- Taiwan

- /

- Real Estate

- /

- TWSE:3266

Can Mixed Fundamentals Have A Negative Impact on Sunty Development Co., LTD (TPE:3266) Current Share Price Momentum?

Sunty Development (TPE:3266) has had a great run on the share market with its stock up by a significant 10% over the last three months. But the company's key financial indicators appear to be differing across the board and that makes us question whether or not the company's current share price momentum can be maintained. Particularly, we will be paying attention to Sunty Development's ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for Sunty Development

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Sunty Development is:

2.9% = NT$165m ÷ NT$5.6b (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. Another way to think of that is that for every NT$1 worth of equity, the company was able to earn NT$0.03 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Sunty Development's Earnings Growth And 2.9% ROE

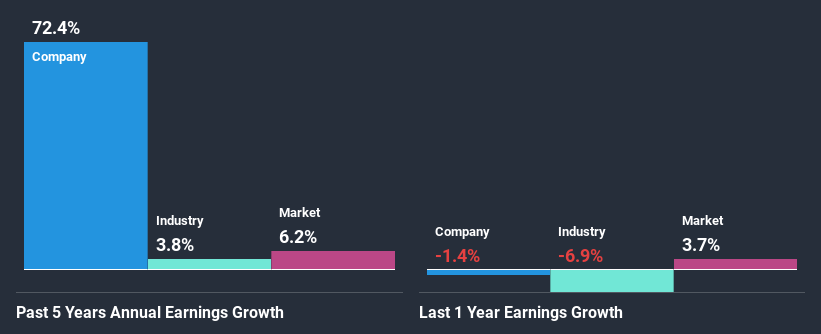

At first glance, Sunty Development's ROE doesn't look very promising. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 7.9% either. However, we we're pleasantly surprised to see that Sunty Development grew its net income at a significant rate of 72% in the last five years. So, there might be other aspects that are positively influencing the company's earnings growth. For instance, the company has a low payout ratio or is being managed efficiently.

Next, on comparing with the industry net income growth, we found that Sunty Development's growth is quite high when compared to the industry average growth of 3.8% in the same period, which is great to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Sunty Development is trading on a high P/E or a low P/E, relative to its industry.

Is Sunty Development Efficiently Re-investing Its Profits?

Sunty Development has very a high three-year median payout ratio of 108% suggesting that the company's shareholders are getting paid from more than just the company's earnings. In spite of this, the company was able to grow its earnings significantly, as we saw above. With that said, it could be worth keeping an eye on the high payout ratio as that's a huge risk. Our risks dashboard should have the 2 risks we have identified for Sunty Development.

Moreover, Sunty Development is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years.

Conclusion

In total, we're a bit ambivalent about Sunty Development's performance. While no doubt its earnings growth is pretty substantial, its ROE and earnings retention is quite poor. So while the company has managed to grow its earnings in spite of this, we are unconvinced if this growth could extend, especially during troubled times. Up till now, we've only made a short study of the company's growth data. To gain further insights into Sunty Development's past profit growth, check out this visualization of past earnings, revenue and cash flows.

If you’re looking to trade Sunty Development, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:3266

Sunty Development

Engages in the residential and commercial building projects in Greater Taipei, Taiwan.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion