- Taiwan

- /

- Semiconductors

- /

- TPEX:6104

Genesys Logic, Inc.'s (GTSM:6104) Fundamentals Look Pretty Strong: Could The Market Be Wrong About The Stock?

It is hard to get excited after looking at Genesys Logic's (GTSM:6104) recent performance, when its stock has declined 14% over the past month. However, stock prices are usually driven by a company’s financials over the long term, which in this case look pretty respectable. In this article, we decided to focus on Genesys Logic's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Genesys Logic

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Genesys Logic is:

22% = NT$333m ÷ NT$1.5b (Based on the trailing twelve months to September 2020).

The 'return' is the income the business earned over the last year. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.22 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Genesys Logic's Earnings Growth And 22% ROE

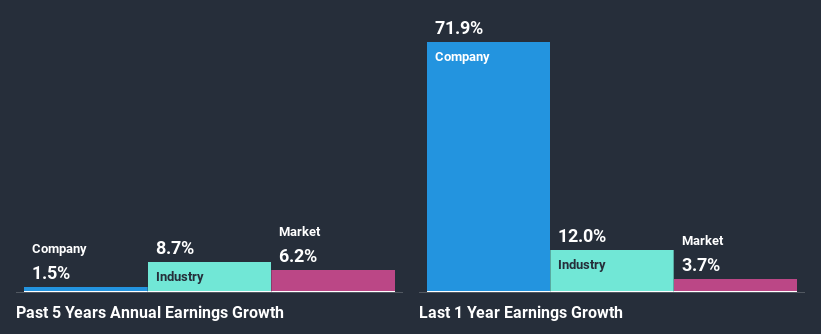

First thing first, we like that Genesys Logic has an impressive ROE. Secondly, even when compared to the industry average of 11% the company's ROE is quite impressive. However, we are curious as to how the high returns still resulted in a flat growth for Genesys Logic in the past five years. We reckon that there could be some other factors at play here that's limiting the company's growth. For example, it could be that the company has a high payout ratio or the business has allocated capital poorly, for instance.

We then compared Genesys Logic's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 8.7% in the same period, which is a bit concerning.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Genesys Logic is trading on a high P/E or a low P/E, relative to its industry.

Is Genesys Logic Making Efficient Use Of Its Profits?

The high three-year median payout ratio of 85% (meaning, the company retains only 15% of profits) for Genesys Logic suggests that the company's earnings growth was miniscule as a result of paying out a majority of its earnings.

Moreover, Genesys Logic has been paying dividends for six years, which is a considerable amount of time, suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Summary

On the whole, we do feel that Genesys Logic has some positive attributes. Although, we are disappointed to see a lack of growth in earnings even in spite of a high ROE. Bear in mind, the company reinvests a small portion of its profits, which means that investors aren't reaping the benefits of the high rate of return. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. You can do your own research on Genesys Logic and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

When trading Genesys Logic or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6104

Genesys Logic

Engages in the designing, manufacturing, testing, and sale of integrated circuits, semiconductors, digital communication products, computer equipment and relevant products, and computer program designing solutions in Taiwan, China, the United States, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion