Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Well Glory Development Co., Ltd. (GTSM:5529) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Well Glory Development

What Is Well Glory Development's Debt?

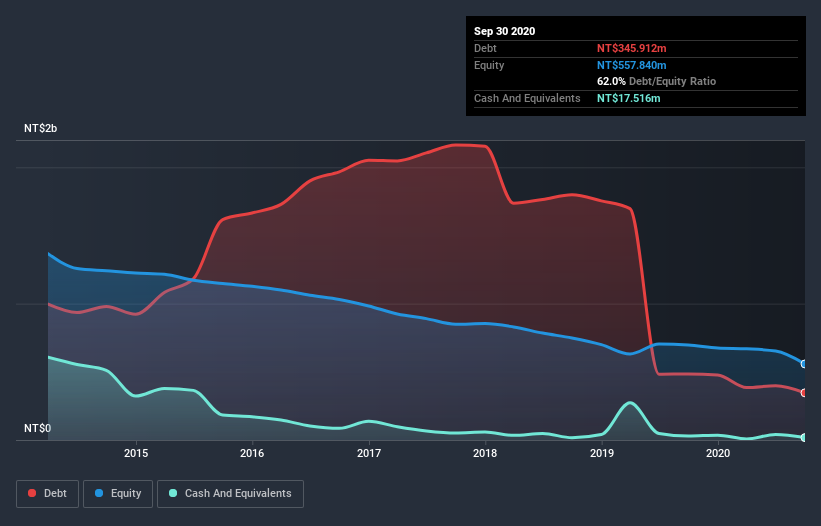

The image below, which you can click on for greater detail, shows that Well Glory Development had debt of NT$345.9m at the end of September 2020, a reduction from NT$484.7m over a year. On the flip side, it has NT$17.5m in cash leading to net debt of about NT$328.4m.

A Look At Well Glory Development's Liabilities

Zooming in on the latest balance sheet data, we can see that Well Glory Development had liabilities of NT$166.1m due within 12 months and liabilities of NT$428.0m due beyond that. Offsetting these obligations, it had cash of NT$17.5m as well as receivables valued at NT$44.6m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by NT$531.9m.

This deficit isn't so bad because Well Glory Development is worth NT$1.06b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Well Glory Development will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Well Glory Development made a loss at the EBIT level, and saw its revenue drop to NT$273m, which is a fall of 83%. To be frank that doesn't bode well.

Caveat Emptor

While Well Glory Development's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. To be specific the EBIT loss came in at NT$51m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. For example, we would not want to see a repeat of last year's loss of NT$138m. So in short it's a really risky stock. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Well Glory Development (of which 1 is a bit unpleasant!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Well Glory Development or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:5529

MEGA International DevelopmentLtd

Engages in the development, rental, and sale of residences and buildings in Taiwan.

Slight risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives