- China

- /

- Healthtech

- /

- SZSE:300253

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets continue to react positively to recent political developments and AI-related initiatives, major indices like the S&P 500 have reached new highs, with growth stocks outperforming value shares for the first time this year. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that are well-positioned to benefit from technological advancements and favorable economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1230 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Winning Health Technology Group (SZSE:300253)

Simply Wall St Growth Rating: ★★★★☆☆

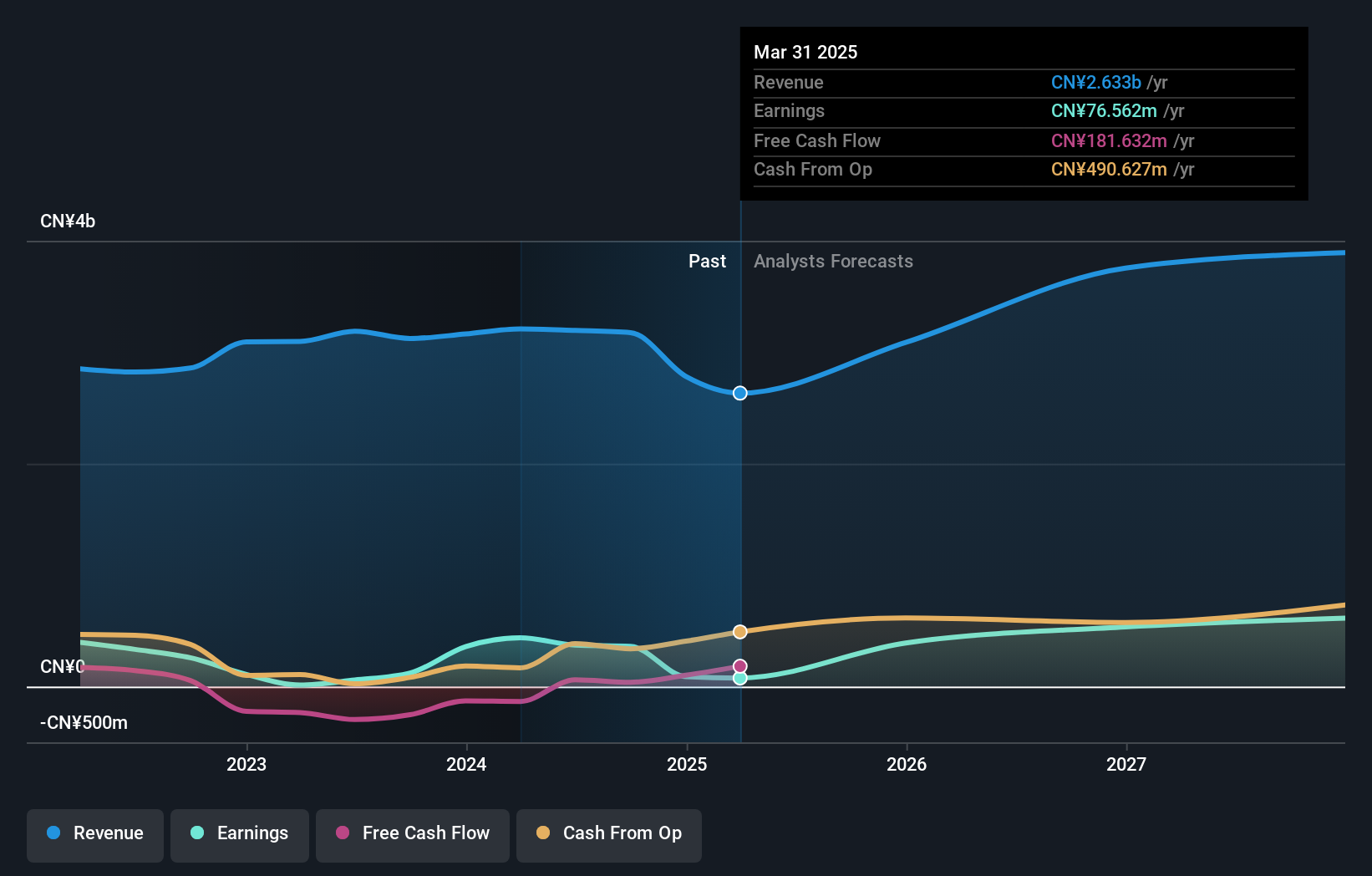

Overview: Winning Health Technology Group Co., Ltd. (SZSE:300253) is a company with a market cap of CN¥14.21 billion, focusing on providing healthcare information technology solutions and services.

Operations: Winning Health Technology Group generates revenue by offering healthcare IT solutions and services. The company's business model leverages technology to enhance healthcare management and operations, contributing to its financial performance.

Winning Health Technology Group has demonstrated robust growth, with earnings surging by 197.9% over the past year, significantly outpacing the Healthcare Services industry's growth of 10.4%. This performance is underpinned by a substantial one-off gain of CN¥107.4M, highlighting an exceptional year but also suggesting the need for scrutiny into recurring revenue streams. The company's commitment to innovation is evident from its R&D investments, crucial for sustaining long-term competitiveness in a rapidly evolving tech landscape. Moreover, recent strategic share buybacks totaling CN¥79.99 million underscore management's confidence in the firm’s trajectory and financial health. With revenue projected to grow at 19.2% annually—faster than the market average—Winning Health appears well-positioned to leverage its technological advancements and market position further.

International Games SystemLtd (TPEX:3293)

Simply Wall St Growth Rating: ★★★★★☆

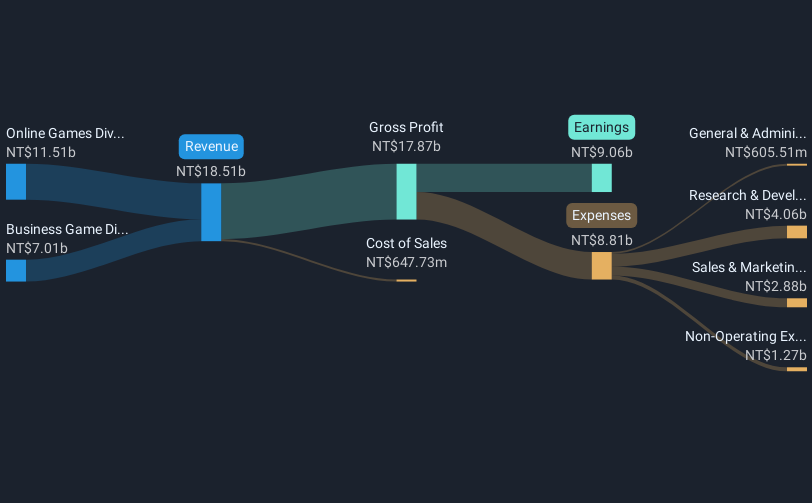

Overview: International Games System Co., Ltd. is engaged in the planning, design, research, development, manufacturing, marketing, servicing, and licensing of arcade, online, and mobile games primarily in Taiwan, the United Kingdom, and China with a market capitalization of NT$266.58 billion.

Operations: The company generates revenue primarily through its Online Games Division, contributing NT$10.11 billion, and its Business Game Division, adding NT$7.13 billion. The focus on these segments highlights a diversified approach in the gaming industry across multiple regions.

International Games SystemLtd. has showcased strong financial performance, with a notable increase in sales to TWD 4.7 billion and net income rising to TWD 2.17 billion in the third quarter of 2024, reflecting year-over-year growth of 31% and 24.5%, respectively. This surge is underpinned by robust annual revenue and earnings forecasts, expected to outpace the Taiwan market with increases of 20.9% and 21.2% per year, respectively. The company's strategic focus on innovation is evident from its significant investment in research and development, aligning with industry trends towards enhanced gaming experiences and interactive entertainment technologies.

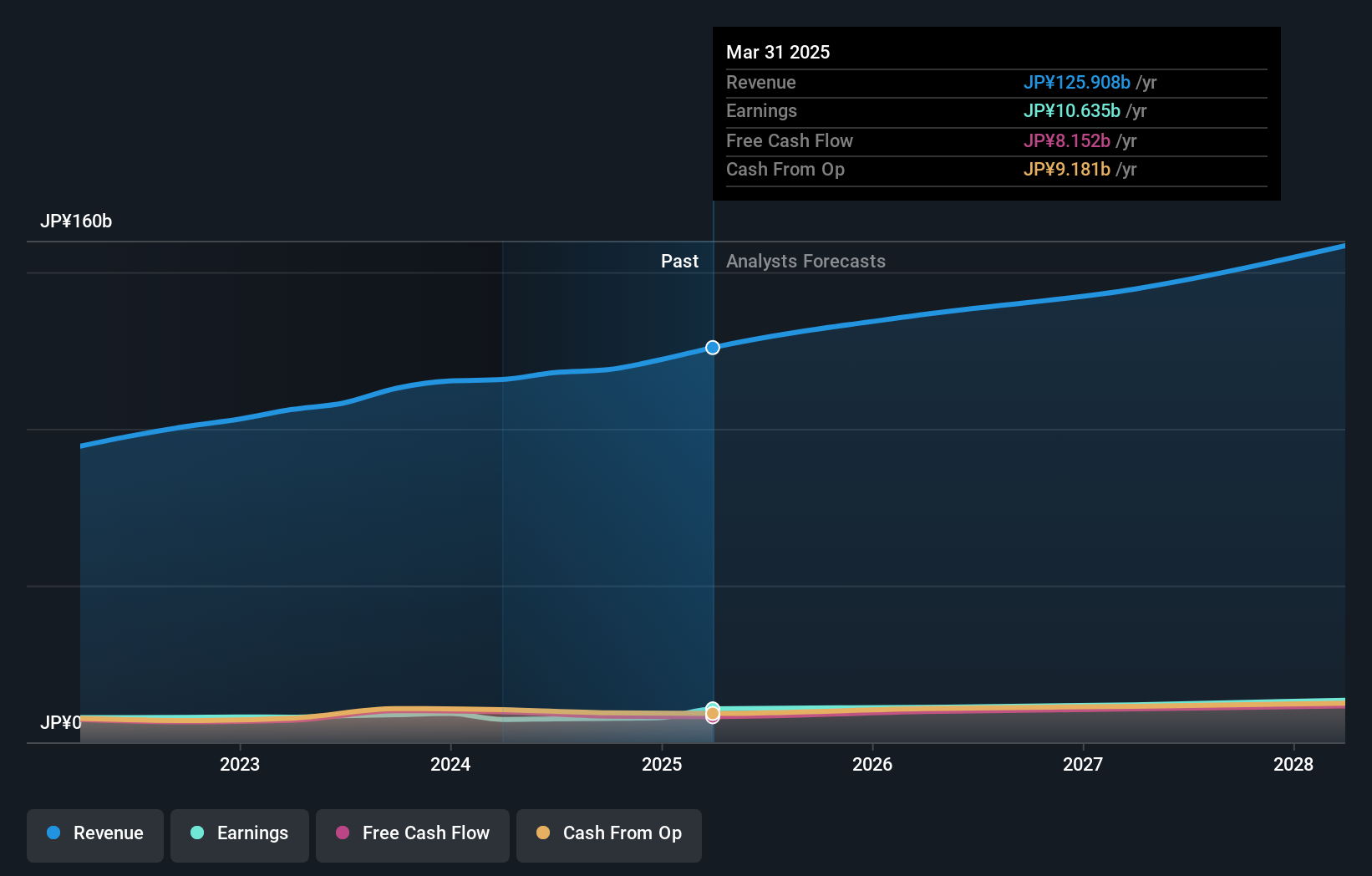

DTS (TSE:9682)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DTS Corporation offers systems integration services in Japan and has a market capitalization of ¥175.23 billion.

Operations: DTS Corporation generates revenue through three primary segments: Platform & Services, Business & Solutions, and Technology & Solutions. The Business & Solutions segment is the largest contributor with ¥49.81 billion in revenue, followed by Technology & Solutions at ¥42.66 billion and Platform & Services at ¥29.38 billion.

DTS has demonstrated a robust commitment to innovation with R&D expenses reaching ¥5.3 billion, representing a significant 5% of its total revenue. This investment supports the company's strategic focus on enhancing technological capabilities in a competitive market, where it recently repurchased shares worth ¥5.99 billion, reflecting confidence in its financial health and future prospects. Despite facing challenges with a -13.8% earnings growth last year, DTS is set for recovery with expected annual earnings growth of 12.3%, outpacing the JP market average of 8.1%. This blend of aggressive share buybacks and strategic R&D spending underscores DTS's proactive approach in maintaining its competitive edge and shareholder value in the evolving tech landscape.

- Delve into the full analysis health report here for a deeper understanding of DTS.

Assess DTS' past performance with our detailed historical performance reports.

Key Takeaways

- Embark on your investment journey to our 1230 High Growth Tech and AI Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winning Health Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300253

Winning Health Technology Group

Provides digital health services for medical and health institutions in China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives