As global markets experience broad-based gains with U.S. indexes approaching record highs, investors are keeping a close eye on economic indicators such as jobless claims and home sales that continue to drive positive sentiment. In this environment of cautious optimism, dividend stocks can offer stability and income potential, making them an attractive option for those looking to navigate the current market landscape effectively.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.01% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.69% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.30% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.88% | ★★★★★★ |

Click here to see the full list of 1948 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Wholetech System Hitech (TPEX:3402)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wholetech System Hitech Limited offers turnkey and system integration services in Taiwan, China, and Singapore with a market cap of NT$7.45 billion.

Operations: Wholetech System Hitech Limited's revenue is generated from providing comprehensive turnkey solutions and system integration services across Taiwan, China, and Singapore.

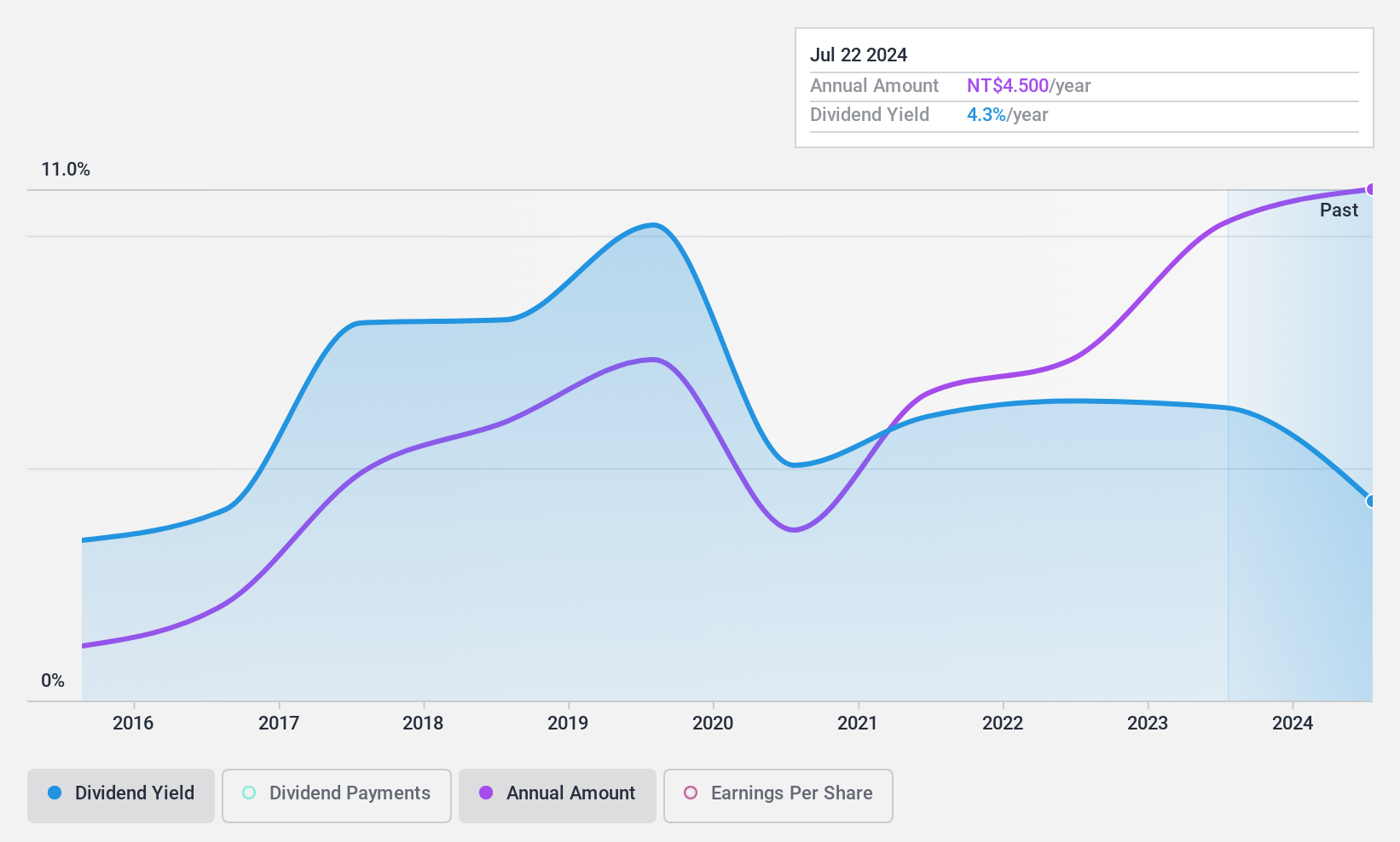

Dividend Yield: 4.3%

Wholetech System Hitech has shown earnings growth with a 26.1% increase over the past year, supporting its dividend payments. Despite a volatile dividend history, the payout ratio of 69.1% and cash payout ratio of 35% suggest dividends are currently sustainable. However, its dividend yield of 4.33% is below the top tier in Taiwan's market, and dividends have not been consistently reliable over the past decade despite recent financial improvements.

- Unlock comprehensive insights into our analysis of Wholetech System Hitech stock in this dividend report.

- Our valuation report here indicates Wholetech System Hitech may be undervalued.

Syscom Computer Engineering (TWSE:2453)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Syscom Computer Engineering Co., along with its subsidiaries, offers information technology services across Taiwan, China, the United States, and Southeast Asia, with a market cap of NT$5.26 billion.

Operations: Syscom Computer Engineering Co. operates through various revenue segments, providing IT services across multiple regions including Taiwan, China, the United States, and Southeast Asia.

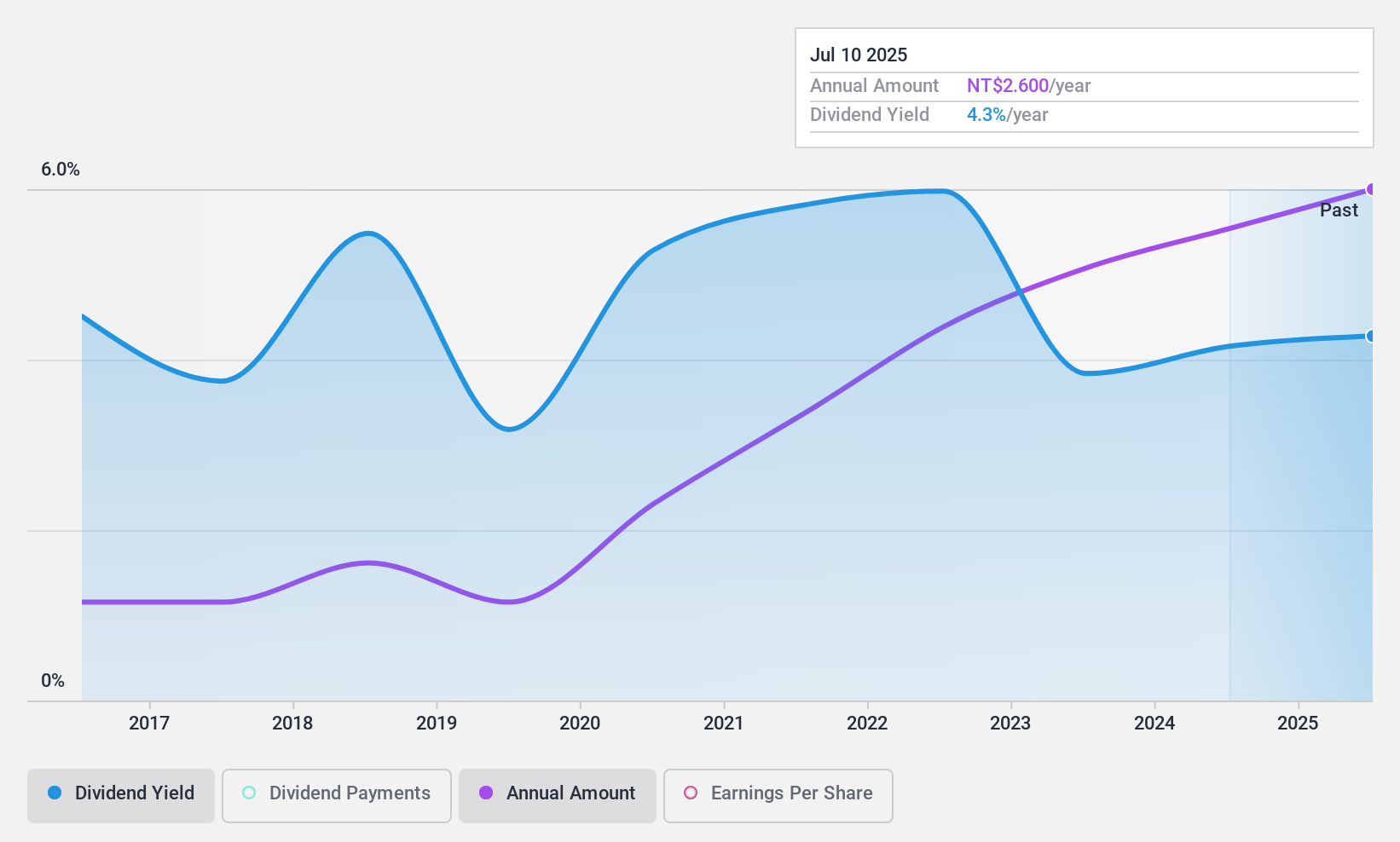

Dividend Yield: 4.5%

Syscom Computer Engineering's recent earnings report shows revenue growth, but net income slightly declined for the third quarter. The stock's price-to-earnings ratio is favorable compared to the Taiwan market, yet its dividend history is marked by volatility and unreliability over the past decade. With a high payout ratio of 80.7%, dividends are covered by earnings but not free cash flow, leading to sustainability concerns despite being among Taiwan's top 25% for dividend yield at 4.48%.

- Navigate through the intricacies of Syscom Computer Engineering with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Syscom Computer Engineering is trading beyond its estimated value.

Trade-Van Information Services (TWSE:6183)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Trade-Van Information Services Co. specializes in custom clearance automation and value-added services in Taiwan, with a market cap of NT$12.30 billion.

Operations: Trade-Van Information Services Co. generates revenue of NT$2.49 billion from Electronic Data Exchange Services and its Peripheral Services in Taiwan.

Dividend Yield: 3.3%

Trade-Van Information Services maintains a reliable dividend history with stable and growing payments over the past decade. Despite a lower yield of 3.33% compared to Taiwan's top dividend payers, its dividends are covered by earnings and cash flows, maintaining payout ratios of 84.3% and 88.3%, respectively. Recent earnings reports show increased sales (TWD 640.98 million) and net income (TWD 150.5 million), supporting its capacity to sustain dividends amidst growth in earnings per share from TWD 0.86 to TWD 1 year-over-year for Q3.

- Click here to discover the nuances of Trade-Van Information Services with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Trade-Van Information Services shares in the market.

Key Takeaways

- Investigate our full lineup of 1948 Top Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade-Van Information Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6183

Trade-Van Information Services

Provides electronic data exchange services and related services in Taiwan.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives