- Taiwan

- /

- Semiconductors

- /

- TPEX:3264

Exploring DigiPlus Interactive And 2 Other Undiscovered Gems In Global Markets

Reviewed by Simply Wall St

In the current landscape, global markets are experiencing a mixed performance with large-cap tech stocks driving gains, while smaller-cap indexes like the S&P MidCap 400 and Russell 2000 have faced declines. Amidst these shifts, investors are navigating interest rate changes and geopolitical developments that impact market sentiment. In such an environment, identifying promising stocks requires a keen eye for companies that demonstrate resilience and potential growth despite broader market challenges. As we explore DigiPlus Interactive along with two other intriguing prospects in global markets, understanding their unique strengths can provide valuable insights into uncovering hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shandong Link Science and TechnologyLtd | 7.07% | 15.69% | 19.39% | ★★★★★★ |

| Techno Ryowa | 1.51% | 9.64% | 32.40% | ★★★★★★ |

| CYMECHS | 8.28% | -3.30% | -18.05% | ★★★★★★ |

| Wuxi Xinan Technology | NA | 10.54% | 5.31% | ★★★★★★ |

| Neosem | 1.52% | 22.22% | 22.14% | ★★★★★★ |

| Te Chang Construction | 15.29% | 14.72% | 17.71% | ★★★★★☆ |

| Guangzhou Ruili Kormee Automotive Electronic | 13.53% | 14.73% | 7.72% | ★★★★★☆ |

| AblePrint Technology | 7.90% | 35.99% | 14.47% | ★★★★★☆ |

| Suqian UnitechLtd | 52.17% | -3.83% | -48.54% | ★★★★☆☆ |

| Mobiltel Iletisim Hizmetleri Sanayi ve Ticaret | 21.21% | 19.59% | -34.35% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

DigiPlus Interactive (PSE:PLUS)

Simply Wall St Value Rating: ★★★★★★

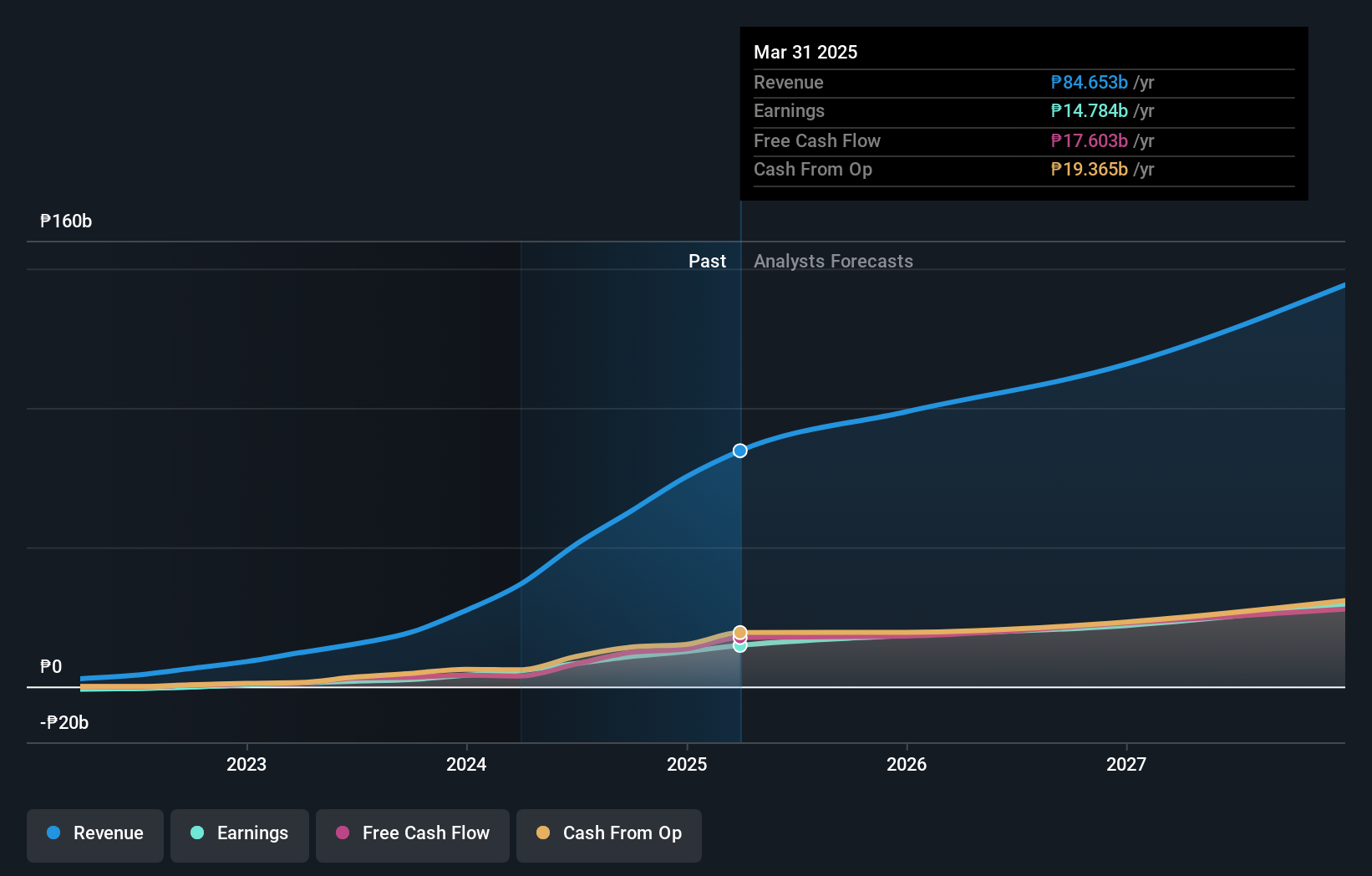

Overview: DigiPlus Interactive Corp. operates as a digital entertainment company in the Philippines through its subsidiaries and has a market capitalization of approximately ₱94.45 billion.

Operations: DigiPlus Interactive generates revenue primarily from its Retail Group, contributing ₱89.49 billion, followed by the Casino Group at ₱526.65 million and the Network and License Group at ₱378.06 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

DigiPlus Interactive is making waves with its impressive financial performance and strategic moves. Over the past year, earnings surged by 91.6%, outpacing the Hospitality industry's 0.9% growth. The company reported a net income of PHP 4,199 million for Q2 2025, up from PHP 3,226 million last year, showcasing robust growth. Additionally, DigiPlus' recent inclusion in the Philippines PSE Composite Index and its partnership with Philippine First Insurance Co. highlight its expanding influence and commitment to player protection in online gaming markets like South Africa's promising sector. Despite share price volatility, it trades at good value compared to peers and industry norms while maintaining strong cash flow positivity and reducing debt significantly over five years from a ratio of 37% to just 2%.

- Get an in-depth perspective on DigiPlus Interactive's performance by reading our health report here.

China Security (SHSE:600654)

Simply Wall St Value Rating: ★★★★★☆

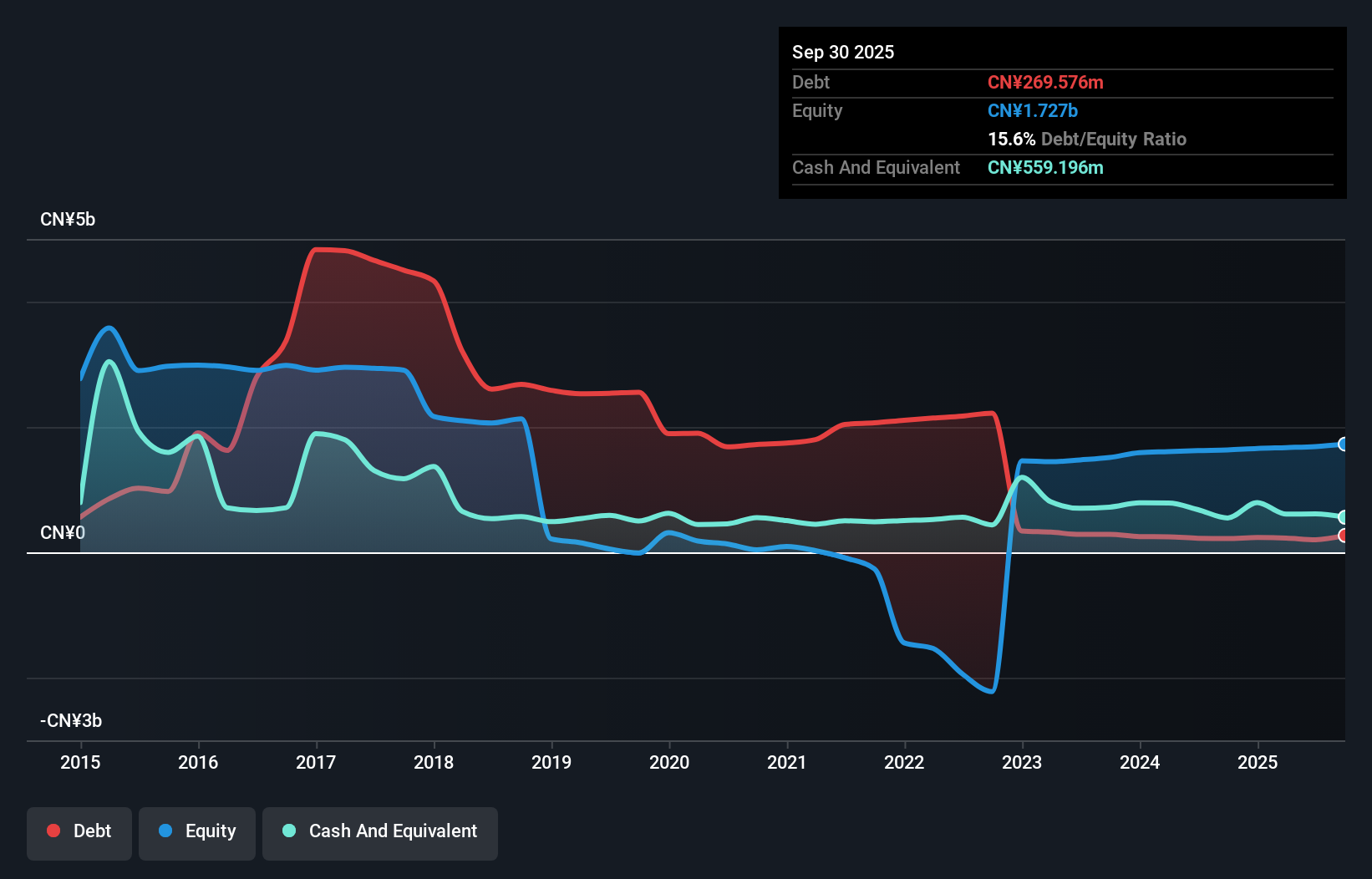

Overview: China Security Co., Ltd. offers security services both domestically and internationally, with a market capitalization of CN¥10.24 billion.

Operations: China Security Co., Ltd. generates revenue primarily through its security services offered in domestic and international markets. The company's financial performance is highlighted by a market capitalization of CN¥10.24 billion.

China Security, with its small market footprint, has demonstrated strong financial health recently. The company's earnings surged by 195% over the past year, significantly outpacing the electronic industry's average growth of 8.7%. Its debt-to-equity ratio impressively dropped from a staggering 4255% to just 15.6% over five years, reflecting prudent financial management. Recent earnings for the nine months ending September 2025 show sales at CNY 2.37 billion compared to CNY 2.04 billion last year, while net income skyrocketed to CNY 197.56 million from CNY 10.69 million previously, indicating robust operational performance and potential value for investors seeking growth opportunities in emerging markets like China Security's niche sector.

- Click to explore a detailed breakdown of our findings in China Security's health report.

Explore historical data to track China Security's performance over time in our Past section.

Ardentec (TPEX:3264)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ardentec Corporation offers semiconductor testing solutions for memory, logic, and mixed-signal integrated circuits to a global clientele including integrated device manufacturers, wafer foundries, and fabless design companies, with a market cap of NT$44.31 billion.

Operations: Ardentec generates revenue primarily through semiconductor testing services for memory, logic, and mixed-signal integrated circuits. The company operates in various international markets including the United States, Taiwan, Singapore, Korea, China, and Europe. With a market cap of NT$44.31 billion, it plays a significant role in the semiconductor industry by serving integrated device manufacturers and fabless design companies.

Ardentec, a player in the semiconductor space, has shown promising performance with its earnings growing 7.7% over the past year, outpacing the industry average of -5.2%. The company’s debt to equity ratio has improved from 56.3% to 43.7% in five years, reflecting effective financial management. With interest payments well covered by EBIT at 17x and a satisfactory net debt to equity ratio of 17.7%, Ardentec appears financially sound. Recent earnings reports highlight a net income rise from TWD 562 million to TWD 827 million for Q3, indicating robust profit growth and solidifying its potential as an investment opportunity.

Taking Advantage

- Get an in-depth perspective on all 2964 Global Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3264

Ardentec

Engages in the provision of semiconductor testing solutions in memory, logic, and mixed-signal ICs to integrated device manufacturers, pure play wafer foundry companies, and fabless design companies in the United States, Taiwan, Singapore, Korea, China, Europe, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion