- Taiwan

- /

- Semiconductors

- /

- TPEX:4944

Would Shareholders Who Purchased Crystalwise Technology's (GTSM:4944) Stock Three Years Be Happy With The Share price Today?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term Crystalwise Technology Inc. (GTSM:4944) shareholders, since the share price is down 49% in the last three years, falling well short of the market return of around 40%. But it's up 6.8% in the last week. But this could be related to the strong market, with stocks up around 3.3% in the same time.

View our latest analysis for Crystalwise Technology

Crystalwise Technology isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

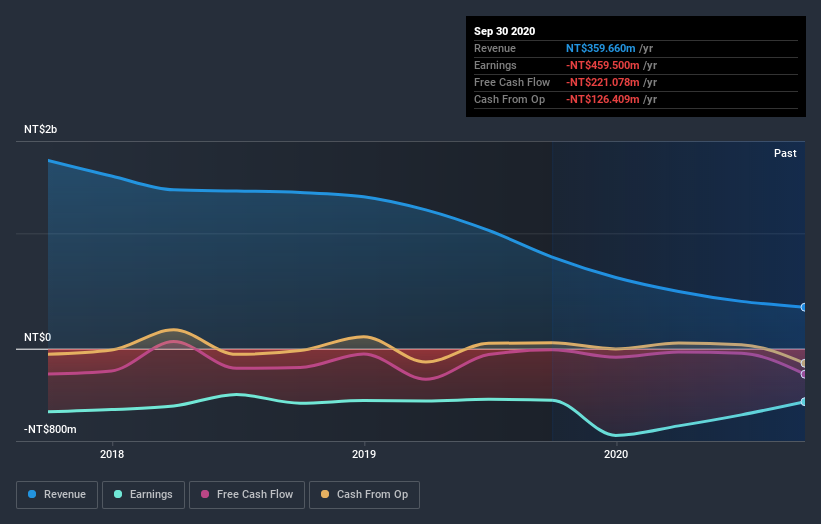

In the last three years Crystalwise Technology saw its revenue shrink by 43% per year. That means its revenue trend is very weak compared to other loss making companies. On the face of it we'd posit the share price fall of 14% compound, over three years is well justified by the fundamental deterioration. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. The company will need to return to revenue growth as quickly as possible, if it wants to see some enthusiasm from investors.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Crystalwise Technology provided a TSR of 22% over the year. That's fairly close to the broader market return. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 4% over the last five years. While 'turnarounds seldom turn' there are green shoots for Crystalwise Technology. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Crystalwise Technology is showing 2 warning signs in our investment analysis , you should know about...

Of course Crystalwise Technology may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade Crystalwise Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:4944

Crystalwise Technology

Crystalwise Technology Inc. manufactures and sells hard substrates in Taiwan.

Good value with adequate balance sheet.

Market Insights

Community Narratives