- China

- /

- Electrical

- /

- SHSE:600268

Undiscovered Gems in Asia to Watch This July 2025

Reviewed by Simply Wall St

As of July 2025, the Asian markets are navigating a complex landscape marked by U.S. tariff announcements and hopes for economic stimulus in China, with the CSI 300 Index and Shanghai Composite showing resilience amidst these challenges. In this environment, identifying promising stocks often involves looking for companies that can adapt to shifting trade dynamics and leverage regional growth opportunities—qualities that define the undiscovered gems we explore in this article.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ascentech K.K | NA | 133.18% | 172.84% | ★★★★★★ |

| Episil-Precision | 19.76% | 0.57% | 16.64% | ★★★★★★ |

| Torigoe | 9.03% | 4.76% | 8.35% | ★★★★★☆ |

| Hangzhou Zhengqiang | 26.03% | 2.95% | 16.75% | ★★★★★☆ |

| Uniplus Electronics | 32.17% | 46.30% | 75.33% | ★★★★★☆ |

| KinjiroLtd | 22.32% | 10.69% | 21.02% | ★★★★★☆ |

| Lucky Cement | 61.41% | 4.55% | 15.65% | ★★★★☆☆ |

| Toho Bank | 112.58% | 4.41% | 32.71% | ★★★★☆☆ |

| ASRock Rack Incorporation | 26.93% | 225.32% | 6287.64% | ★★★★☆☆ |

| Lan Fa Textile | 59.50% | -14.81% | 9.91% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Guodian Nanjing Automation (SHSE:600268)

Simply Wall St Value Rating: ★★★★★★

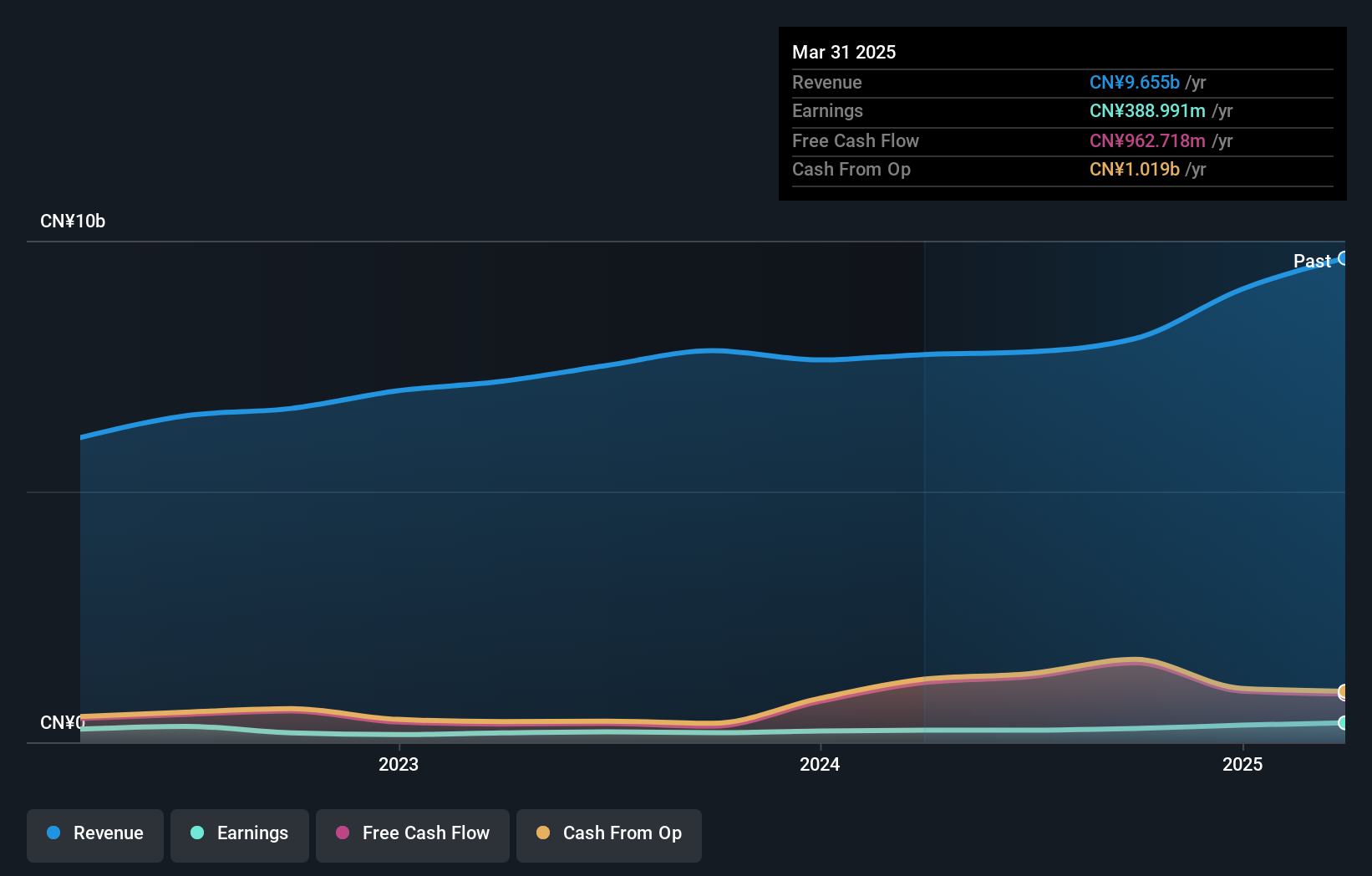

Overview: Guodian Nanjing Automation Co., Ltd. specializes in the manufacture and sale of industrial power automation equipment, serving both domestic and international markets, with a market cap of CN¥9.27 billion.

Operations: The primary revenue stream for Guodian Nanjing Automation comes from its power automation equipment segment, generating CN¥9.65 billion.

Guodian Nanjing Automation is making waves with its impressive financial performance. Over the past year, earnings surged by 61.7%, outpacing the electrical industry’s -1.4% downturn, and net income reached CNY 29.8 million from a prior loss of CNY 18.57 million. The company has improved its debt profile significantly, reducing the debt-to-equity ratio from 37.8% to just 6.4% over five years, and holds more cash than total debt, indicating strong financial health and interest coverage capability without concern for interest payments. Trading at a slight discount to fair value adds an attractive edge for potential investors seeking growth opportunities in Asia's dynamic market landscape.

- Click to explore a detailed breakdown of our findings in Guodian Nanjing Automation's health report.

Understand Guodian Nanjing Automation's track record by examining our Past report.

Advanced Echem Materials (TPEX:4749)

Simply Wall St Value Rating: ★★★★★★

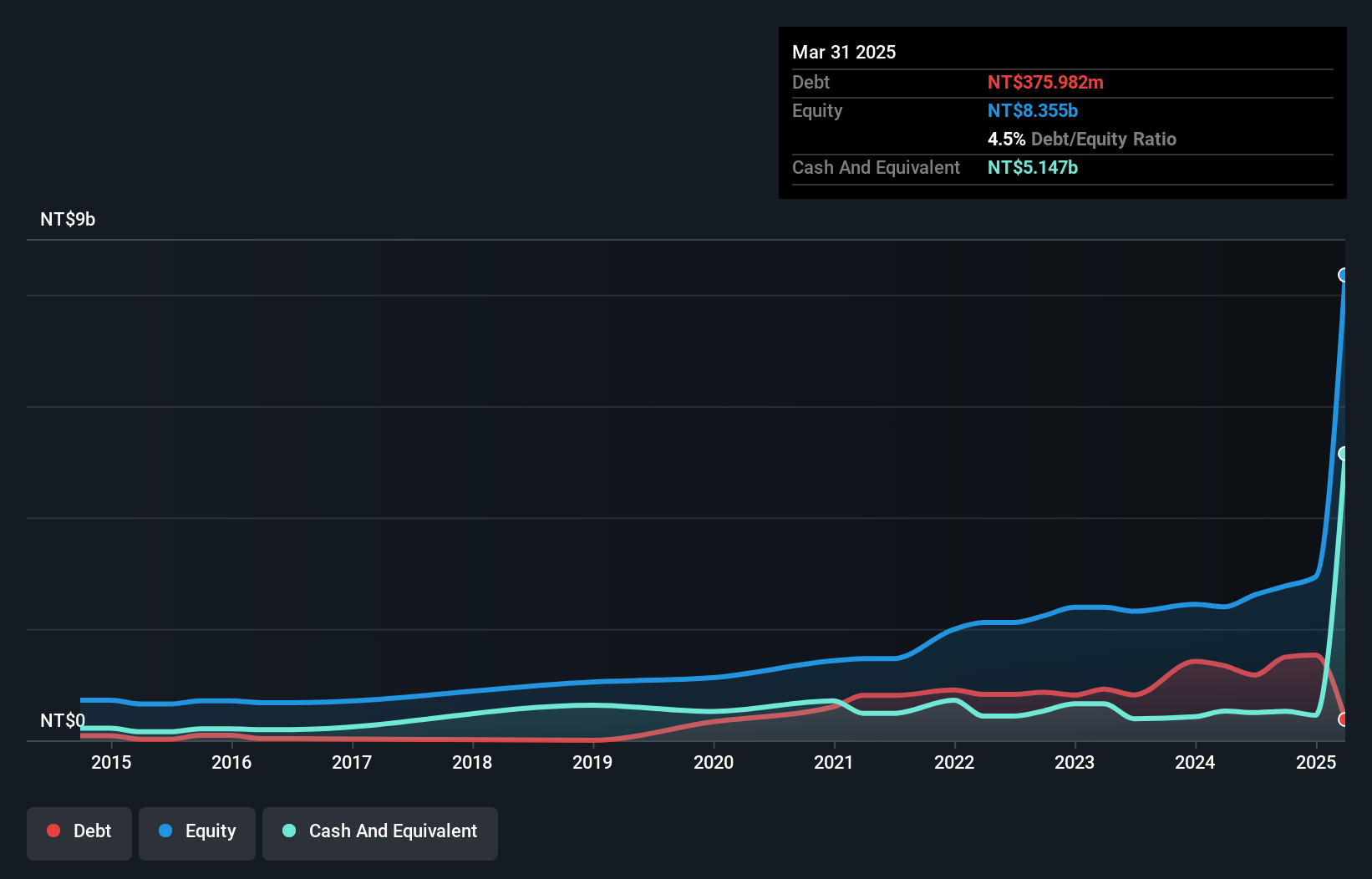

Overview: Advanced Echem Materials Company Limited specializes in developing and manufacturing specialty chemical materials for semiconductor and display applications in Taiwan, with a market cap of NT$56.85 billion.

Operations: The primary revenue stream for Advanced Echem Materials comes from electronic components and parts, generating NT$3.59 billion. The company's financial performance is highlighted by a focus on this segment, which plays a crucial role in its overall revenue model.

Advanced Echem Materials stands out with its impressive earnings growth of 88.2% over the past year, far surpassing the Semiconductor industry's 10.8% pace. The company's revenue for Q1 2025 was TWD 959 million, a significant jump from TWD 692 million in the previous year, showcasing robust performance. Despite a highly volatile share price recently, it maintains a strong financial position with more cash than total debt and has reduced its debt to equity ratio from 33.3% to just 4.5% over five years. The forecasted annual revenue growth of approximately 31% suggests promising prospects ahead for this dynamic player in Asia's market landscape.

- Navigate through the intricacies of Advanced Echem Materials with our comprehensive health report here.

Evaluate Advanced Echem Materials' historical performance by accessing our past performance report.

Create SD Holdings (TSE:3148)

Simply Wall St Value Rating: ★★★★★★

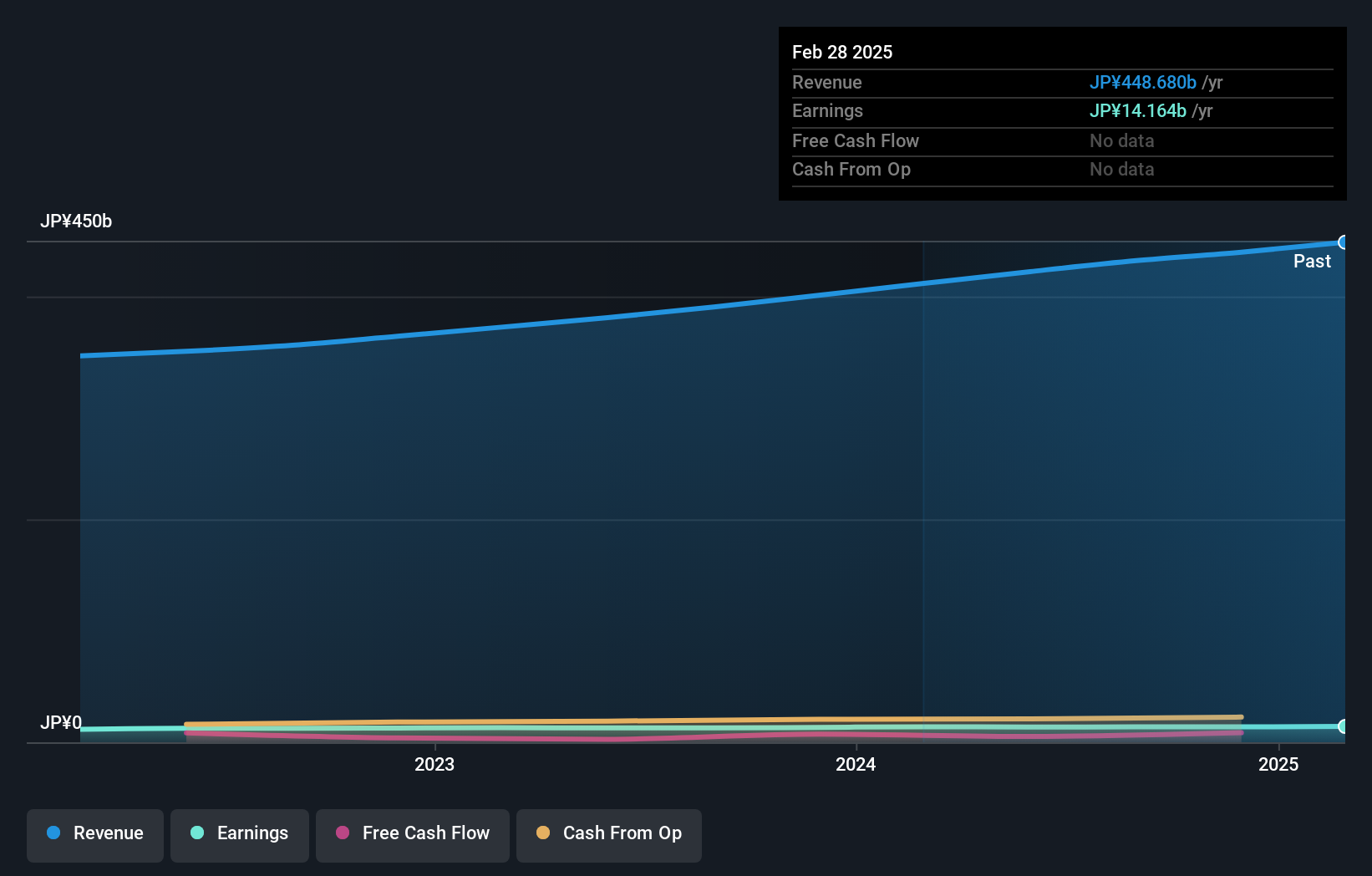

Overview: Create SD Holdings Co., Ltd. operates in Japan through its subsidiaries, focusing on drug stores, dispensing pharmacies, and nursing care services, with a market cap of ¥228.05 billion.

Operations: Create SD Holdings generates revenue through its subsidiaries in the drug store, dispensing pharmacy, and nursing care sectors in Japan. The company has a market capitalization of ¥228.05 billion.

Create SD Holdings stands out in the Asian market with its impressive financial health, having been debt-free for five years. The company has demonstrated robust earnings growth of 14.6% over the past year, surpassing the Consumer Retailing industry's average of 5.7%. Its high-quality earnings and positive free cash flow further bolster its position as a reliable entity in this sector. Recent discussions at a board meeting on surplus distribution indicate proactive financial management, which could enhance shareholder value. With no debt concerns and strong profitability metrics, Create SD Holdings presents an intriguing prospect for investors seeking stability and growth potential in Asia's dynamic market landscape.

- Get an in-depth perspective on Create SD Holdings' performance by reading our health report here.

Assess Create SD Holdings' past performance with our detailed historical performance reports.

Taking Advantage

- Take a closer look at our Asian Undiscovered Gems With Strong Fundamentals list of 2611 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600268

Guodian Nanjing Automation

Engages in the manufacture and sale of industrial power automation equipment in China and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives