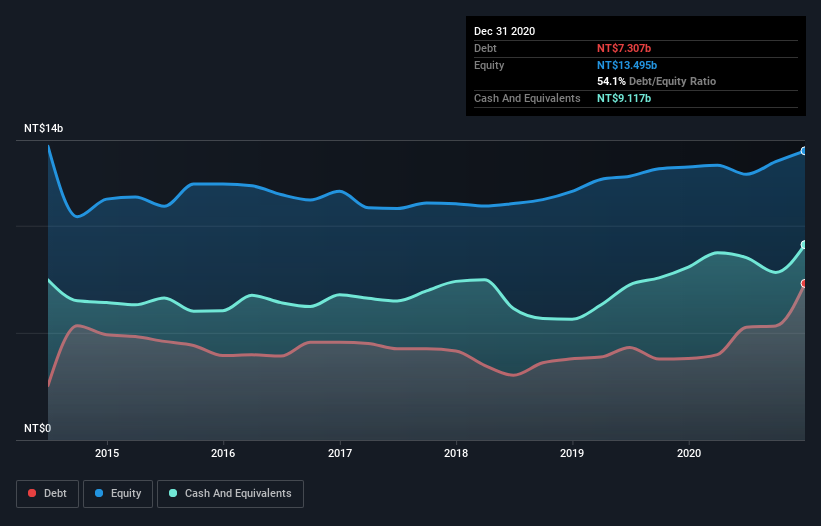

As you can see below, at the end of December 2020, Taiwan Surface Mounting Technology had NT$7.31b of debt, up from NT$3.81b a year ago. Click the image for more detail. However, its balance sheet shows it holds NT$9.12b in cash, so it actually has NT$1.81b net cash.

How Strong Is Taiwan Surface Mounting Technology's Balance Sheet?

According to the last reported balance sheet, Taiwan Surface Mounting Technology had liabilities of NT$20.2b due within 12 months, and liabilities of NT$4.36b due beyond 12 months. Offsetting these obligations, it had cash of NT$9.12b as well as receivables valued at NT$13.0b due within 12 months. So it has liabilities totalling NT$2.39b more than its cash and near-term receivables, combined.

Of course, Taiwan Surface Mounting Technology has a market capitalization of NT$33.9b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, Taiwan Surface Mounting Technology boasts net cash, so it's fair to say it does not have a heavy debt load!

But the other side of the story is that Taiwan Surface Mounting Technology saw its EBIT decline by 3.5% over the last year. That sort of decline, if sustained, will obviously make debt harder to handle. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Taiwan Surface Mounting Technology can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Taiwan Surface Mounting Technology has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, Taiwan Surface Mounting Technology created free cash flow amounting to 15% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Taiwan Surface Mounting Technology has NT$1.81b in net cash. So we are not troubled with Taiwan Surface Mounting Technology's debt use. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 3 warning signs we've spotted with Taiwan Surface Mounting Technology (including 1 which doesn't sit too well with us) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Surface Mounting Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6278

Taiwan Surface Mounting Technology

Engages in the design, processing, manufacturing, and trading of TFT-LCD panels, general electronic information products, and PCB surface mount packaging worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026