Dafeng TV Ltd. (TPE:6184) On An Uptrend: Could Fundamentals Be Driving The Stock?

Dafeng TV's (TPE:6184) stock is up by 6.8% over the past three months. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Specifically, we decided to study Dafeng TV's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

See our latest analysis for Dafeng TV

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Dafeng TV is:

12% = NT$514m ÷ NT$4.2b (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. So, this means that for every NT$1 of its shareholder's investments, the company generates a profit of NT$0.12.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Dafeng TV's Earnings Growth And 12% ROE

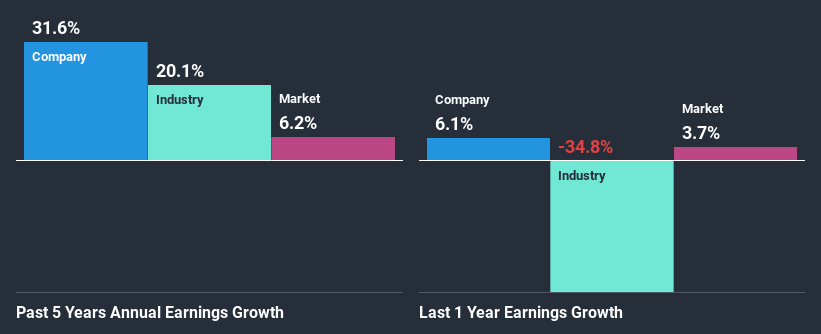

To start with, Dafeng TV's ROE looks acceptable. And on comparing with the industry, we found that the the average industry ROE is similar at 12%. This certainly adds some context to Dafeng TV's exceptional 32% net income growth seen over the past five years. However, there could also be other drivers behind this growth. For instance, the company has a low payout ratio or is being managed efficiently.

We then compared Dafeng TV's net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 20% in the same period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Dafeng TV is trading on a high P/E or a low P/E, relative to its industry.

Is Dafeng TV Efficiently Re-investing Its Profits?

Dafeng TV has a significant three-year median payout ratio of 91%, meaning the company only retains 9.2% of its income. This implies that the company has been able to achieve high earnings growth despite returning most of its profits to shareholders.

Moreover, Dafeng TV is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years.

Summary

Overall, we feel that Dafeng TV certainly does have some positive factors to consider. Especially the growth in earnings which was backed by an impressive ROE. Still, the high ROE could have been even more beneficial to investors had the company been reinvesting more of its profits. As highlighted earlier, the current reinvestment rate appears to be negligible. Up till now, we've only made a short study of the company's growth data. To gain further insights into Dafeng TV's past profit growth, check out this visualization of past earnings, revenue and cash flows.

If you decide to trade Dafeng TV, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:6184

Dafeng TV

Engages in cable television system and broadband business in Taiwan.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives