- Taiwan

- /

- Semiconductors

- /

- TWSE:2455

Is Visual Photonics Epitaxy Co., Ltd. (TPE:2455) A Good Dividend Stock?

Could Visual Photonics Epitaxy Co., Ltd. (TPE:2455) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

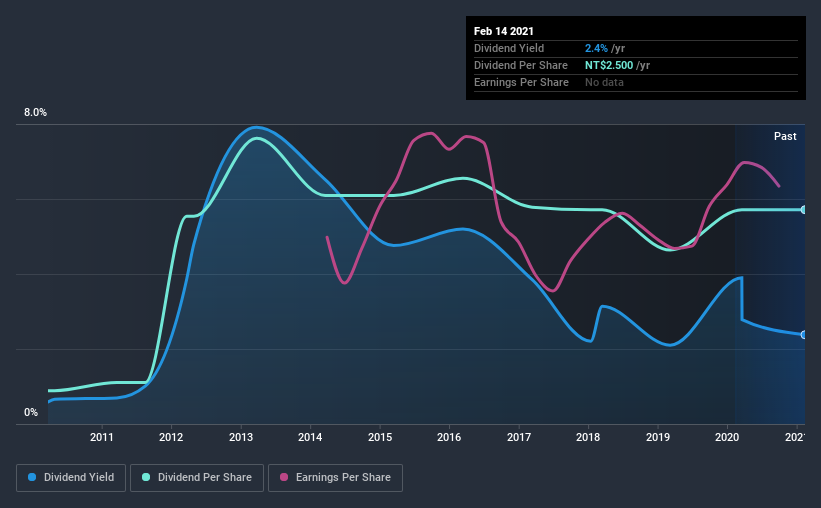

While Visual Photonics Epitaxy's 2.4% dividend yield is not the highest, we think its lengthy payment history is quite interesting. Some simple analysis can reduce the risk of holding Visual Photonics Epitaxy for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on Visual Photonics Epitaxy!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. In the last year, Visual Photonics Epitaxy paid out 90% of its profit as dividends. With a payout ratio this high, we'd say its dividend is not well covered by earnings. This may be fine if earnings are growing, but it might not take much of a downturn for the dividend to come under pressure.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Visual Photonics Epitaxy paid out 57% of its free cash flow last year, which is acceptable, but is starting to limit the amount of earnings that can be reinvested into the business. It's good to see that while Visual Photonics Epitaxy's dividends were not well covered by profits, at least they are affordable from a free cash flow perspective. Even so, if the company were to continue paying out almost all of its profits, we'd be concerned about whether the dividend is sustainable in a downturn.

While the above analysis focuses on dividends relative to a company's earnings, we do note Visual Photonics Epitaxy's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Consider getting our latest analysis on Visual Photonics Epitaxy's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Visual Photonics Epitaxy has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. Its dividend payments have declined on at least one occasion over the past 10 years. During the past 10-year period, the first annual payment was NT$0.4 in 2011, compared to NT$2.5 last year. This works out to be a compound annual growth rate (CAGR) of approximately 20% a year over that time. The growth in dividends has not been linear, but the CAGR is a decent approximation of the rate of change over this time frame.

Visual Photonics Epitaxy has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, but it might be worth considering if the business has turned a corner.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. In the last five years, Visual Photonics Epitaxy's earnings per share have shrunk at approximately 3.9% per annum. If earnings continue to decline, the dividend may come under pressure. Every investor should make an assessment of whether the company is taking steps to stabilise the situation.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. We're not keen on the fact that Visual Photonics Epitaxy paid out such a high percentage of its income, although its cashflow is in better shape. Earnings per share have been falling, and the company has cut its dividend at least once in the past. From a dividend perspective, this is a cause for concern. Using these criteria, Visual Photonics Epitaxy looks quite suboptimal from a dividend investment perspective.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come accross 2 warning signs for Visual Photonics Epitaxy you should be aware of, and 1 of them shouldn't be ignored.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you’re looking to trade Visual Photonics Epitaxy, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2455

Visual Photonics Epitaxy

Engages in the research and development, manufacture, and sale of optoelectronic semiconductors epitaxy and optoelectronic components products in Taiwan, the United States, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives