- Taiwan

- /

- Specialty Stores

- /

- TWSE:2207

Here's Why Hotai MotorLtd (TPE:2207) Can Manage Its Debt Responsibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Hotai Motor Co.,Ltd. (TPE:2207) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Hotai MotorLtd

What Is Hotai MotorLtd's Net Debt?

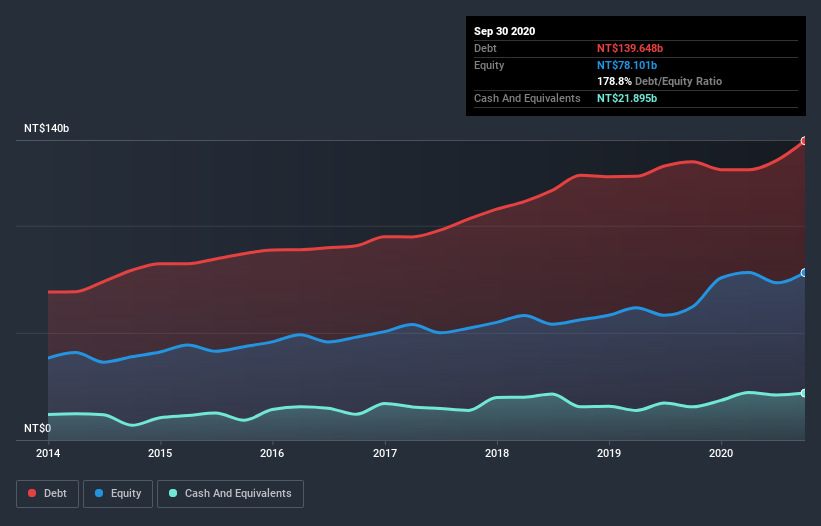

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Hotai MotorLtd had NT$139.6b of debt, an increase on NT$129.8b, over one year. However, because it has a cash reserve of NT$21.9b, its net debt is less, at about NT$117.8b.

A Look At Hotai MotorLtd's Liabilities

According to the last reported balance sheet, Hotai MotorLtd had liabilities of NT$172.1b due within 12 months, and liabilities of NT$21.1b due beyond 12 months. Offsetting these obligations, it had cash of NT$21.9b as well as receivables valued at NT$145.6b due within 12 months. So it has liabilities totalling NT$25.8b more than its cash and near-term receivables, combined.

Given Hotai MotorLtd has a humongous market capitalization of NT$380.7b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Hotai MotorLtd's net debt is 3.9 times its EBITDA, which is a significant but still reasonable amount of leverage. But its EBIT was about 11.2 times its interest expense, implying the company isn't really paying a high cost to maintain that level of debt. Even were the low cost to prove unsustainable, that is a good sign. One way Hotai MotorLtd could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 16%, as it did over the last year. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Hotai MotorLtd can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Hotai MotorLtd recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

When it comes to the balance sheet, the standout positive for Hotai MotorLtd was the fact that it seems able to cover its interest expense with its EBIT confidently. However, our other observations weren't so heartening. To be specific, it seems about as good at converting EBIT to free cash flow as wet socks are at keeping your feet warm. Looking at all this data makes us feel a little cautious about Hotai MotorLtd's debt levels. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Hotai MotorLtd , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Hotai MotorLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hotai MotorLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:2207

Hotai MotorLtd

Hotai Motor Co.,Ltd., together with its subsidiaries, exports and imports, trades, and sells vehicles, automobile air conditioners, and related parts in Taiwan and Mainland China.

Proven track record with mediocre balance sheet.