As global markets experience a rebound, driven by easing core inflation and strong earnings in the financial sector, small-cap stocks are gaining renewed attention amid broader market optimism. The Russell 2000 Index's recent uptick highlights growing investor interest in these smaller companies that often offer unique growth opportunities. In this environment, identifying stocks with solid fundamentals and potential for expansion can be crucial for investors looking to capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Yindu Kitchen Equipment (SHSE:603277)

Simply Wall St Value Rating: ★★★★★☆

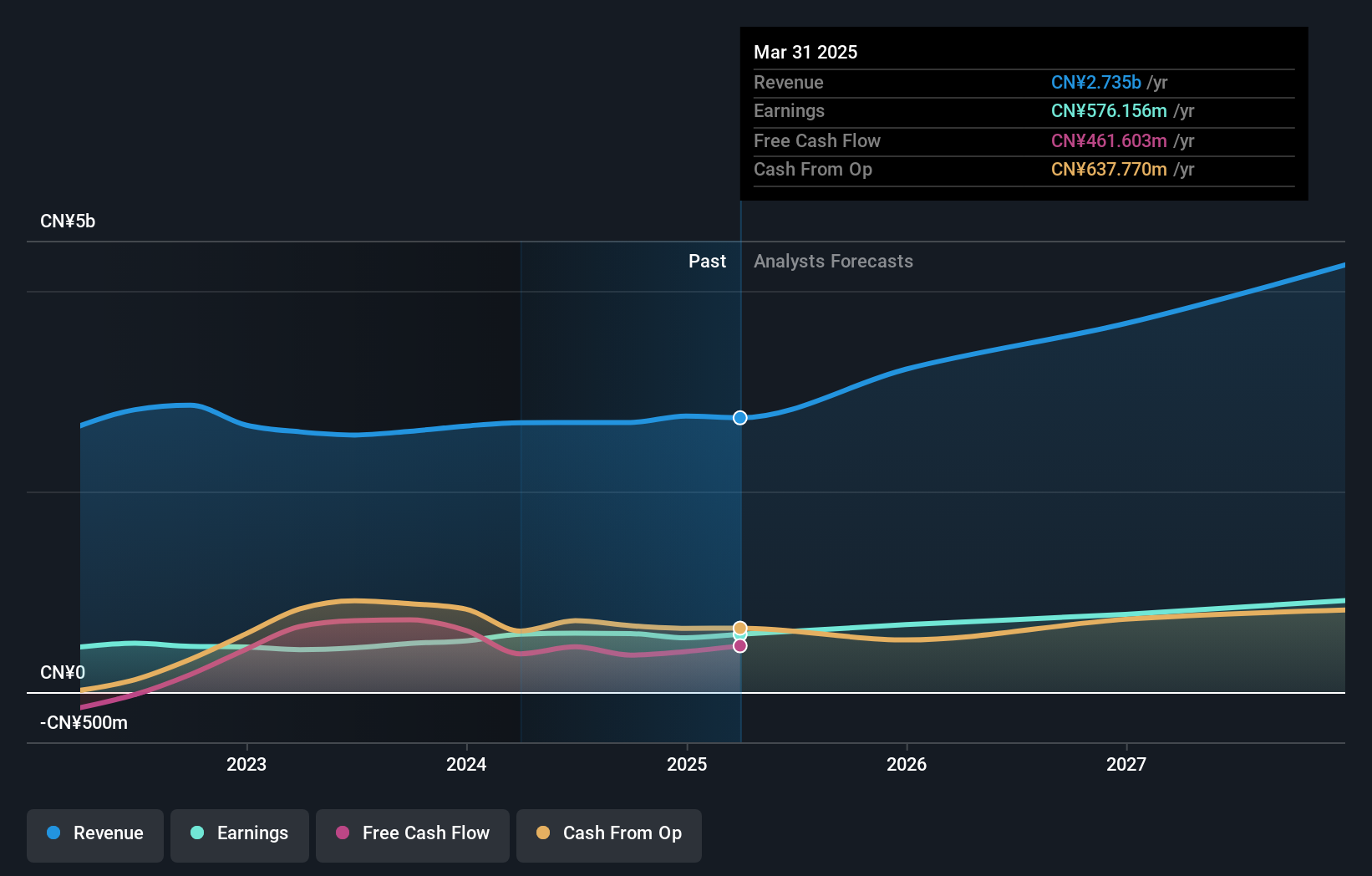

Overview: Yindu Kitchen Equipment Co., Ltd specializes in the research, development, production, and sale of commercial catering equipment both in China and internationally, with a market cap of CN¥11.13 billion.

Operations: Yindu Kitchen Equipment generates revenue primarily through the sale of commercial catering equipment in domestic and international markets. The company's financial performance is highlighted by its net profit margin, which reflects its profitability after accounting for all expenses.

Yindu Kitchen Equipment, a smaller player in the machinery sector, has been making waves with its solid financial footing. The price-to-earnings ratio of 19.1x suggests it’s trading at a good value compared to the broader CN market's 34.9x. Impressively, earnings have grown by 20% over the past year, outpacing the industry average of -0.2%. The company is also in a healthy position with more cash than total debt and consistently positive free cash flow. With earnings forecasted to grow at 21.9% annually, Yindu seems poised for continued momentum in its niche market segment.

- Unlock comprehensive insights into our analysis of Yindu Kitchen Equipment stock in this health report.

Gain insights into Yindu Kitchen Equipment's past trends and performance with our Past report.

Tokuyama (TSE:4043)

Simply Wall St Value Rating: ★★★★★★

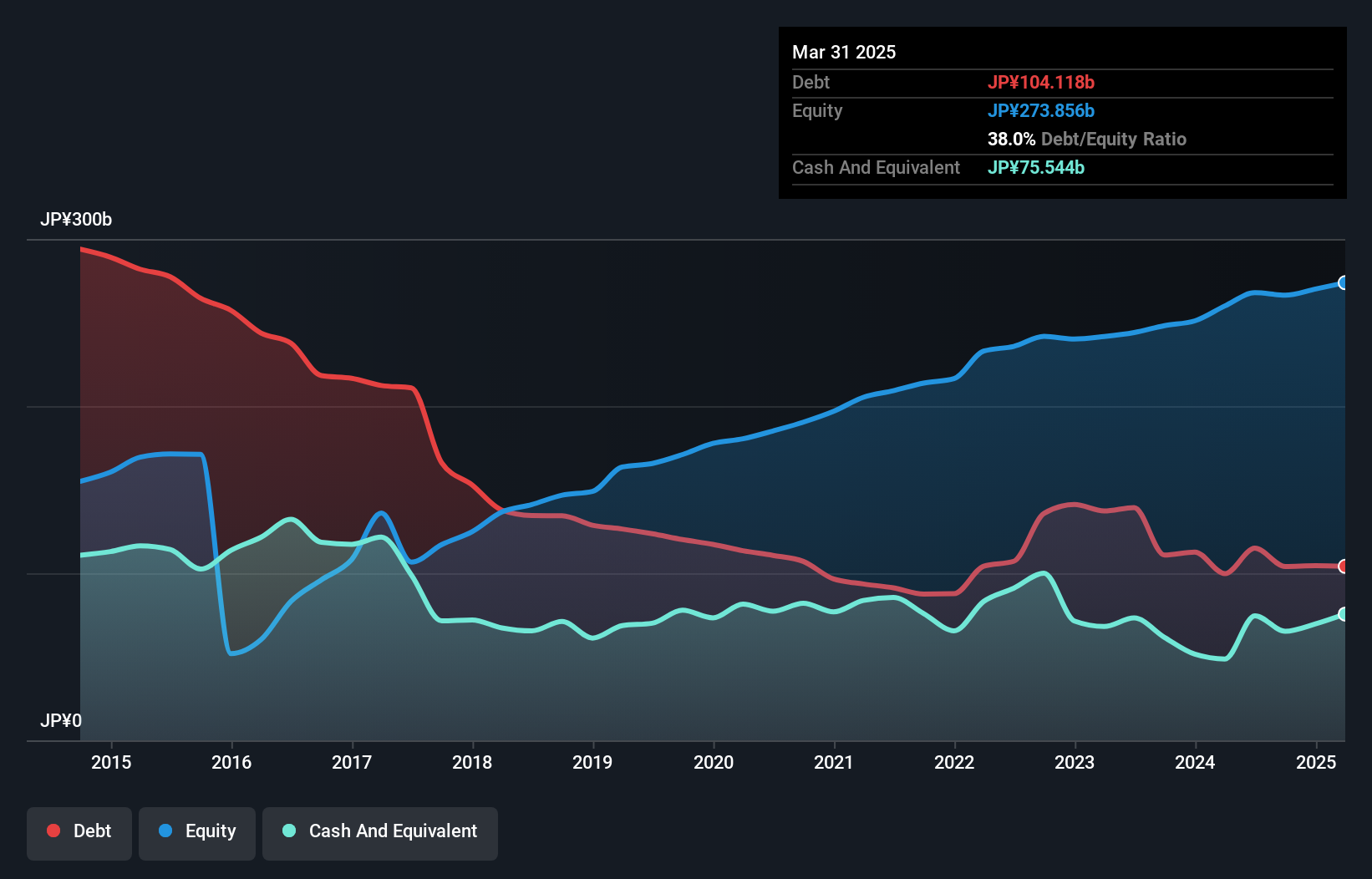

Overview: Tokuyama Corporation is a Japanese company engaged in the production and sale of chemical products, with a market capitalization of ¥188.06 billion.

Operations: Tokuyama Corporation's primary revenue streams are derived from Chemical Products, contributing ¥117.09 billion, and Electronic & Advanced Materials at ¥81.82 billion. Cement and Life Science segments also add significant revenues of ¥66.89 billion and ¥41.07 billion, respectively.

Tokuyama, a notable player in the chemicals sector, has shown impressive earnings growth of 156% over the past year, significantly outpacing the industry average of 14%. The company's debt management appears robust with its debt to equity ratio decreasing from 70% to 39% over five years. Additionally, Tokuyama's interest payments are well covered by EBIT at a remarkable 378 times coverage. However, recent strategic moves include discontinuing operations at its Shanghai subsidiary due to market challenges. Despite these hurdles, Tokuyama trades at an attractive value—54% below estimated fair value—and maintains satisfactory net debt levels at around 15%.

- Dive into the specifics of Tokuyama here with our thorough health report.

Assess Tokuyama's past performance with our detailed historical performance reports.

Da-Li DevelopmentLtd (TWSE:6177)

Simply Wall St Value Rating: ★★★★★☆

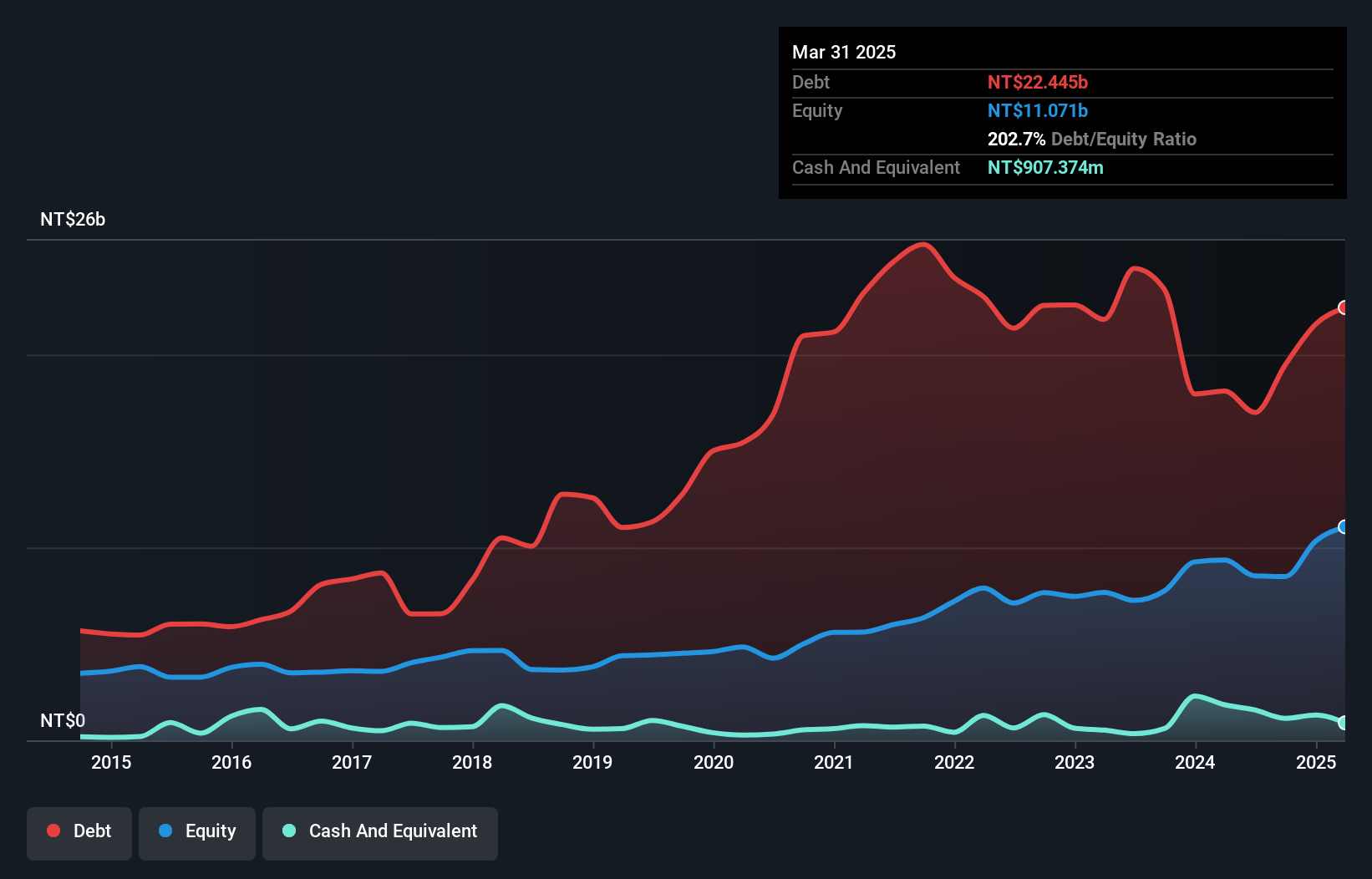

Overview: Da-Li Development Co., Ltd., along with its subsidiaries, engages in the construction business across Taiwan and the United States, with a market capitalization of NT$18.10 billion.

Operations: The company's primary revenue streams come from its Construction Segment and Construction Department, generating NT$4.36 billion and NT$14.61 billion respectively.

Da-Li Development, a smaller player in the real estate sector, has shown impressive earnings growth of 388% over the past year, outpacing the industry average of 52%. Despite this surge, their net debt to equity ratio remains high at 215%, though it has improved from 282% five years ago. The company's interest payments are well covered by EBIT at nearly 1980 times. Recent financials reveal a significant drop in quarterly sales to TWD 568.87 million from TWD 3.29 billion last year and net income down to TWD 11.65 million from TWD 430 million, suggesting potential volatility ahead despite trading significantly below estimated fair value.

- Delve into the full analysis health report here for a deeper understanding of Da-Li DevelopmentLtd.

Evaluate Da-Li DevelopmentLtd's historical performance by accessing our past performance report.

Seize The Opportunity

- Unlock our comprehensive list of 4658 Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tokuyama might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4043

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion