- Taiwan

- /

- Semiconductors

- /

- TPEX:6129

Introducing Princeton Technology (GTSM:6129), The Stock That Soared 300% In The Last Year

Active investing isn't easy, but for those that do it, the aim is to find the best companies to buy, and to profit handsomely. When an investor finds a multi-bagger (a stock that goes up over 200%), it makes a big difference to their portfolio. In the case of Princeton Technology Corporation (GTSM:6129), the share price is up an incredible 300% in the last year alone. Also pleasing for shareholders was the 127% gain in the last three months. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report. And shareholders have also done well over the long term, with an increase of 174% in the last three years.

Check out our latest analysis for Princeton Technology

Princeton Technology wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Princeton Technology saw its revenue shrink by 0.5%. So it's very confusing to see that the share price gained a whopping 300%. It's pretty clear the market isn't basing its valuation on fundamental metrics like revenue. While this gain looks like speculative buying to us, sometimes speculation pays off.

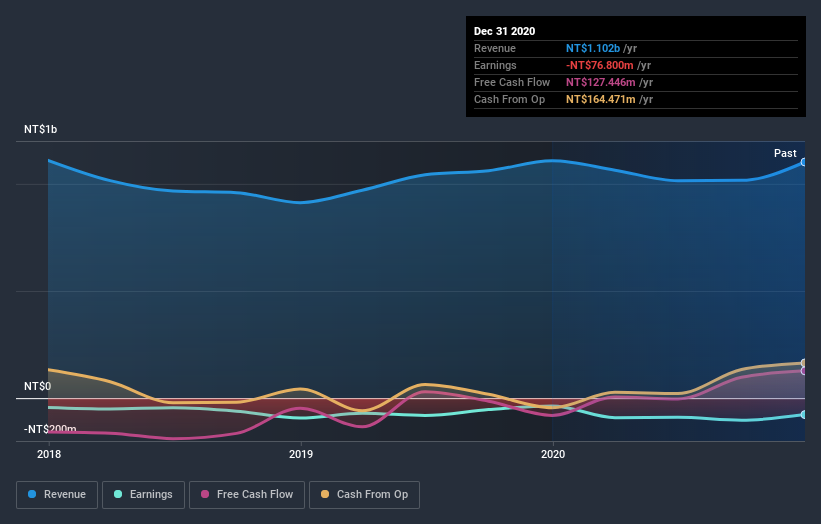

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Princeton Technology stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Princeton Technology shareholders have received a total shareholder return of 300% over the last year. That's better than the annualised return of 27% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Princeton Technology better, we need to consider many other factors. Even so, be aware that Princeton Technology is showing 2 warning signs in our investment analysis , and 1 of those is significant...

We will like Princeton Technology better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading Princeton Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6129

Princeton Technology

Engages in the design, development, testing, and sale of consumer integrated circuits (ICs) in Taiwan, Japan, Mainland China, Korea, and internationally.

Flawless balance sheet with low risk.

Market Insights

Community Narratives