- Taiwan

- /

- Real Estate

- /

- TWSE:2536

Hong Pu Real Estate Development Co., Ltd.'s (TWSE:2536) 27% Price Boost Is Out Of Tune With Revenues

Hong Pu Real Estate Development Co., Ltd. (TWSE:2536) shareholders have had their patience rewarded with a 27% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 56%.

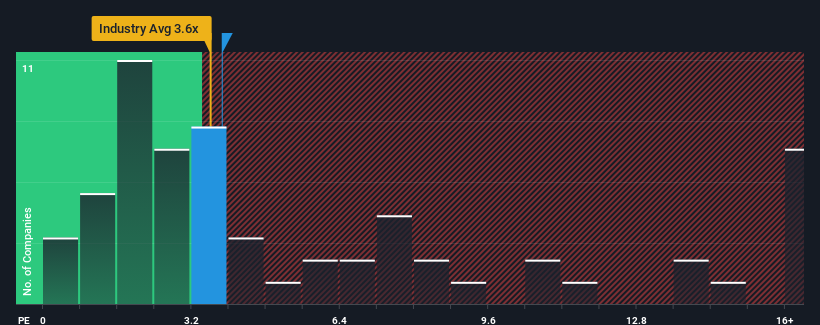

In spite of the firm bounce in price, it's still not a stretch to say that Hong Pu Real Estate Development's price-to-sales (or "P/S") ratio of 3.9x right now seems quite "middle-of-the-road" compared to the Real Estate industry in Taiwan, where the median P/S ratio is around 3.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Hong Pu Real Estate Development

How Hong Pu Real Estate Development Has Been Performing

Recent times have been quite advantageous for Hong Pu Real Estate Development as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. Those who are bullish on Hong Pu Real Estate Development will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Hong Pu Real Estate Development's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Hong Pu Real Estate Development would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. However, this wasn't enough as the latest three year period has seen the company endure a nasty 19% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 11% shows it's an unpleasant look.

With this in mind, we find it worrying that Hong Pu Real Estate Development's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Key Takeaway

Its shares have lifted substantially and now Hong Pu Real Estate Development's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Hong Pu Real Estate Development currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Hong Pu Real Estate Development, and understanding these should be part of your investment process.

If you're unsure about the strength of Hong Pu Real Estate Development's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hong Pu Real Estate Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2536

Hong Pu Real Estate Development

Hong Pu Real Estate Development Co., Ltd.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives