- Taiwan

- /

- Semiconductors

- /

- TPEX:3260

Exploring Undiscovered Gems on None This December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious Federal Reserve commentary and political uncertainties, smaller-cap indexes have experienced notable declines, reflecting broader investor apprehension. Despite these challenges, the U.S. economy has shown resilience with strong growth indicators such as increased consumer spending and robust job data, suggesting potential opportunities for discerning investors. In this environment, identifying undiscovered gems requires a keen eye for companies that can thrive amid economic fluctuations and interest rate shifts. These stocks often possess unique qualities or innovative approaches that enable them to stand out in turbulent times, making them intriguing prospects for those looking to explore beyond the beaten path.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Advanced Ceramic X (TPEX:3152)

Simply Wall St Value Rating: ★★★★★★

Overview: Advanced Ceramic X Corporation designs, manufactures, and sells RF front-end devices and modules for wireless communication applications globally, with a market cap of NT$12.73 billion.

Operations: The primary revenue stream for Advanced Ceramic X comes from the high-frequency integration of components and modules, generating NT$1.65 billion. The company's market cap stands at NT$12.73 billion.

Advanced Ceramic X has shown promising performance with a recent earnings growth of 68.3%, outpacing the Communications industry, which saw a 9.2% decline. Despite being debt-free for five years, the company reported TWD 428.64 million in sales for Q3 2024, up from TWD 396.04 million in the previous year, and net income increased to TWD 98.81 million from TWD 90.87 million. The company's high-quality earnings are reflected in its basic earnings per share rising to TWD 1.43 from TWD 1.32 year-on-year, indicating robust profitability and a strong market position within its niche sector.

ADATA Technology (TPEX:3260)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ADATA Technology Co., Ltd. is a global manufacturer and seller of memory products with a market cap of NT$23.31 billion.

Operations: The company's primary revenue stream is its Electronics Division, generating NT$41.31 billion, while the Biotech Department contributes NT$37.68 million.

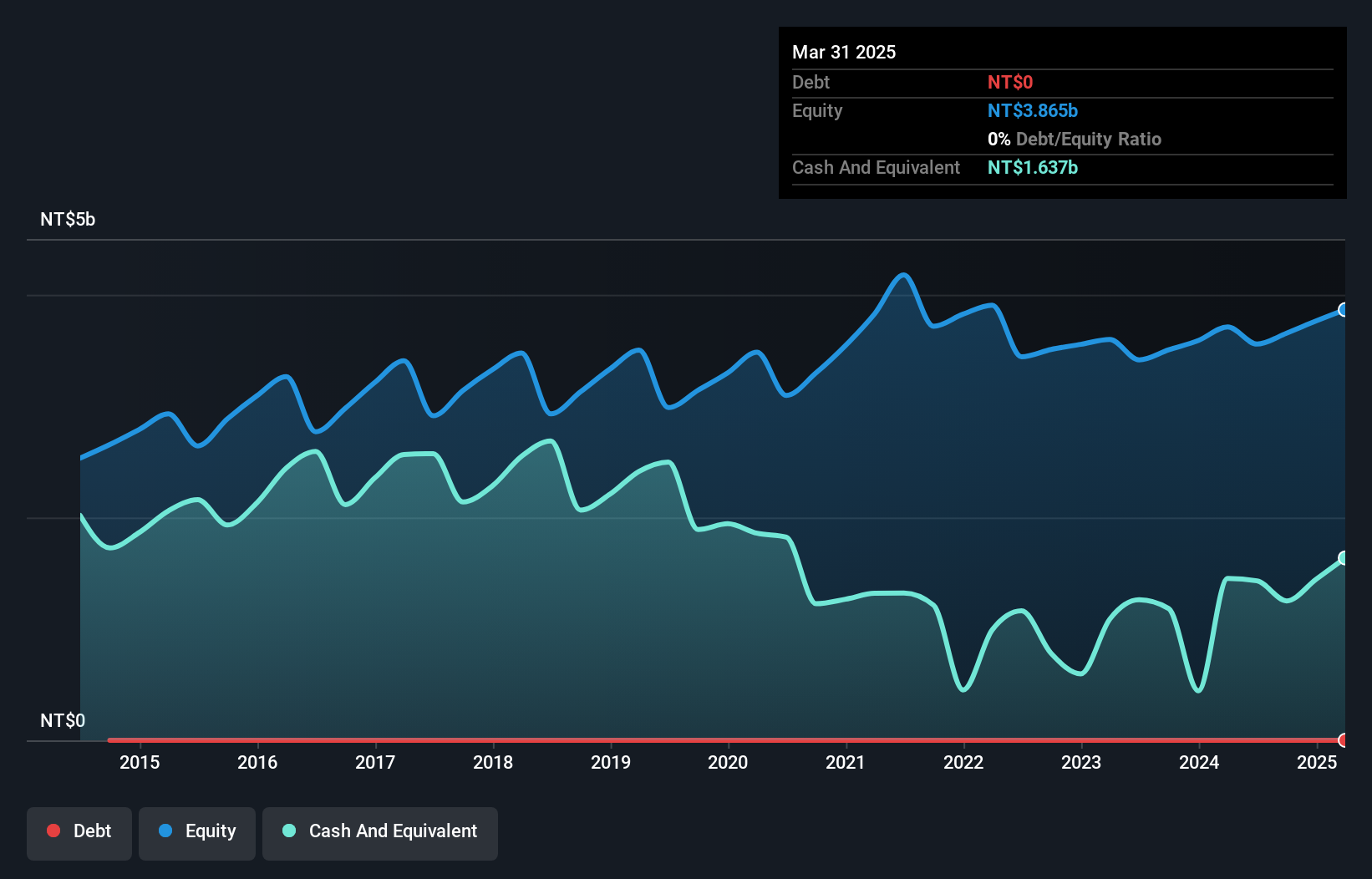

ADATA Technology, a player in the semiconductor industry, has shown impressive earnings growth of 251.4% over the past year, outpacing the industry's 5.9%. The company’s net debt to equity ratio stands at a high 129.3%, though it has decreased from 186.2% five years ago to 151.7%. ADATA's price-to-earnings ratio is an attractive 7.5x compared to the TW market's average of 20.7x, suggesting potential undervaluation. Recent quarterly results highlight sales of TWD 9,399 million and net income of TWD 590 million, indicating robust financial performance and positive momentum in earnings per share improvements year-over-year.

- Take a closer look at ADATA Technology's potential here in our health report.

Explore historical data to track ADATA Technology's performance over time in our Past section.

Nihon Dengi (TSE:1723)

Simply Wall St Value Rating: ★★★★★★

Overview: Nihon Dengi Co., Ltd. operates in Japan's automatic control system industry and has a market capitalization of ¥54.70 billion.

Operations: Nihon Dengi generates revenue primarily from its automatic control system business in Japan, contributing to a market capitalization of ¥54.70 billion.

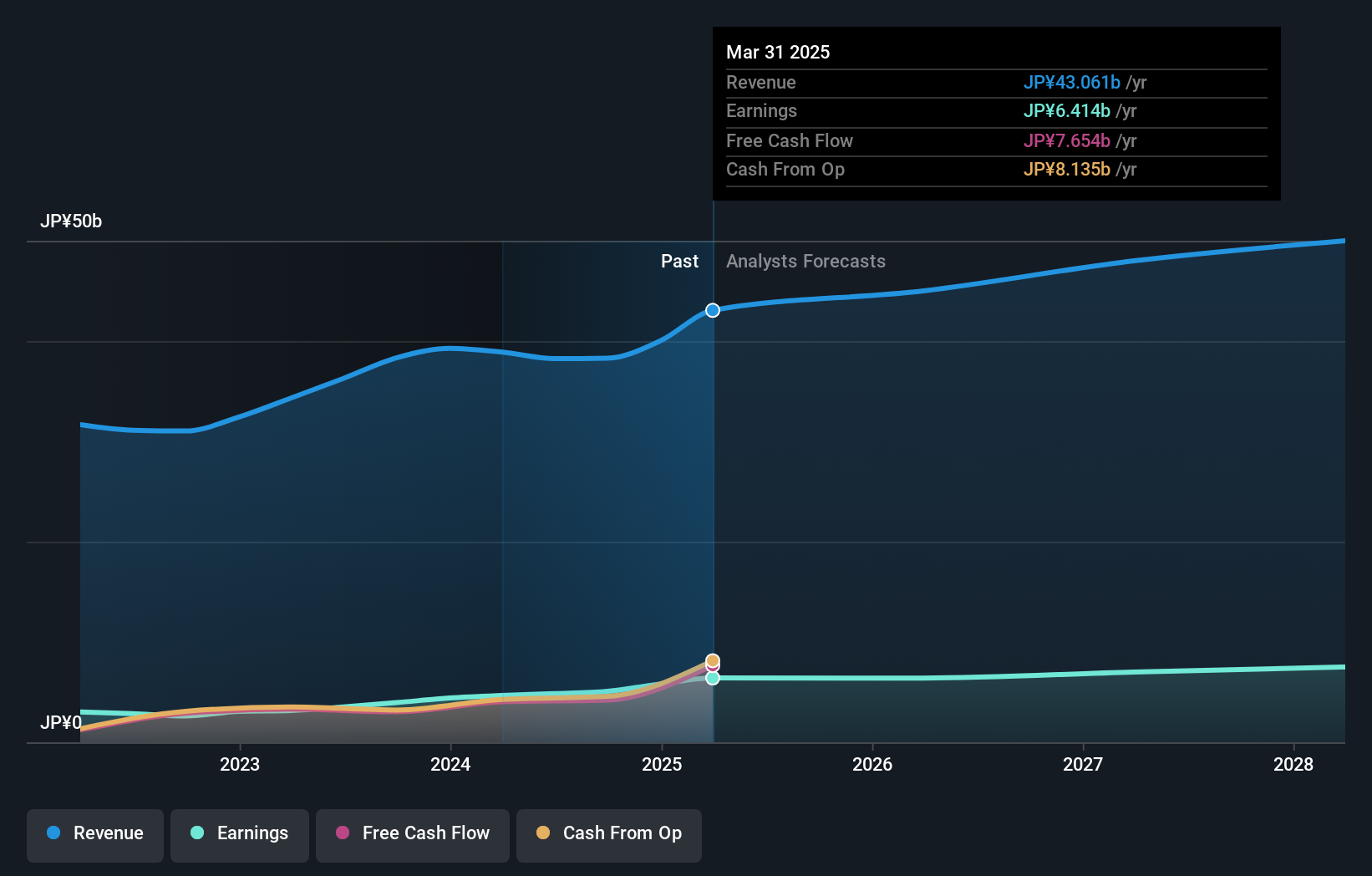

Nihon Dengi, a modestly-sized player in its field, has shown notable financial resilience. The company is debt-free and has maintained this status for five years, highlighting strong fiscal discipline. Its earnings grew by 28.7% over the past year, outpacing the building industry's growth of 7.6%, which suggests robust operational performance. Trading at 54% below its estimated fair value indicates potential undervaluation in the market's eyes. Recent guidance projects net sales of ¥42.5 billion and an operating profit of ¥7.5 billion for the fiscal year ending March 2025, with dividends increased to ¥82 per share from ¥76 previously, reflecting confidence in future prospects.

- Click to explore a detailed breakdown of our findings in Nihon Dengi's health report.

Examine Nihon Dengi's past performance report to understand how it has performed in the past.

Make It Happen

- Unlock our comprehensive list of 4624 Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3260

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives