David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Syntek Semiconductor Co., Ltd. (GTSM:5302) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Syntek Semiconductor

How Much Debt Does Syntek Semiconductor Carry?

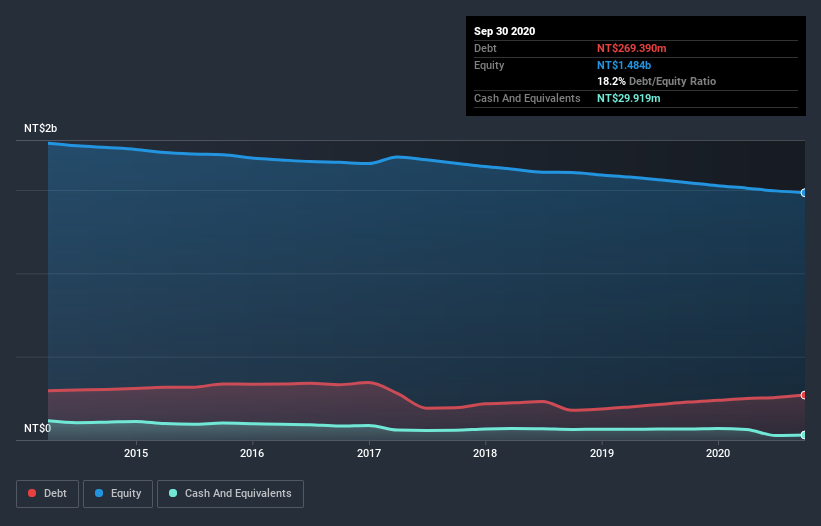

The image below, which you can click on for greater detail, shows that at September 2020 Syntek Semiconductor had debt of NT$269.4m, up from NT$227.3m in one year. However, it does have NT$29.9m in cash offsetting this, leading to net debt of about NT$239.5m.

How Strong Is Syntek Semiconductor's Balance Sheet?

We can see from the most recent balance sheet that Syntek Semiconductor had liabilities of NT$222.8m falling due within a year, and liabilities of NT$119.9m due beyond that. Offsetting these obligations, it had cash of NT$29.9m as well as receivables valued at NT$2.54m due within 12 months. So it has liabilities totalling NT$310.2m more than its cash and near-term receivables, combined.

Syntek Semiconductor has a market capitalization of NT$1.16b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Syntek Semiconductor will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Syntek Semiconductor made a loss at the EBIT level, and saw its revenue drop to NT$37m, which is a fall of 36%. That makes us nervous, to say the least.

Caveat Emptor

Not only did Syntek Semiconductor's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost NT$83m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled NT$42m in negative free cash flow over the last twelve months. So to be blunt we think it is risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 4 warning signs for Syntek Semiconductor you should be aware of, and 2 of them don't sit too well with us.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Syntek Semiconductor or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:5302

Syntek Semiconductor

Designs, manufactures, and sells integrate circuit in Taiwan.

Low and slightly overvalued.

Market Insights

Community Narratives