- Taiwan

- /

- Real Estate

- /

- TWSE:2505

Kuo Yang Construction Co.,Ltd (TWSE:2505) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

Kuo Yang Construction Co.,Ltd (TWSE:2505) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 54%.

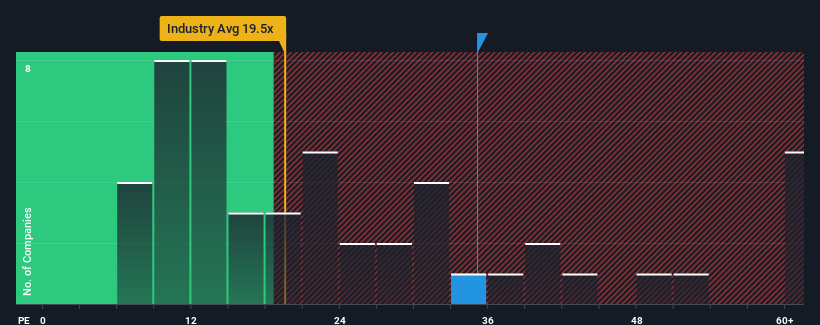

After such a large jump in price, given close to half the companies in Taiwan have price-to-earnings ratios (or "P/E's") below 22x, you may consider Kuo Yang ConstructionLtd as a stock to avoid entirely with its 35.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

For instance, Kuo Yang ConstructionLtd's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Kuo Yang ConstructionLtd

How Is Kuo Yang ConstructionLtd's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Kuo Yang ConstructionLtd's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 37%. As a result, earnings from three years ago have also fallen 94% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 26% shows it's an unpleasant look.

With this information, we find it concerning that Kuo Yang ConstructionLtd is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Kuo Yang ConstructionLtd's P/E

The strong share price surge has got Kuo Yang ConstructionLtd's P/E rushing to great heights as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Kuo Yang ConstructionLtd revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Kuo Yang ConstructionLtd, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Kuo Yang ConstructionLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kuo Yang Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2505

Kuo Yang Construction

Engages in the construction of public housing projects in Taiwan.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026