- Taiwan

- /

- Semiconductors

- /

- TPEX:8027

If You Had Bought E&R Engineering (GTSM:8027) Shares Five Years Ago You'd Have Earned 322% Returns

It might be of some concern to shareholders to see the E&R Engineering Corporation (GTSM:8027) share price down 12% in the last month. But over five years returns have been remarkably great. In that time, the share price has soared some 322% higher! So it might be that some shareholders are taking profits after good performance. Only time will tell if there is still too much optimism currently reflected in the share price.

View our latest analysis for E&R Engineering

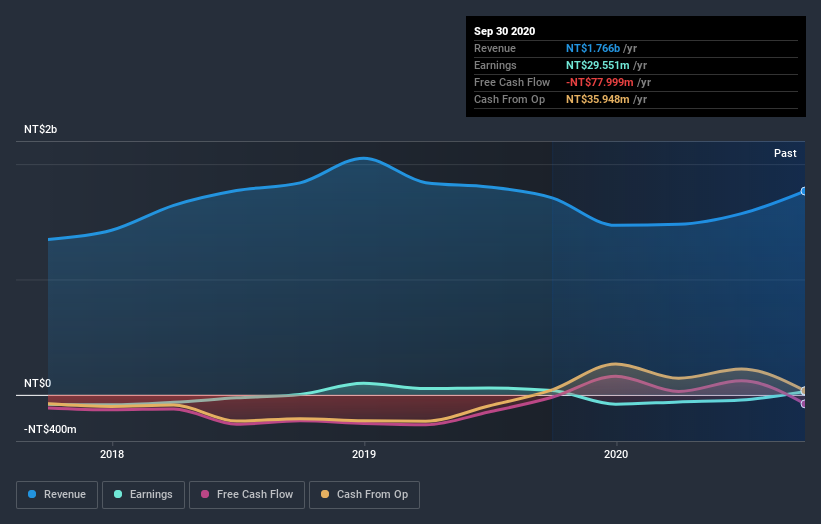

Given that E&R Engineering only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

For the last half decade, E&R Engineering can boast revenue growth at a rate of 3.5% per year. Put simply, that growth rate fails to impress. So shareholders should be pretty elated with the 33% increase per year, in that time. We don't think the growth over the period is that great, but it could be that faster growth appears to some to be on the horizon. Having said that, a closer look at the numbers might surface good reasons to believe that profits will gush in the future.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between E&R Engineering's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that E&R Engineering's TSR of 338% over the last 5 years is better than the share price return.

A Different Perspective

It's good to see that E&R Engineering has rewarded shareholders with a total shareholder return of 178% in the last twelve months. That gain is better than the annual TSR over five years, which is 34%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with E&R Engineering , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade E&R Engineering, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if E&R Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:8027

E&R Engineering

Provides automation machines for semiconductor, light emitting diode (LED), passive component, material, and medical industries in Taiwan, Hong Kong, Mainland China, Southeast Asia, the United States, Europe, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives