- Taiwan

- /

- Semiconductors

- /

- TWSE:3031

Should You Buy Bright LED Electronics Corp. (TPE:3031) For Its Dividend?

Dividend paying stocks like Bright LED Electronics Corp. (TPE:3031) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

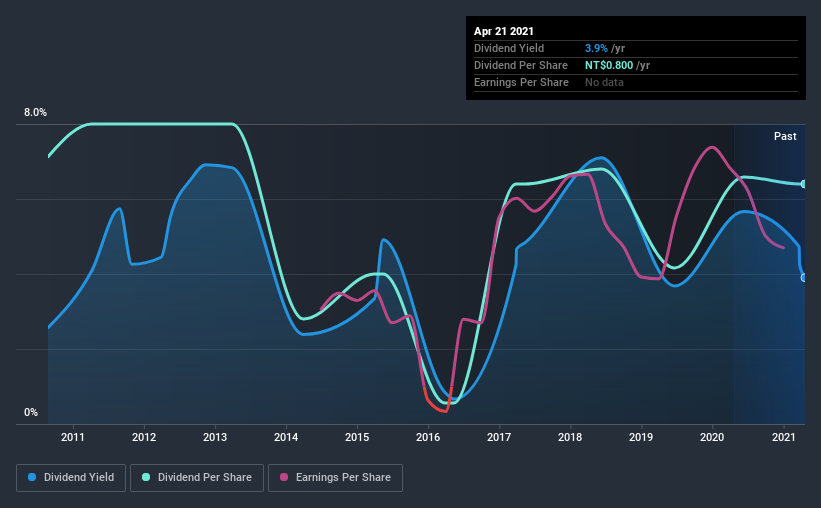

With Bright LED Electronics yielding 3.9% and having paid a dividend for over 10 years, many investors likely find the company quite interesting. We'd guess that plenty of investors have purchased it for the income. The company also bought back stock equivalent to around 2.0% of market capitalisation this year. That said, the recent jump in the share price will make Bright LED Electronics's dividend yield look smaller, even though the company prospects could be improving. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. In the last year, Bright LED Electronics paid out 108% of its profit as dividends. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Of the free cash flow it generated last year, Bright LED Electronics paid out 48% as dividends, suggesting the dividend is affordable. It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Bright LED Electronics fortunately did generate enough cash to fund its dividend. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

While the above analysis focuses on dividends relative to a company's earnings, we do note Bright LED Electronics' strong net cash position, which will let it pay larger dividends for a time, should it choose.

Remember, you can always get a snapshot of Bright LED Electronics' latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Bright LED Electronics has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. Its dividend payments have declined on at least one occasion over the past 10 years. During the past 10-year period, the first annual payment was NT$0.9 in 2011, compared to NT$0.8 last year. The dividend has shrunk at around 1.1% a year during that period. Bright LED Electronics' dividend has been cut sharply at least once, so it hasn't fallen by 1.1% every year, but this is a decent approximation of the long term change.

A shrinking dividend over a 10-year period is not ideal, and we'd be concerned about investing in a dividend stock that lacks a solid record of growing dividends per share.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Bright LED Electronics has grown its earnings per share at 18% per annum over the past five years. While EPS are growing rapidly, Bright LED Electronics paid out a very high 108% of its income as dividends. If earnings continue to grow, this dividend may be sustainable, but we think a payout this high definitely bears watching.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. We're a bit uncomfortable with its high payout ratio, although at least the dividend was covered by free cash flow. We were also glad to see it growing earnings, but it was concerning to see the dividend has been cut at least once in the past. In sum, we find it hard to get excited about Bright LED Electronics from a dividend perspective. It's not that we think it's a bad business; just that there are other companies that perform better on these criteria.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 2 warning signs for Bright LED Electronics that investors should take into consideration.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

When trading Bright LED Electronics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bright LED Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3031

Bright LED Electronics

Manufactures and sells light-emitting diodes, indicator lights, displays, and other products in China, Taiwan, Korea, the United States, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion