- Taiwan

- /

- Specialty Stores

- /

- TWSE:2207

Hotai Motor Co.,Ltd.'s (TWSE:2207) Shares May Have Run Too Fast Too Soon

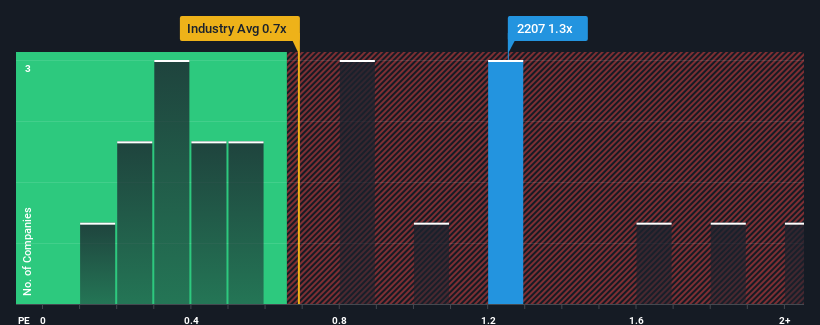

Hotai Motor Co.,Ltd.'s (TWSE:2207) price-to-sales (or "P/S") ratio of 1.3x may not look like an appealing investment opportunity when you consider close to half the companies in the Specialty Retail industry in Taiwan have P/S ratios below 0.7x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Hotai MotorLtd

How Hotai MotorLtd Has Been Performing

Hotai MotorLtd's revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hotai MotorLtd.Is There Enough Revenue Growth Forecasted For Hotai MotorLtd?

In order to justify its P/S ratio, Hotai MotorLtd would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 12% last year. The solid recent performance means it was also able to grow revenue by 18% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 1.6% as estimated by the lone analyst watching the company. That's shaping up to be materially lower than the 12% growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Hotai MotorLtd's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Hotai MotorLtd, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 3 warning signs for Hotai MotorLtd (2 don't sit too well with us!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hotai MotorLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2207

Hotai MotorLtd

Hotai Motor Co.,Ltd., together with its subsidiaries, exports and imports, trades, and sells vehicles, automobile air conditioners, and related parts in Taiwan and Mainland China.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives