As global markets navigate a complex landscape marked by cautious Federal Reserve commentary and tempered investor optimism, Asian tech stocks continue to capture attention with their potential for high growth. In this environment, identifying promising tech stocks involves considering factors such as innovation capabilities, market adaptability, and the ability to leverage regional economic trends.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ASROCK Incorporation | 28.31% | 29.76% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.55% | 44.13% | ★★★★★★ |

| Zhongji Innolight | 28.73% | 30.71% | ★★★★★★ |

| PharmaEssentia | 31.84% | 62.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 56.27% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Willfar Information Technology (SHSE:688100)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Willfar Information Technology Co., Ltd. offers smart utility services and IoT solutions both in China and internationally, with a market cap of CN¥18.33 billion.

Operations: Willfar Information Technology Co., Ltd. generates revenue primarily through its smart utility services and IoT solutions. The company's operations span both domestic and international markets, focusing on advanced technological offerings in the utility sector.

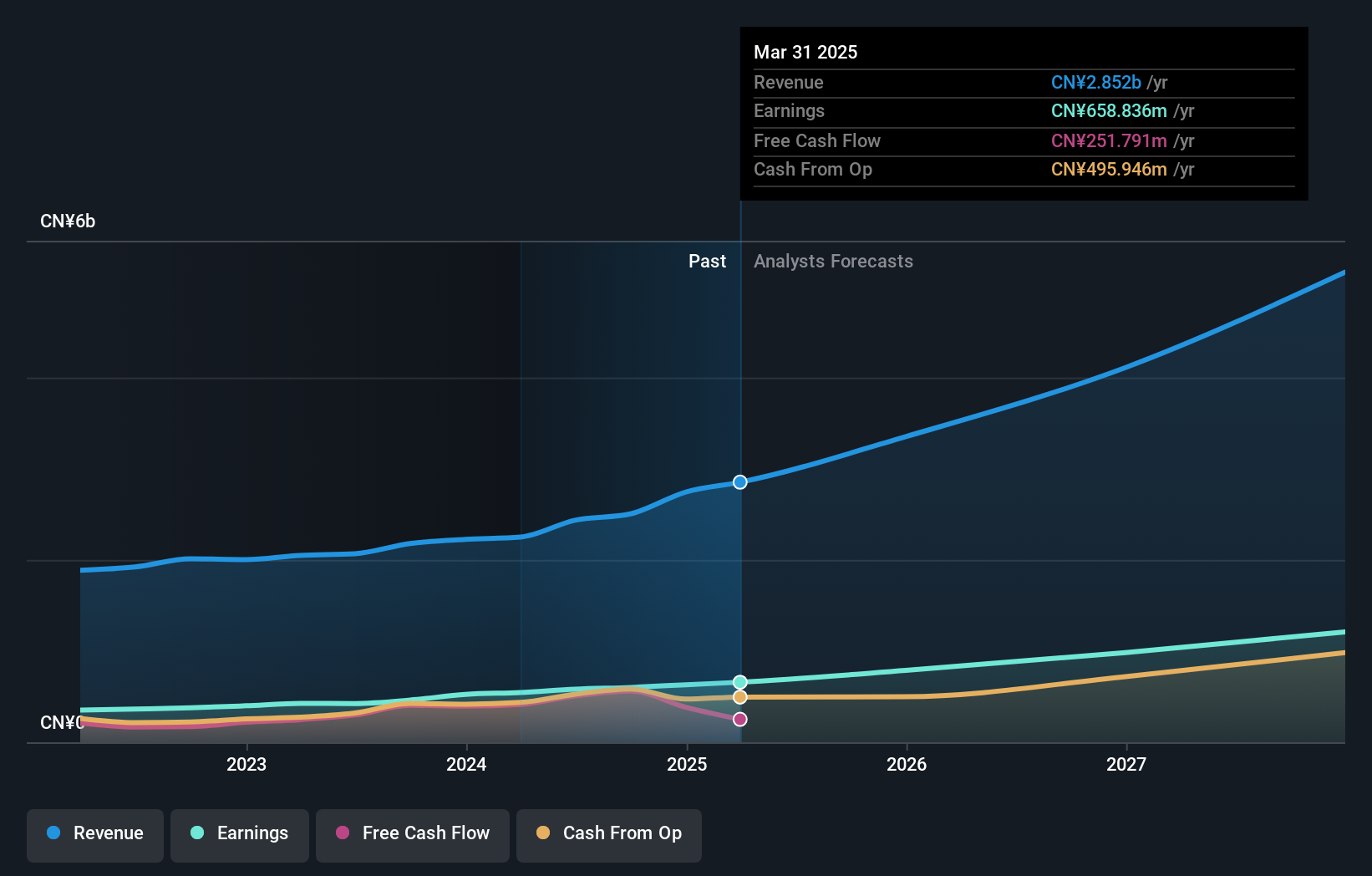

Willfar Information Technology has demonstrated robust financial performance with a notable 22.2% annual revenue growth and earnings expansion at 22.1% per year, outpacing the broader Chinese market's average. This growth trajectory is complemented by strategic share repurchases, where the company bought back shares worth CNY 149.96 million, underscoring confidence in its operational stability and future prospects. Furthermore, Willfar's commitment to innovation is evident from its substantial R&D investments which are pivotal in maintaining its competitive edge in the high-tech sector of Asia. These efforts are aligned with industry trends where companies increasingly invest in technology to drive future growth, positioning Willfar well amidst evolving market dynamics.

Chengdu Spaceon Electronics (SZSE:002935)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chengdu Spaceon Electronics Co., Ltd. focuses on the research, design, production, and sale of time-frequency and satellite application products globally with a market cap of CN¥6.65 billion.

Operations: Chengdu Spaceon Electronics generates revenue primarily from the computer, communications, and other electronic equipment manufacturing segment, with reported earnings of CN¥903.44 million. The company is involved in the research and development, design, production, and sale of time-frequency and satellite application products both domestically in China and internationally.

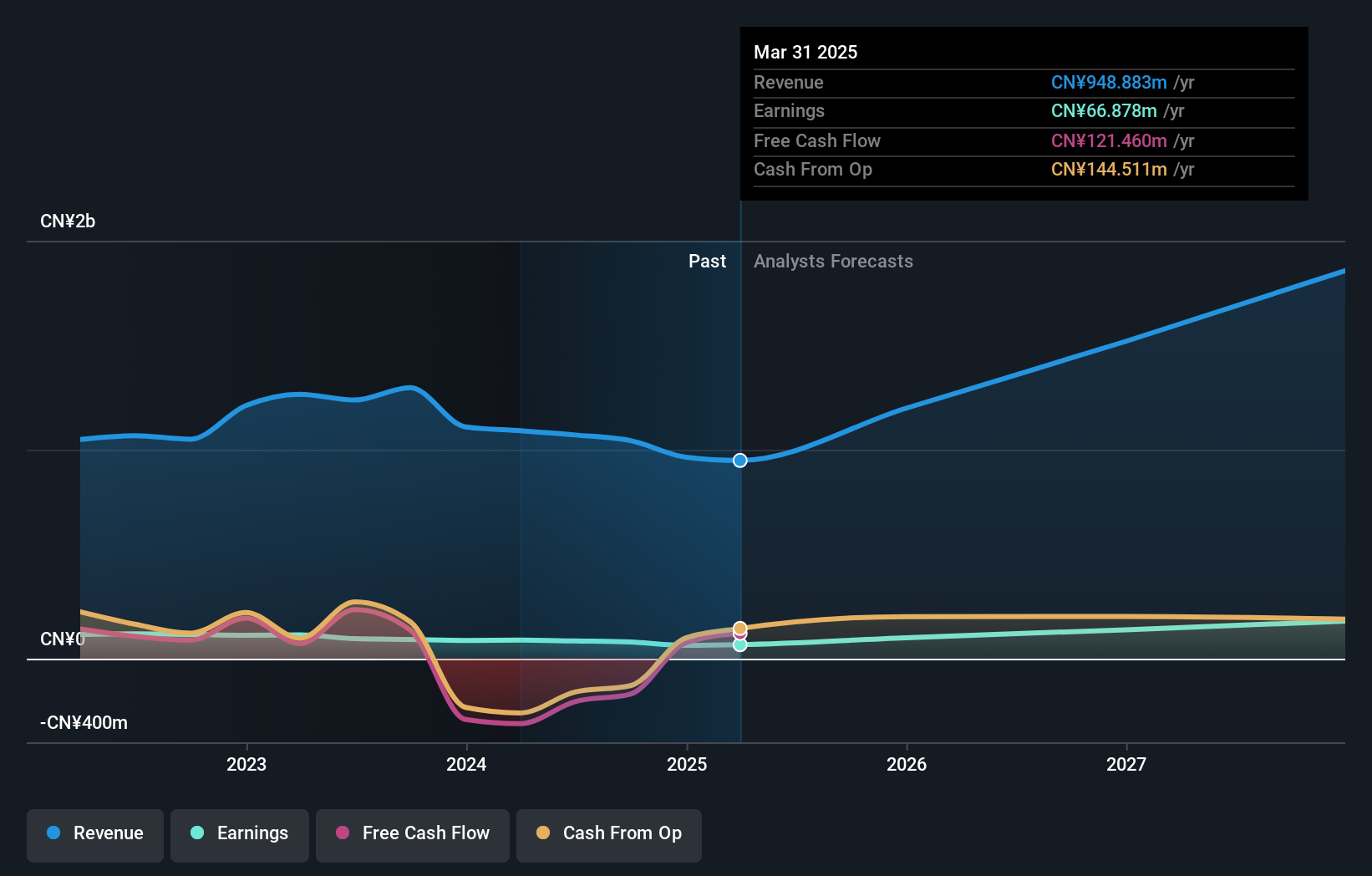

Chengdu Spaceon Electronics, amidst a challenging market, reported a revenue dip to CNY 317.64 million from CNY 378.57 million year-over-year for the first half of 2025, with net income also falling to CNY 8.31 million from CNY 15.46 million. Despite these setbacks, the company's commitment to growth is underscored by its projected annual earnings increase of 39.4% and revenue growth at an impressive rate of 27.4%, significantly outpacing the broader Chinese market's averages of 26.8% and 14.1%, respectively. These figures reflect a resilient strategy in navigating market fluctuations while investing in future capabilities, positioning Chengdu Spaceon Electronics favorably for recovery and expansion in Asia’s tech sector.

- Delve into the full analysis health report here for a deeper understanding of Chengdu Spaceon Electronics.

Understand Chengdu Spaceon Electronics' track record by examining our Past report.

PharmaEssentia (TWSE:6446)

Simply Wall St Growth Rating: ★★★★★★

Overview: PharmaEssentia Corporation is a biopharmaceutical company that focuses on developing treatments for human diseases in Taiwan and internationally, with a market capitalization of NT$206.74 billion.

Operations: PharmaEssentia Corporation generates revenue primarily from the research and development of new drugs, amounting to NT$12.63 billion.

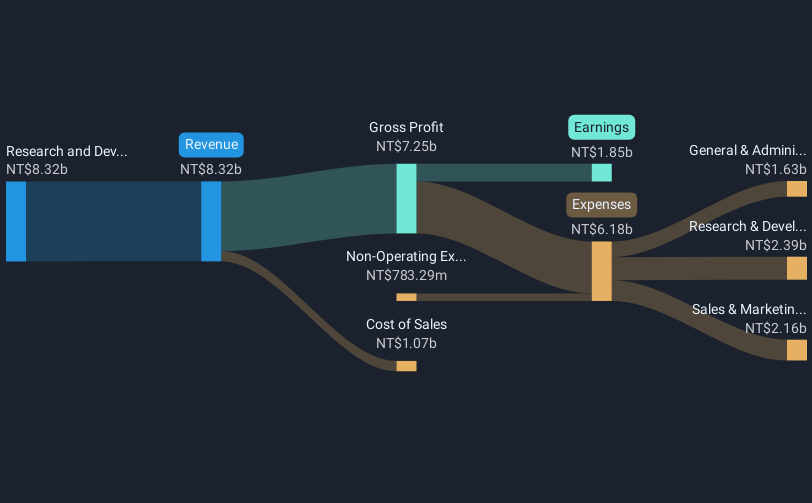

PharmaEssentia, amidst robust growth metrics, showcases a promising trajectory in Asia's high-tech biotech sector. With a significant revenue jump to TWD 6.86 billion in the first half of 2025 from TWD 3.96 billion the previous year, and net income more than doubling to TWD 2.10 billion from TWD 1.01 billion, the company’s financial health is on an upward trend. This performance is bolstered by a substantial annual earnings growth rate of 62.2% and revenue growth forecast at 31.8%. At a recent healthcare conference, PharmaEssentia highlighted innovations that could further drive these figures, positioning them as a dynamic player in the global market with high-quality earnings marked by non-cash elements contributing significantly to their financial statements.

- Click here to discover the nuances of PharmaEssentia with our detailed analytical health report.

Evaluate PharmaEssentia's historical performance by accessing our past performance report.

Make It Happen

- Click through to start exploring the rest of the 180 Asian High Growth Tech and AI Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6446

PharmaEssentia

A biopharmaceutical company engages in treatment for human diseases in Taiwan and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives