- Taiwan

- /

- Semiconductors

- /

- TPEX:6138

Asian Dividend Stocks: Anpec Electronics And 2 Other Top Picks

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing monetary policies and trade tensions, investors are increasingly turning their attention to dividend stocks in Asia, which offer potential stability amid volatility. In this environment, a good dividend stock is often characterized by its ability to provide consistent payouts and resilience against economic fluctuations, making them attractive for those seeking reliable income streams.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.22% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.02% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.82% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.07% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Daicel (TSE:4202) | 4.32% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.45% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.63% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.64% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.60% | ★★★★★★ |

Click here to see the full list of 1042 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

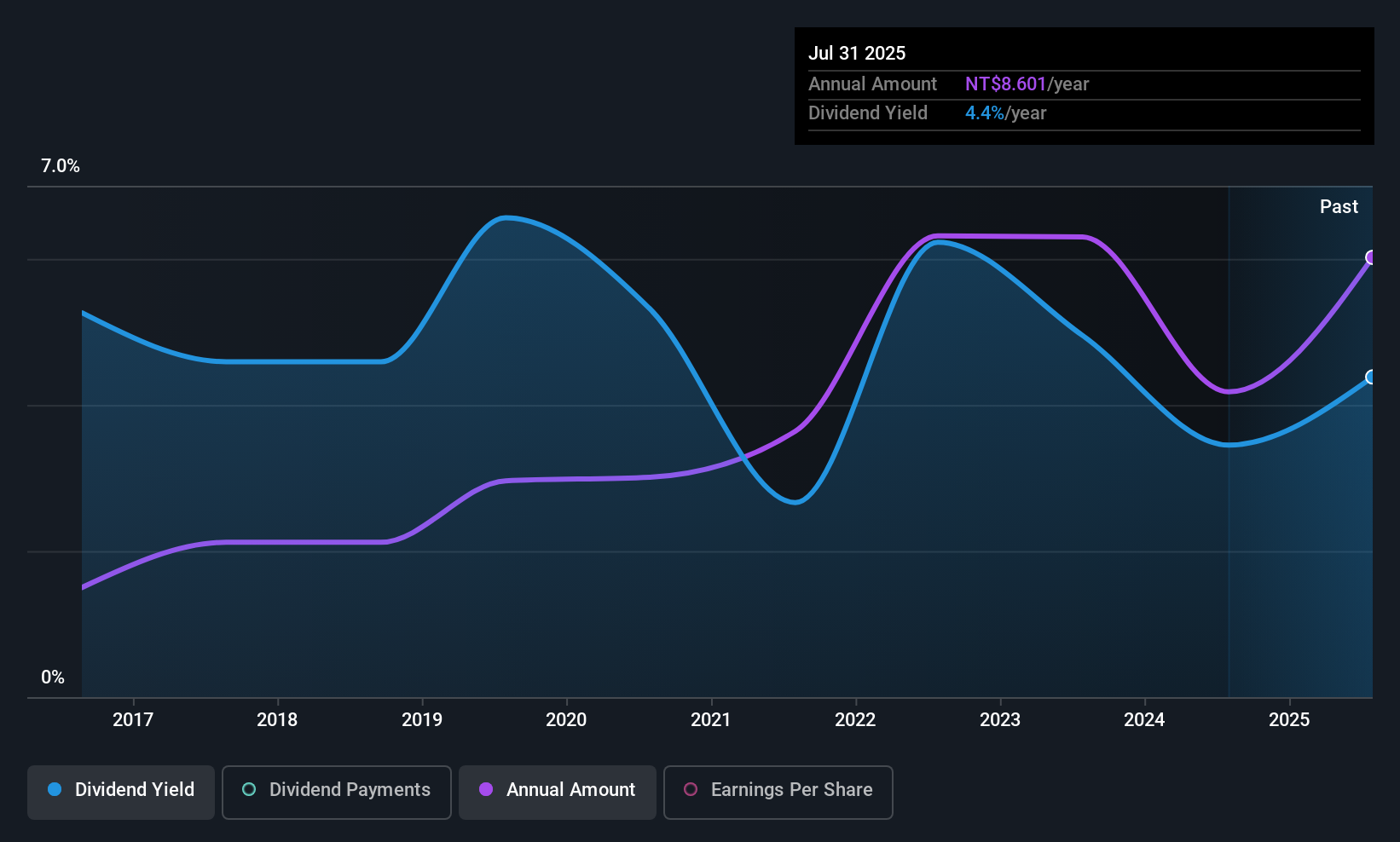

Anpec Electronics (TPEX:6138)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anpec Electronics Corporation is involved in the design, testing, production, and marketing of mixed-signal power chips and sensors both in Taiwan and internationally, with a market cap of NT$16.96 billion.

Operations: Anpec Electronics Corporation generates its revenue primarily from the Semiconductors segment, which accounts for NT$6.71 billion.

Dividend Yield: 3.7%

Anpec Electronics' dividend yield (3.72%) lags behind the top 25% in Taiwan's market, but its payouts are covered by earnings and cash flow with a payout ratio of 82.9% and a cash payout ratio of 52.7%. Despite a decade-long increase in dividends, their volatility raises concerns about reliability. Recent developments include Yageo Corporation's acquisition of a 21.43% stake for TWD 3.7 billion, potentially impacting future dividend stability and strategic direction.

- Take a closer look at Anpec Electronics' potential here in our dividend report.

- According our valuation report, there's an indication that Anpec Electronics' share price might be on the cheaper side.

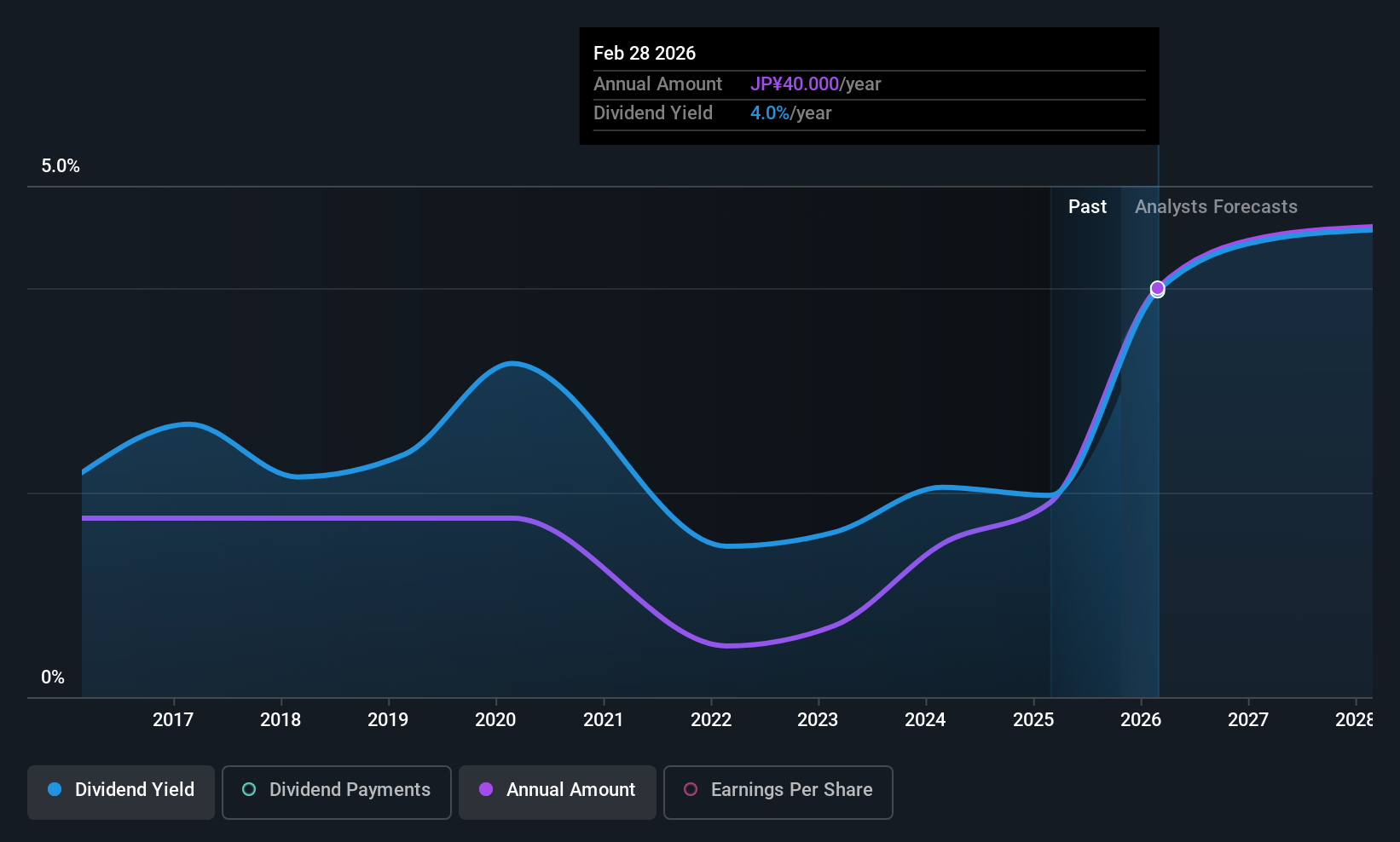

TSI HoldingsLtd (TSE:3608)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TSI Holdings Co., Ltd. is involved in the planning, manufacturing, and sale of clothing both in Japan and internationally, with a market cap of ¥59.45 billion.

Operations: TSI Holdings Co., Ltd. generates revenue primarily from its Apparel Related segment, which accounts for ¥142.13 billion.

Dividend Yield: 3.9%

TSI Holdings' dividend yield of 3.92% ranks in the top 25% of Japan's market, yet its sustainability is questionable due to a lack of free cash flow coverage. Despite an increase over the past decade, dividends have been volatile and not consistently reliable. Recent guidance projects net sales at ¥169 billion for fiscal year ending February 2026, but earnings are expected to decline significantly over the next three years, affecting future dividend prospects.

- Unlock comprehensive insights into our analysis of TSI HoldingsLtd stock in this dividend report.

- The valuation report we've compiled suggests that TSI HoldingsLtd's current price could be quite moderate.

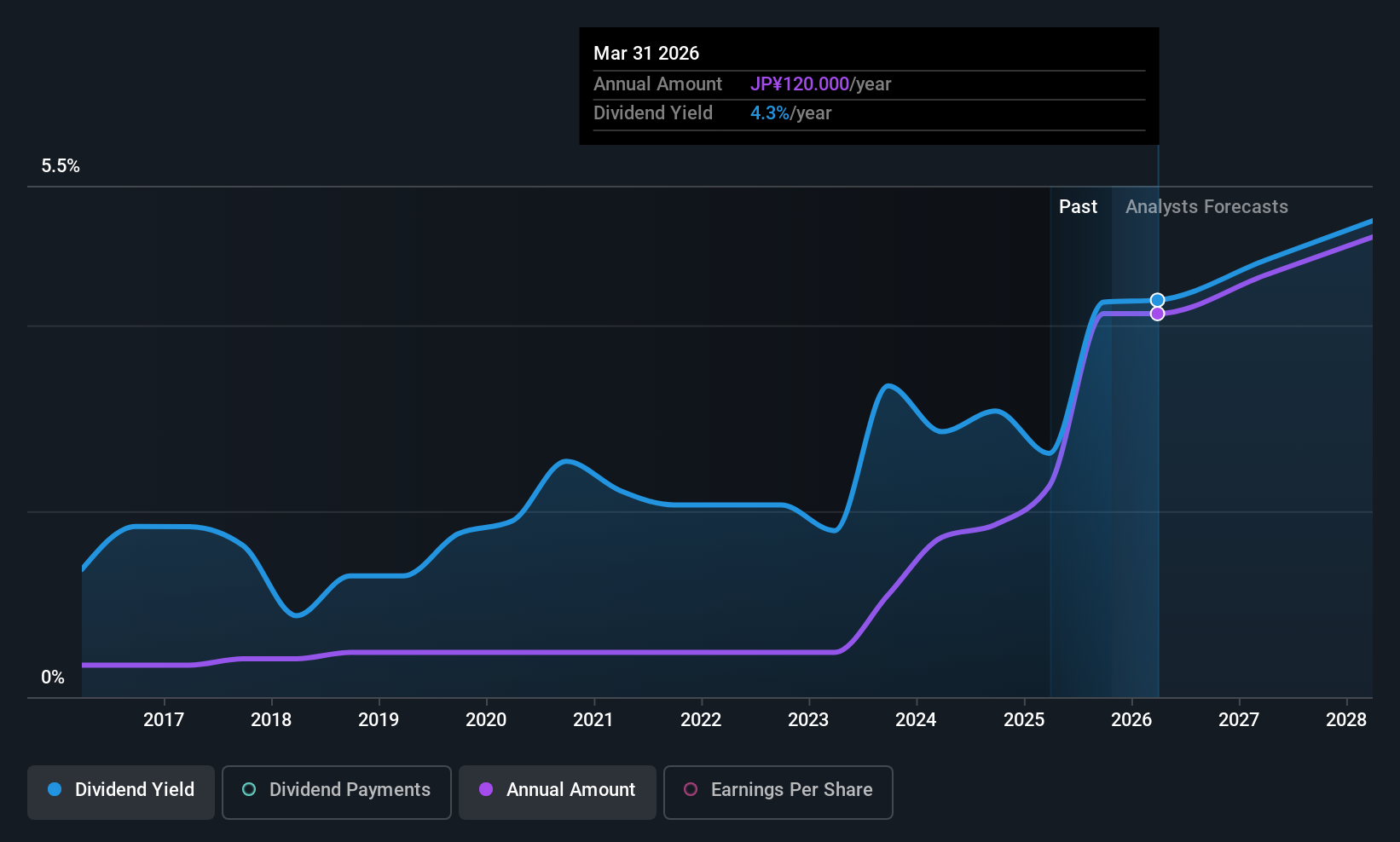

NCD (TSE:4783)

Simply Wall St Dividend Rating: ★★★★★★

Overview: NCD Co., Ltd. operates in Japan, focusing on system development, support and service, and parking system businesses, with a market cap of ¥23.99 billion.

Operations: NCD Co., Ltd.'s revenue is derived from its System Development Business, which generates ¥12.76 billion, the Support & Service Business contributing ¥9.50 billion, and the Parking System segment adding ¥8.08 billion.

Dividend Yield: 4.1%

NCD Co., Ltd. offers a compelling dividend profile with stable and growing payouts over the past decade, supported by a low payout ratio of 31.6% and cash payout ratio of 49.9%. The dividend yield stands at 4.09%, placing it in the top quartile of Japan's market, while trading at 22.3% below estimated fair value suggests potential for appreciation. Recent inclusion in the S&P Global BMI Index may enhance visibility among investors seeking reliable income streams in Asia.

- Dive into the specifics of NCD here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of NCD shares in the market.

Seize The Opportunity

- Investigate our full lineup of 1042 Top Asian Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6138

Anpec Electronics

Engages in the design, testing, production, and marketing of mixed-signal power chips and sensors in Taiwan and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives