- Taiwan

- /

- Real Estate

- /

- TWSE:1436

Investors Still Aren't Entirely Convinced By Hua Yu Lien Development Co., Ltd's (TWSE:1436) Earnings Despite 28% Price Jump

Despite an already strong run, Hua Yu Lien Development Co., Ltd (TWSE:1436) shares have been powering on, with a gain of 28% in the last thirty days. The last month tops off a massive increase of 105% in the last year.

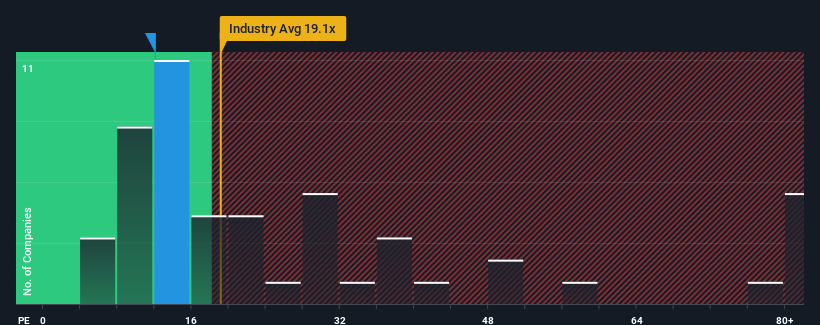

Even after such a large jump in price, given about half the companies in Taiwan have price-to-earnings ratios (or "P/E's") above 23x, you may still consider Hua Yu Lien Development as an attractive investment with its 12.1x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Hua Yu Lien Development certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Hua Yu Lien Development

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Hua Yu Lien Development's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 48% gain to the company's bottom line. Pleasingly, EPS has also lifted 414% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is only predicted to deliver 24% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it odd that Hua Yu Lien Development is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Hua Yu Lien Development's P/E

Hua Yu Lien Development's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Hua Yu Lien Development currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Hua Yu Lien Development (1 is potentially serious!) that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Hua Yu Lien Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1436

Good value with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026