- Taiwan

- /

- Tech Hardware

- /

- TPEX:6143

Exploring Undiscovered Gems with Potential in December 2024

Reviewed by Simply Wall St

In December 2024, global markets are navigating a complex landscape marked by cautious Federal Reserve commentary and political uncertainty in the U.S., contributing to broad-based declines across major indices, with small-cap stocks feeling the brunt of investor apprehension. Amid these challenges, discerning investors often seek out undiscovered gems—stocks that may offer potential opportunities due to their unique positioning or resilience in turbulent times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Libra Insurance | 38.26% | 44.30% | 56.31% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Gallant Precision Machining (TPEX:5443)

Simply Wall St Value Rating: ★★★★★★

Overview: Gallant Precision Machining Co., Ltd. focuses on the R&D, production, and sale of flat panel display testing, semiconductor assembly, and intelligent automation equipment across Taiwan, China, and international markets with a market cap of NT$19.04 billion.

Operations: Gallant Precision Machining generates revenue primarily through its subsidiary Gallant Micro. Machining Co., Ltd., which contributes NT$2.41 billion, and the parent company itself, contributing NT$1.77 billion.

Gallant Precision Machining, a nimble player in the semiconductor space, has shown impressive earnings growth of 224.3% over the past year, outpacing industry averages. The company’s net debt to equity ratio stands at a satisfactory 10.7%, reflecting prudent financial management. Recent earnings for Q3 revealed sales of TWD 1 billion and net income of TWD 106 million, both significantly higher than last year's figures. Additionally, Gallant has announced a share repurchase program aimed at employee incentives, potentially enhancing shareholder value by acquiring up to 4.3 million shares for TWD 896.95 million within specified price ranges until early January next year.

Netronix (TPEX:6143)

Simply Wall St Value Rating: ★★★★★★

Overview: Netronix, Inc. is a company that designs and manufactures network and e-Reader products in Taiwan and internationally, with a market capitalization of approximately NT$9.64 billion.

Operations: The primary revenue streams for Netronix come from its Consumer Electronics Division, generating NT$5.01 billion, and the Computer Interface Equipment Division, contributing NT$1.39 billion.

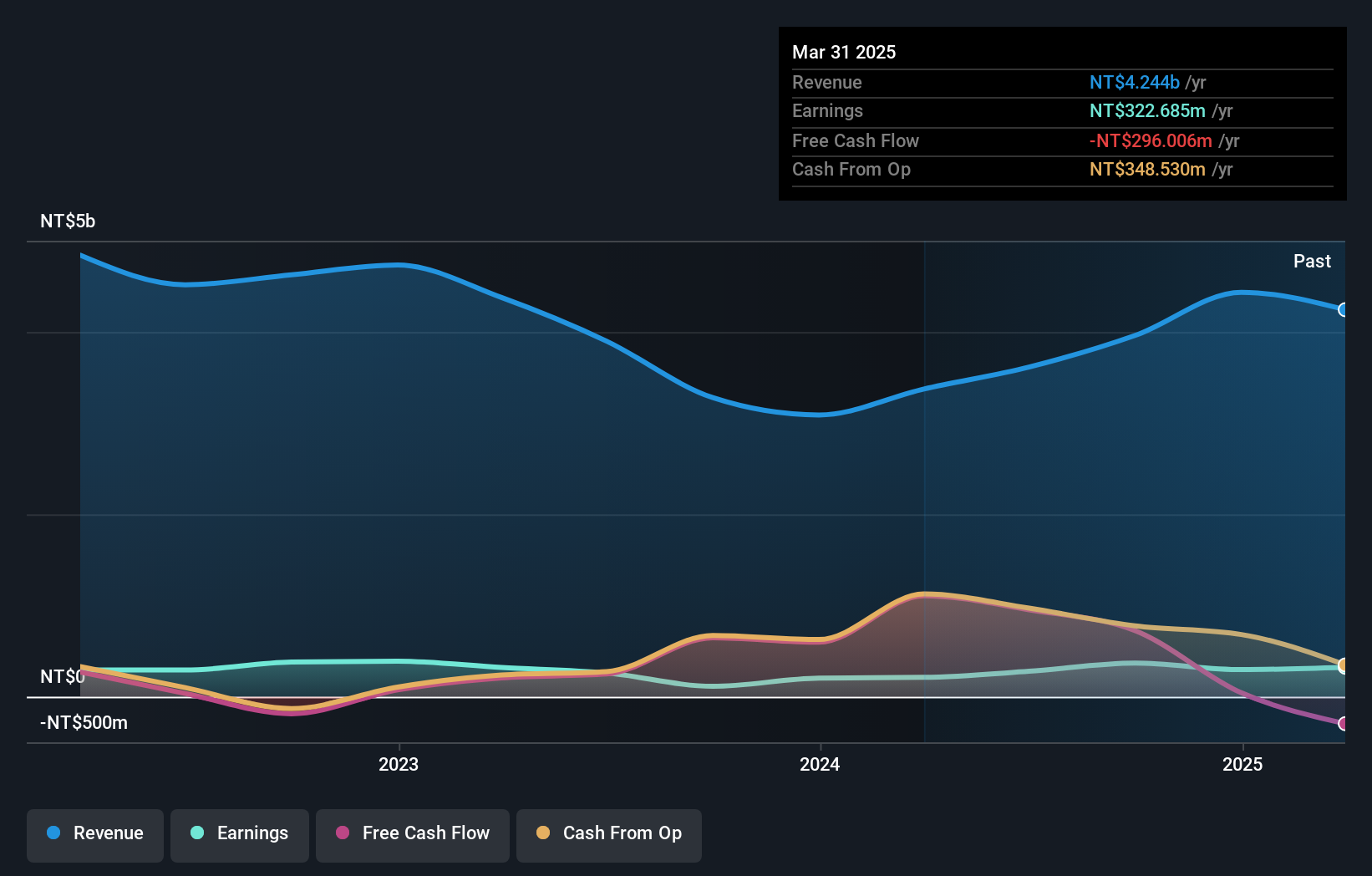

Netronix, a nimble player in the tech sector, has shown impressive earnings growth of 37.1% over the past year, outpacing the industry's 11.4%. This growth is supported by a robust financial position with more cash than total debt and high-quality earnings. Despite recent volatility in its share price, Netronix's debt to equity ratio has significantly improved from 136.7% to 8.5% over five years. Recent announcements reveal sales of TWD 1,820 million for Q3 and net income of TWD 115 million compared to last year's TWD 181 million, indicating some challenges but potential for value at current levels trading below fair value estimates.

- Delve into the full analysis health report here for a deeper understanding of Netronix.

Examine Netronix's past performance report to understand how it has performed in the past.

TXC (TWSE:3042)

Simply Wall St Value Rating: ★★★★★★

Overview: TXC Corporation is involved in the research, design, development, production, and sale of crystal and oscillator products both in Taiwan and internationally with a market capitalization of approximately NT$36.01 billion.

Operations: The primary revenue stream for TXC comes from its Quartz Components Department, generating NT$12.37 billion, while the Real Estate Development Department contributes a minor NT$13.33 million.

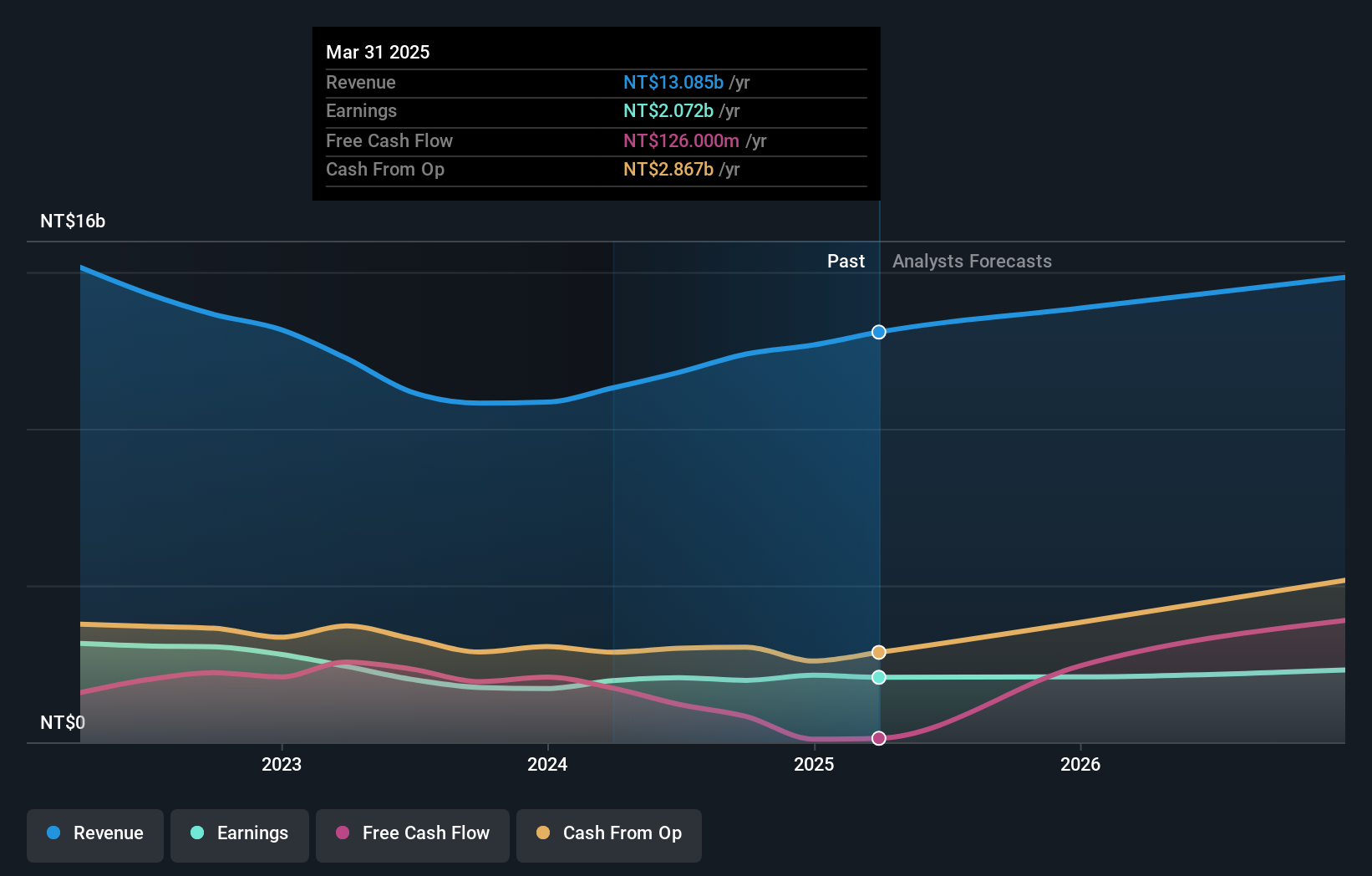

TXC, an intriguing player in the electronic industry, has shown robust earnings growth of 13% over the past year, outpacing the industry's 6.6%. Despite a dip in quarterly net income to TWD 513.92 million from TWD 598.26 million last year, sales climbed to TWD 3,668.27 million from TWD 3,085.92 million. The company trades at a value perceived as being below its fair estimate by about 15%, suggesting potential upside for investors seeking value opportunities. TXC's debt-to-equity ratio improved from 24.8% to a healthier 19% over five years, indicating prudent financial management and positioning it well for future growth prospects.

Key Takeaways

- Unlock our comprehensive list of 4611 Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netronix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6143

Netronix

Designs and manufactures network and e-Reader products in Taiwan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives