- Taiwan

- /

- Real Estate

- /

- TWSE:5534

Chong Hong Construction Co., Ltd.'s (TPE:5534) Recent Stock Price Movement Is Nothing To Get Excited About But Its Strong Financial Prospects Can't Be Ignored

Looking at Chong Hong Construction's (TPE:5534) mostly flat share price movement over the past month, it is easy to think that there’s nothing interesting about the stock. But since value is created over the longer term, it's worth studying the company's strong financials to see what the future could hold. Particularly, we will be paying attention to Chong Hong Construction's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

See our latest analysis for Chong Hong Construction

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Chong Hong Construction is:

14% = NT$2.5b ÷ NT$17b (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.14 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Chong Hong Construction's Earnings Growth And 14% ROE

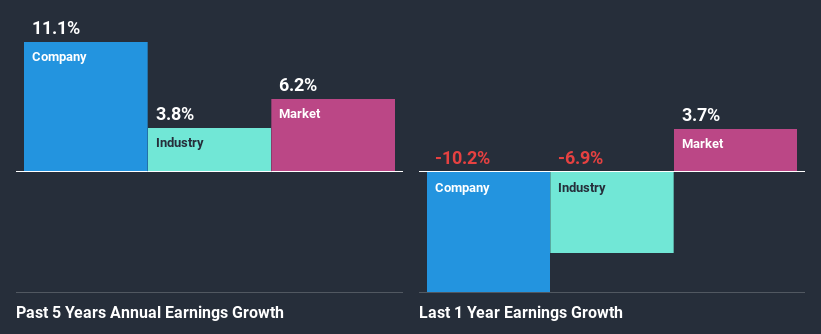

At first glance, Chong Hong Construction seems to have a decent ROE. Further, the company's ROE compares quite favorably to the industry average of 7.9%. This certainly adds some context to Chong Hong Construction's decent 11% net income growth seen over the past five years.

As a next step, we compared Chong Hong Construction's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 3.8%.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Is Chong Hong Construction fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Chong Hong Construction Using Its Retained Earnings Effectively?

Chong Hong Construction has a significant three-year median payout ratio of 59%, meaning that it is left with only 41% to reinvest into its business. This implies that the company has been able to achieve decent earnings growth despite returning most of its profits to shareholders.

Besides, Chong Hong Construction has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders.

Summary

Overall, we are quite pleased with Chong Hong Construction's performance. In particular, its high ROE is quite noteworthy and also the probable explanation behind its considerable earnings growth. Yet, the company is retaining a small portion of its profits. Which means that the company has been able to grow its earnings in spite of it, so that's not too bad. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. To gain further insights into Chong Hong Construction's past profit growth, check out this visualization of past earnings, revenue and cash flows.

If you’re looking to trade Chong Hong Construction, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:5534

Chong Hong Construction

Engages in the construction, sale, and leasing of residential and commercial buildings in Taiwan.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives