- Taiwan

- /

- Real Estate

- /

- TWSE:2524

King's Town Construction's (TWSE:2524) one-year total shareholder returns outpace the underlying earnings growth

While King's Town Construction Co., Ltd. (TWSE:2524) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 27% in the last quarter. On the other hand, over the last twelve months the stock has delivered rather impressive returns. During that period, the share price soared a full 103%. So we think most shareholders won't be too upset about the recent fall. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

While the stock has fallen 7.4% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for King's Town Construction

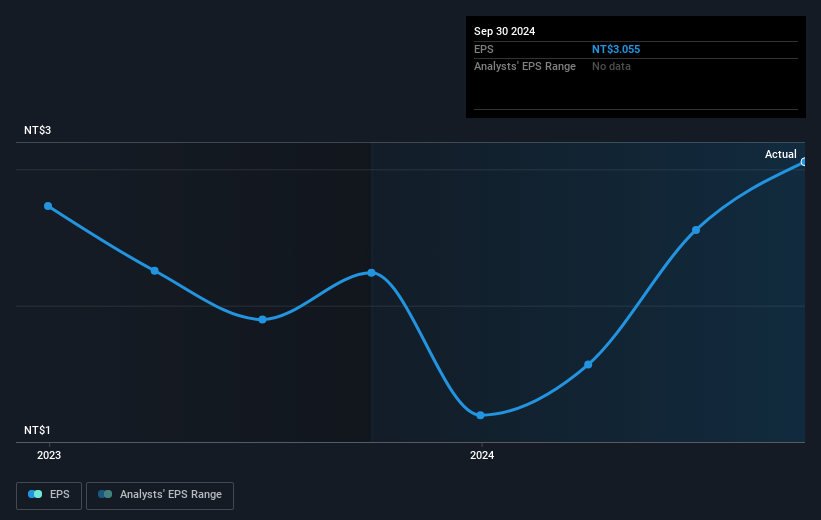

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year King's Town Construction grew its earnings per share (EPS) by 36%. The share price gain of 103% certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

We're pleased to report that King's Town Construction shareholders have received a total shareholder return of 103% over one year. That gain is better than the annual TSR over five years, which is 15%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 3 warning signs we've spotted with King's Town Construction (including 2 which are a bit unpleasant) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if King's Town Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2524

King's Town Construction

Engages in the residential and building development in Taiwan.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives