David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that AMICCOM Electronics Corporation (GTSM:5272) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for AMICCOM Electronics

How Much Debt Does AMICCOM Electronics Carry?

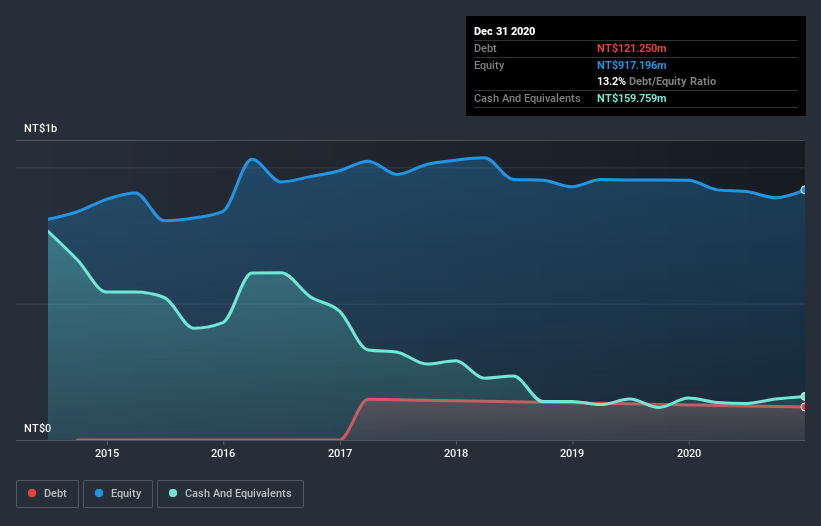

You can click the graphic below for the historical numbers, but it shows that AMICCOM Electronics had NT$121.3m of debt in December 2020, down from NT$128.8m, one year before. But it also has NT$159.8m in cash to offset that, meaning it has NT$38.5m net cash.

A Look At AMICCOM Electronics' Liabilities

We can see from the most recent balance sheet that AMICCOM Electronics had liabilities of NT$68.6m falling due within a year, and liabilities of NT$131.8m due beyond that. On the other hand, it had cash of NT$159.8m and NT$57.5m worth of receivables due within a year. So it can boast NT$16.9m more liquid assets than total liabilities.

This state of affairs indicates that AMICCOM Electronics' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the NT$2.29b company is short on cash, but still worth keeping an eye on the balance sheet. Simply put, the fact that AMICCOM Electronics has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is AMICCOM Electronics's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year AMICCOM Electronics had a loss before interest and tax, and actually shrunk its revenue by 15%, to NT$445m. That's not what we would hope to see.

So How Risky Is AMICCOM Electronics?

Although AMICCOM Electronics had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of NT$25m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. We'll feel more comfortable with the stock once EBIT is positive, given the lacklustre revenue growth. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with AMICCOM Electronics (including 1 which shouldn't be ignored) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade AMICCOM Electronics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:5272

AMICCOM Electronics

A semiconductor company, researches, designs, develops, manufactures, and sells radio frequency integrated circuits and modules in China, Taiwan, and internationally.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Q3 Outlook modestly optimistic

A fully integrated LNG business seems to be ignored by the market.

Hims & Hers Health aims for three dimensional revenue expansion

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale