- China

- /

- Electrical

- /

- SZSE:300709

July 2024 Insight Into High Insider Ownership Growth Stocks

Reviewed by Simply Wall St

As global markets navigate through a mix of trade tensions and shifts in investment trends, investors are increasingly attentive to the nuances that define resilient growth stocks. High insider ownership often signals strong confidence in a company's future prospects, making such stocks particularly compelling in the current economic landscape.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.8% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.5% | 60.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Vow (OB:VOW) | 31.7% | 97.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Here we highlight a subset of our preferred stocks from the screener.

Vista Energy. de (BMV:VISTA A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vista Energy, S.A.B. de C.V. operates in the oil and gas exploration and production sector in Latin America, with a market capitalization of approximately MX$82.84 billion.

Operations: The company generates revenue primarily from the exploration and production of crude oil, natural gas, and LPG, totaling $1.33 billion.

Insider Ownership: 12.4%

Earnings Growth Forecast: 19.5% p.a.

Vista Energy demonstrates notable growth with a recent surge in quarterly sales to US$396.72 million from US$239.63 million year-over-year and a significant increase in net income to US$139.64 million from US$52.18 million. Despite high debt levels, the company's revenue is expected to grow by 21.1% annually, outpacing the MX market's 9.7%. Additionally, Vista Energy has been actively repurchasing shares, recently completing a buyback of 1,062,355 shares for US$49.98 million, signaling strong insider confidence and commitment to shareholder value amidst its highly volatile share price.

- Take a closer look at Vista Energy. de's potential here in our earnings growth report.

- Our valuation report here indicates Vista Energy. de may be undervalued.

Jiangsu Gian Technology (SZSE:300709)

Simply Wall St Growth Rating: ★★★★★☆

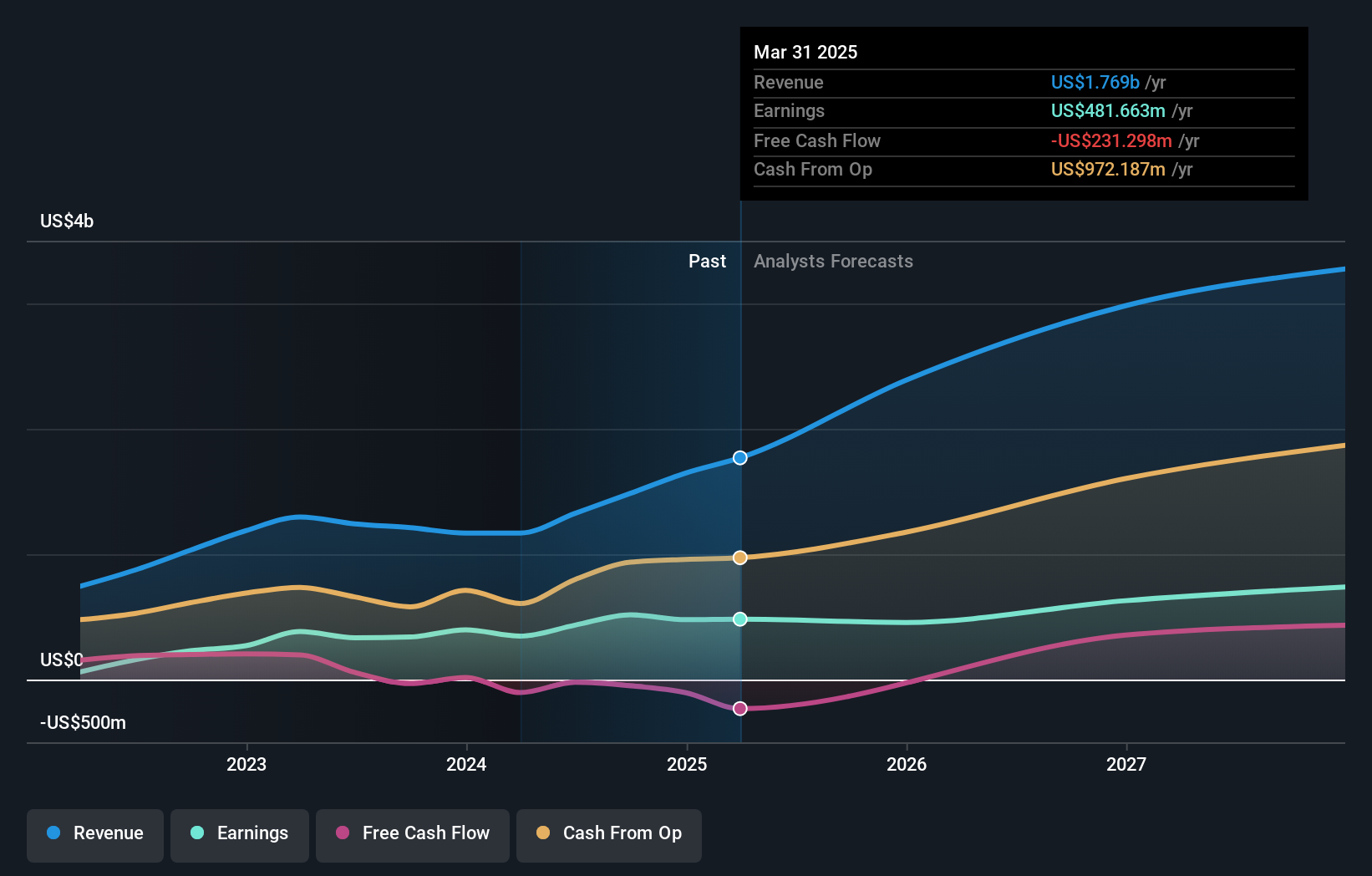

Overview: Jiangsu Gian Technology Co., Ltd. is a company that specializes in manufacturing and selling metal injection molding products, operating both in China and internationally, with a market cap of approximately CN¥4.20 billion.

Operations: The company generates revenue through the manufacture and sale of metal injection molding products across domestic and international markets.

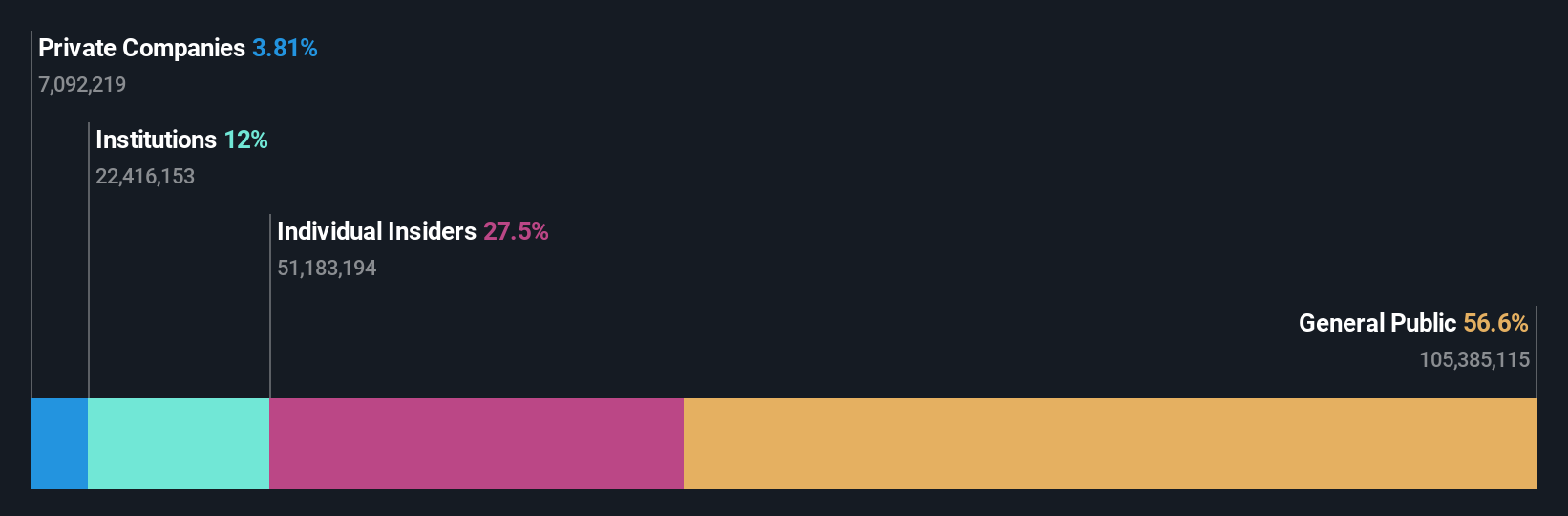

Insider Ownership: 27.5%

Earnings Growth Forecast: 26.6% p.a.

Jiangsu Gian Technology, despite a recent net loss of CNY 27.1 million, shows promising growth with first-quarter sales rising to CNY 388.83 million from CNY 301.56 million year-over-year. The company's revenue is expected to grow by 24.7% annually, outperforming the Chinese market forecast of 13.7%. Although its Return on Equity is projected to remain low at 12.6%, earnings are anticipated to increase significantly by 26.6% per year, surpassing the market's expectation of 22.1%.

- Dive into the specifics of Jiangsu Gian Technology here with our thorough growth forecast report.

- Our expertly prepared valuation report Jiangsu Gian Technology implies its share price may be too high.

International Games SystemLtd (TPEX:3293)

Simply Wall St Growth Rating: ★★★★★☆

Overview: International Games System Co., Ltd. specializes in the planning, design, research, development, manufacturing, marketing, servicing, and licensing of arcade, online, and mobile games mainly in Taiwan, the United Kingdom, and China with a market cap of approximately NT$206.42 billion.

Operations: The company generates revenue through its Online Games Division, which brought in NT$7.95 billion, and its Business Game Division, which earned NT$7.08 billion.

Insider Ownership: 6.2%

Earnings Growth Forecast: 21.1% p.a.

International Games System Co., Ltd. has demonstrated strong financial performance with a recent 25.3% earnings growth year-over-year and a robust dividend payout of TWD 35 per share, totaling TWD 4.93 billion. The company's revenue and earnings are forecasted to grow at an annual rate of 21.4%, significantly outpacing the Taiwanese market projections of 11.8%. Recent corporate governance changes include new appointments in key committees, ensuring fresh oversight as it continues on its growth trajectory.

- Click to explore a detailed breakdown of our findings in International Games SystemLtd's earnings growth report.

- Upon reviewing our latest valuation report, International Games SystemLtd's share price might be too optimistic.

Summing It All Up

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1447 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300709

Jiangsu Gian Technology

Manufactures and sells metal injection molding products in China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives