- Taiwan

- /

- Semiconductors

- /

- TPEX:8086

Shareholders Are Thrilled That The Advanced Wireless Semiconductor (GTSM:8086) Share Price Increased 147%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But in contrast you can make much more than 100% if the company does well. For instance the Advanced Wireless Semiconductor Company (GTSM:8086) share price is 147% higher than it was three years ago. How nice for those who held the stock! Also pleasing for shareholders was the 35% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 19% in 90 days).

View our latest analysis for Advanced Wireless Semiconductor

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

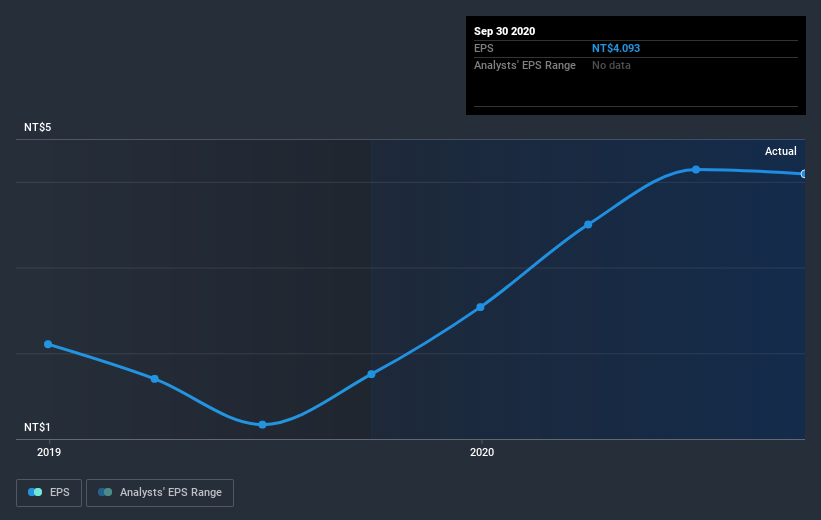

During three years of share price growth, Advanced Wireless Semiconductor achieved compound earnings per share growth of 33% per year. We don't think it is entirely coincidental that the EPS growth is reasonably close to the 35% average annual increase in the share price. This observation indicates that the market's attitude to the business hasn't changed all that much. Au contraire, the share price change has arguably mimicked the EPS growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Advanced Wireless Semiconductor has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Advanced Wireless Semiconductor's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Advanced Wireless Semiconductor the TSR over the last 3 years was 163%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Advanced Wireless Semiconductor shareholders have received a total shareholder return of 78% over the last year. And that does include the dividend. That's better than the annualised return of 20% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Advanced Wireless Semiconductor better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Advanced Wireless Semiconductor (of which 2 are concerning!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade Advanced Wireless Semiconductor, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:8086

Advanced Wireless Semiconductor

Engages in research, development, production, testing, and sales of gallium arsenide (GaAs) wafers in Taiwan.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026