- Taiwan

- /

- Semiconductors

- /

- TPEX:3122

We're Not Very Worried About Megawin Technology's (GTSM:3122) Cash Burn Rate

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

Given this risk, we thought we'd take a look at whether Megawin Technology (GTSM:3122) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Megawin Technology

How Long Is Megawin Technology's Cash Runway?

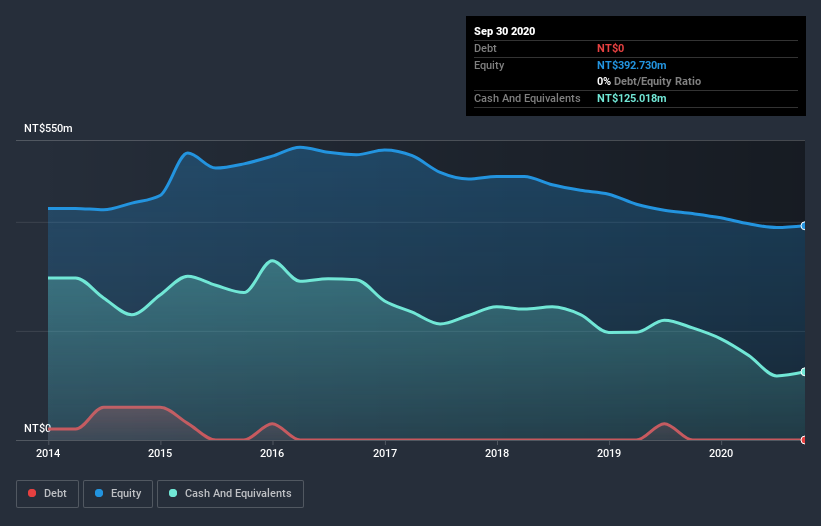

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at September 2020, Megawin Technology had cash of NT$125m and such minimal debt that we can ignore it for the purposes of this analysis. Looking at the last year, the company burnt through NT$53m. So it had a cash runway of about 2.4 years from September 2020. Arguably, that's a prudent and sensible length of runway to have. The image below shows how its cash balance has been changing over the last few years.

How Well Is Megawin Technology Growing?

Notably, Megawin Technology actually ramped up its cash burn very hard and fast in the last year, by 167%, signifying heavy investment in the business. While operating revenue was up over the same period, the 14% gain gives us scant comfort. Taken together, we think these growth metrics are a little worrying. In reality, this article only makes a short study of the company's growth data. This graph of historic earnings and revenue shows how Megawin Technology is building its business over time.

How Hard Would It Be For Megawin Technology To Raise More Cash For Growth?

Even though it seems like Megawin Technology is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Megawin Technology has a market capitalisation of NT$576m and burnt through NT$53m last year, which is 9.2% of the company's market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

So, Should We Worry About Megawin Technology's Cash Burn?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Megawin Technology's cash runway was relatively promising. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. On another note, we conducted an in-depth investigation of the company, and identified 4 warning signs for Megawin Technology (1 can't be ignored!) that you should be aware of before investing here.

Of course Megawin Technology may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Megawin Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:3122

Megawin Technology

Engages in the manufacture and sale of electronic instruments and their components in Asia, Europe, and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives