- Taiwan

- /

- Real Estate

- /

- TWSE:2520

Top Dividend Stocks In Global For December 2025

Reviewed by Simply Wall St

As global markets navigate the implications of the Federal Reserve's interest rate cuts and renewed concerns about technology stock valuations, investors are keenly observing how these factors influence broader economic trends. Amidst this backdrop, dividend stocks continue to attract attention for their potential to provide steady income streams, especially in times of market volatility. In this environment, a good dividend stock is often characterized by its ability to maintain consistent payouts and demonstrate financial resilience despite fluctuating economic conditions.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.73% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.20% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.93% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.64% | ★★★★★★ |

| NCD (TSE:4783) | 3.99% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.68% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.10% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.73% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.32% | ★★★★★★ |

Click here to see the full list of 1298 stocks from our Top Global Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

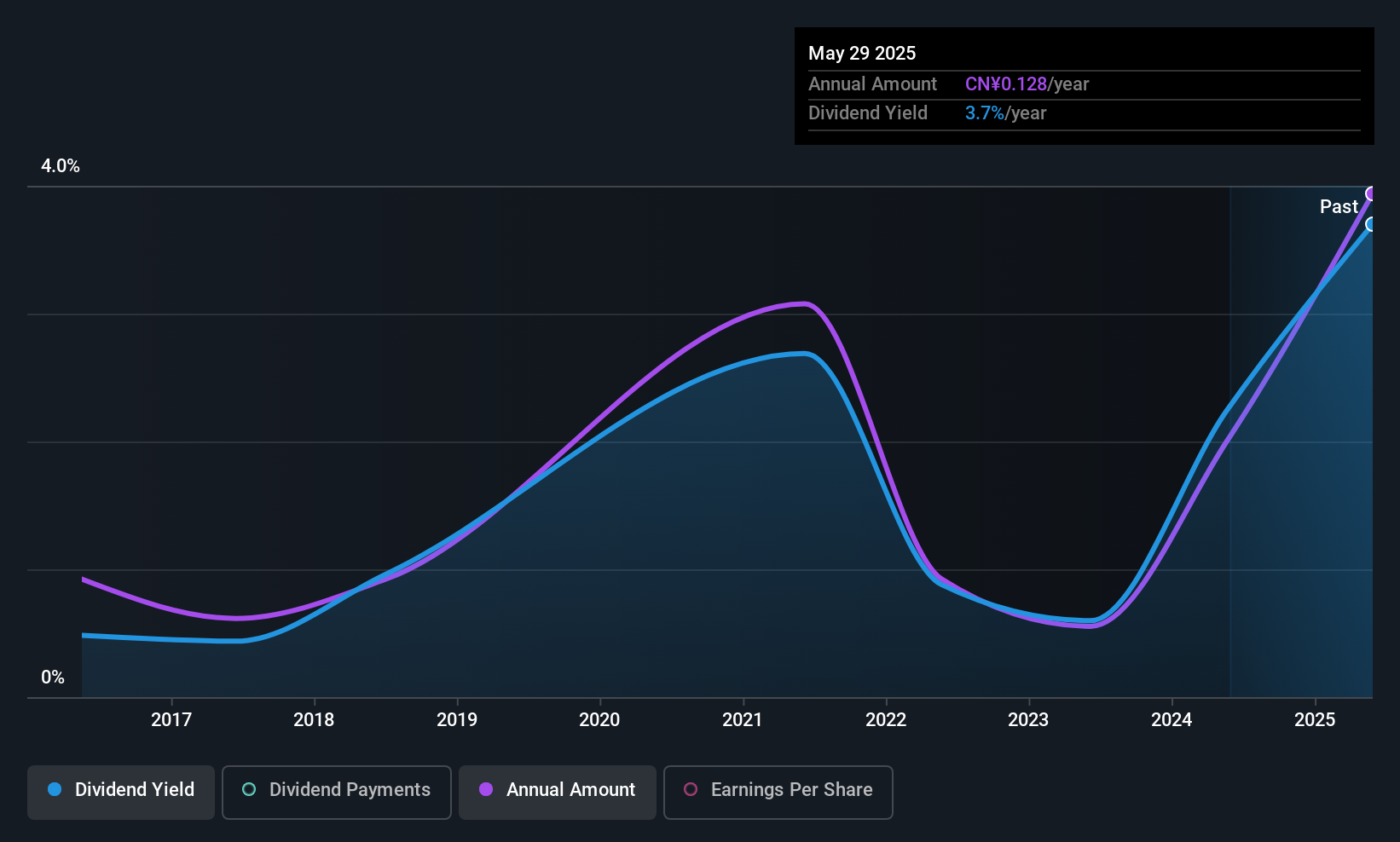

V V Food & BeverageLtd (SHSE:600300)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: V V Food & Beverage Co., Ltd operates in the research, development, production, and sale of soybean milk powder, plant protein beverages, dairy products, tea, and other products both in China and internationally with a market cap of CN¥5.87 billion.

Operations: V V Food & Beverage Co., Ltd generates revenue from its primary segments, including soybean milk powder, plant protein beverages, dairy products, and tea.

Dividend Yield: 3.4%

V V Food & Beverage Ltd offers a dividend yield of 3.43%, placing it in the top 25% of CN market payers, with dividends well-covered by earnings and cash flows (payout ratios at 51.1% and 24.8%, respectively). Despite past volatility, dividends have grown over the last decade. Recent earnings showed slight declines in sales to CNY 2.39 billion but stable net income at CNY 241.25 million, suggesting ongoing financial resilience for dividend sustainability.

- Click here to discover the nuances of V V Food & BeverageLtd with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that V V Food & BeverageLtd is trading behind its estimated value.

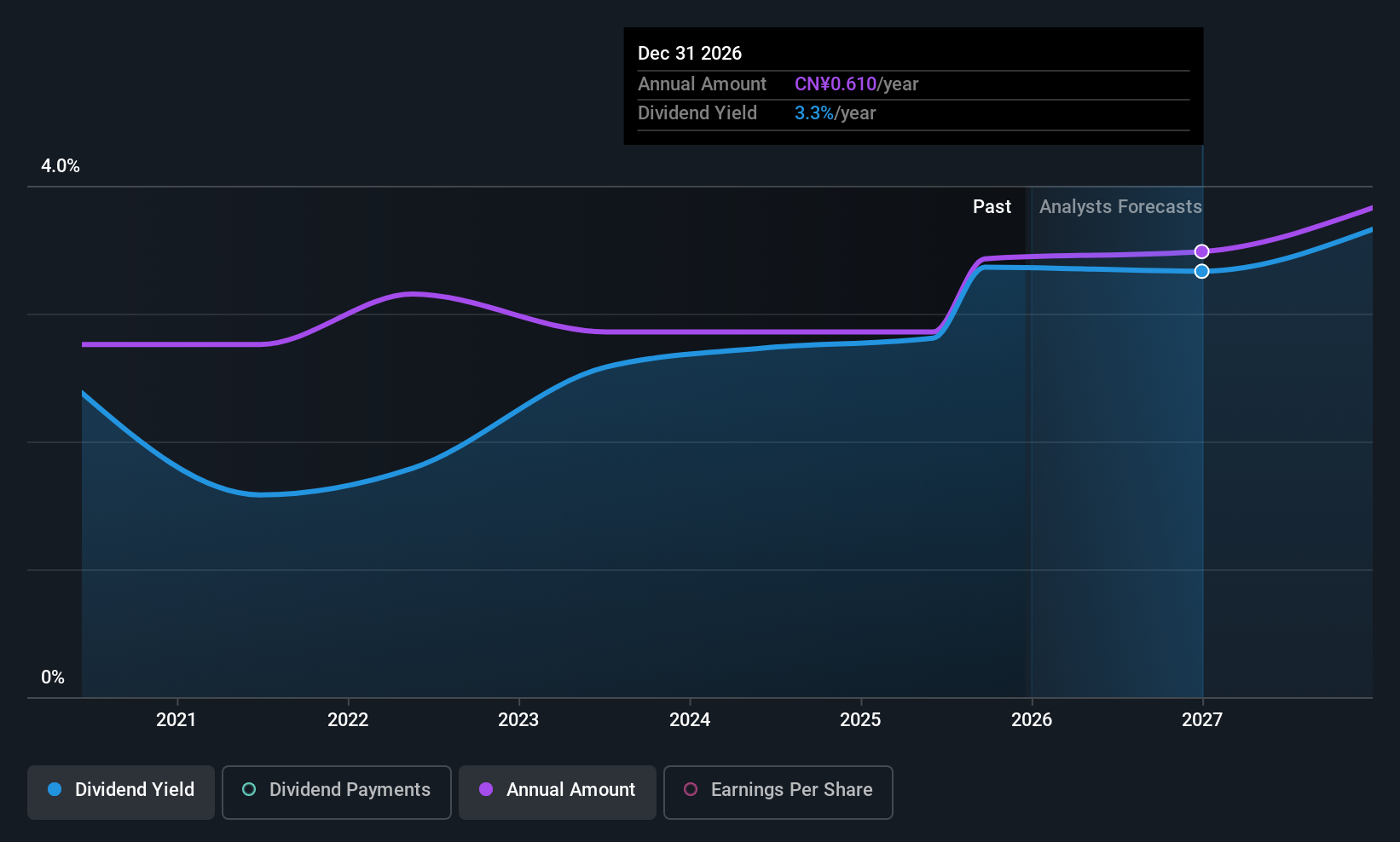

Yongjin Technology Group (SHSE:603995)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yongjin Technology Group Co., Ltd. specializes in the research, development, production, and sale of cold-rolled stainless steel strips in China with a market cap of CN¥6.26 billion.

Operations: Yongjin Technology Group Co., Ltd. generates its revenue primarily through the production and sale of cold-rolled stainless steel strips in China.

Dividend Yield: 3.3%

Yongjin Technology Group's dividend yield of 3.28% ranks in the top 25% of CN market payers, with dividends well-covered by earnings and cash flows (payout ratios at 42.8% and 55.5%, respectively). Despite only six years of dividend history, payouts have been stable and increasing. Recent earnings showed sales growth to CNY 31.56 billion, though net income declined to CNY 449.87 million, highlighting potential challenges for future dividend sustainability amidst a high debt level.

- Take a closer look at Yongjin Technology Group's potential here in our dividend report.

- Our valuation report here indicates Yongjin Technology Group may be undervalued.

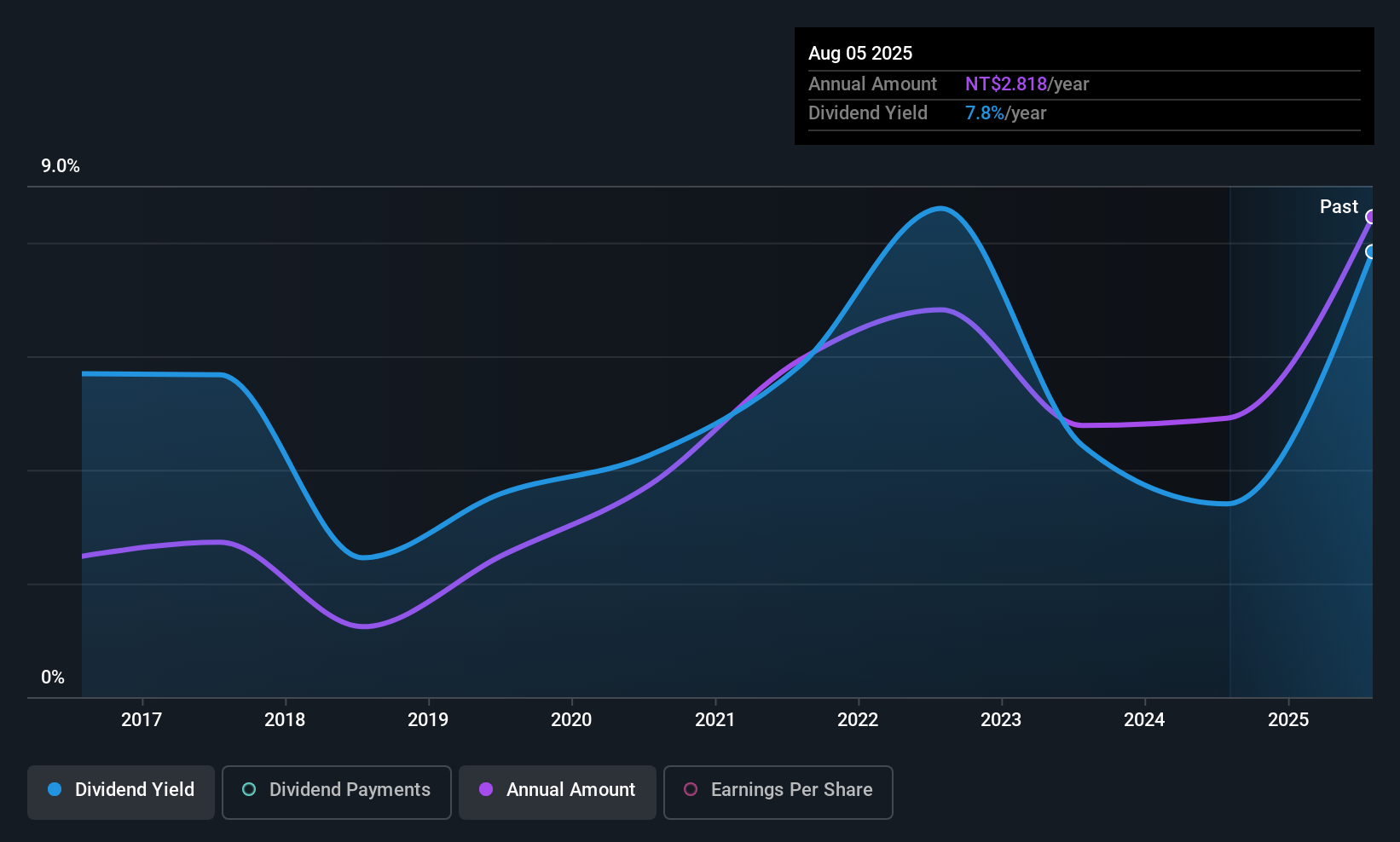

Kindom Development (TWSE:2520)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kindom Development Co., Ltd., along with its subsidiaries, is engaged in the construction, development, and sale of real estate properties in Taiwan, with a market capitalization of NT$20.29 billion.

Operations: Kindom Development Co., Ltd.'s revenue is primarily derived from its Construction Segments, which generated NT$20.02 billion, followed by Manufacturing at NT$5.21 billion and Department Store operations at NT$1.82 billion.

Dividend Yield: 8%

Kindom Development's dividend yield of 8.02% is among the top in the TW market, yet its reliability is questionable due to volatile historical payments and lack of free cash flow coverage. Despite a payout ratio of 80.6% being covered by earnings, recent financials reveal declining sales and net income, with third-quarter earnings dropping significantly year-over-year. This raises concerns about future dividend sustainability given the current profit margin decline from 19.6% to 9.2%.

- Unlock comprehensive insights into our analysis of Kindom Development stock in this dividend report.

- Upon reviewing our latest valuation report, Kindom Development's share price might be too pessimistic.

Make It Happen

- Unlock more gems! Our Top Global Dividend Stocks screener has unearthed 1295 more companies for you to explore.Click here to unveil our expertly curated list of 1298 Top Global Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kindom Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2520

Kindom Development

Kindom Development Co., Ltd., together with its subsidiaries, constructs, develops, and sells real estate properties in Taiwan.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion