The Eslite Spectrum Corporation's (GTSM:2926) Financial Prospects Don't Look Very Positive: Could It Mean A Stock Price Drop In The Future?

Most readers would already know that Eslite Spectrum's (GTSM:2926) stock increased by 7.5% over the past three months. However, its weak financial performance indicators makes us a bit doubtful if that trend could continue. Specifically, we decided to study Eslite Spectrum's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Eslite Spectrum

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Eslite Spectrum is:

5.8% = NT$63m ÷ NT$1.1b (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.06 in profit.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Eslite Spectrum's Earnings Growth And 5.8% ROE

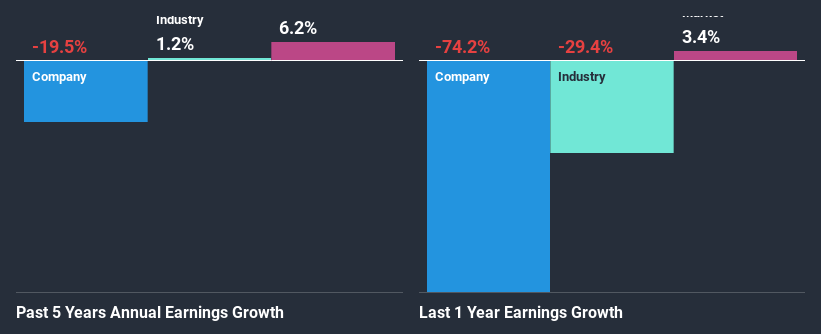

When you first look at it, Eslite Spectrum's ROE doesn't look that attractive. However, its ROE is similar to the industry average of 6.1%, so we won't completely dismiss the company. Having said that, Eslite Spectrum's five year net income decline rate was 20%. Remember, the company's ROE is a bit low to begin with. Hence, this goes some way in explaining the shrinking earnings.

That being said, we compared Eslite Spectrum's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 1.2% in the same period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Eslite Spectrum fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Eslite Spectrum Making Efficient Use Of Its Profits?

Eslite Spectrum's very high three-year median payout ratio of 103% over the last three years suggests that the company is paying its shareholders more than what it is earning and this explains the company's shrinking earnings. Paying a dividend beyond their means is usually not viable over the long term. You can see the 3 risks we have identified for Eslite Spectrum by visiting our risks dashboard for free on our platform here.

In addition, Eslite Spectrum has been paying dividends over a period of nine years suggesting that keeping up dividend payments is preferred by the management even though earnings have been in decline.

Conclusion

Overall, we would be extremely cautious before making any decision on Eslite Spectrum. Specifically, it has shown quite an unsatisfactory performance as far as earnings growth is concerned, and a poor ROE and an equally poor rate of reinvestment seem to be the reason behind this inadequate performance. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Eslite Spectrum's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

When trading Eslite Spectrum or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eslite Spectrum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:2926

Eslite Spectrum

Operates department stores in Taiwan, Hong Kong, China, Japan, and Malaysia.

Solid track record and slightly overvalued.

Market Insights

Community Narratives