- Taiwan

- /

- Real Estate

- /

- TWSE:2923

Shareholders Of Sino Horizon Holdings (TPE:2923) Must Be Happy With Their 88% Return

The main point of investing for the long term is to make money. But more than that, you probably want to see it rise more than the market average. But Sino Horizon Holdings Limited (TPE:2923) has fallen short of that second goal, with a share price rise of 59% over five years, which is below the market return. Zooming in, the stock is up a respectable 5.7% in the last year.

Check out our latest analysis for Sino Horizon Holdings

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Sino Horizon Holdings actually saw its EPS drop 40% per year. The impact of extraordinary items on earnings, in the last year, partially explain the diversion.

This means it's unlikely the market is judging the company based on earnings growth. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

In fact, the dividend has increased over time, which is a positive. Maybe dividend investors have helped support the share price.

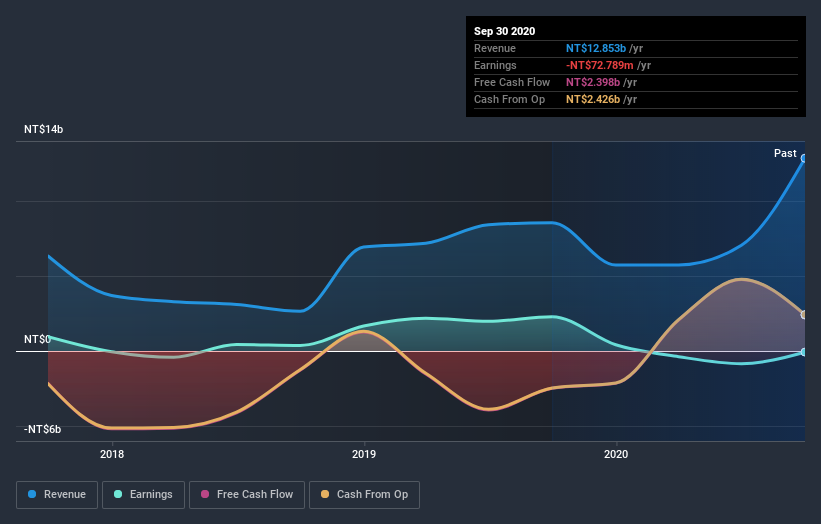

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Sino Horizon Holdings stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Sino Horizon Holdings the TSR over the last 5 years was 88%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Sino Horizon Holdings provided a TSR of 15% over the last twelve months. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 13% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Sino Horizon Holdings (2 make us uncomfortable!) that you should be aware of before investing here.

Of course Sino Horizon Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading Sino Horizon Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2923

Sino Horizon Holdings

Engages in the development, sale, and leasing of real estate properties in mainland China and Taiwan.

Imperfect balance sheet very low.

Similar Companies

Market Insights

Community Narratives